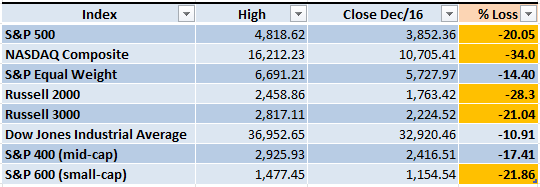

The Market has its own timing, if you are waiting for the next Bull Market, then you aren't alone. One issue that many traders face is that some of them are thinking about the past and others about the future. The current Market situation is different than the past we lived from 2008-2021 and it might not necessarily already be the future that you are expecting. After the last trading week, most of the important indexes are back at Bear Market territory (a loss of 20% or more from the previous high).

Market Overview

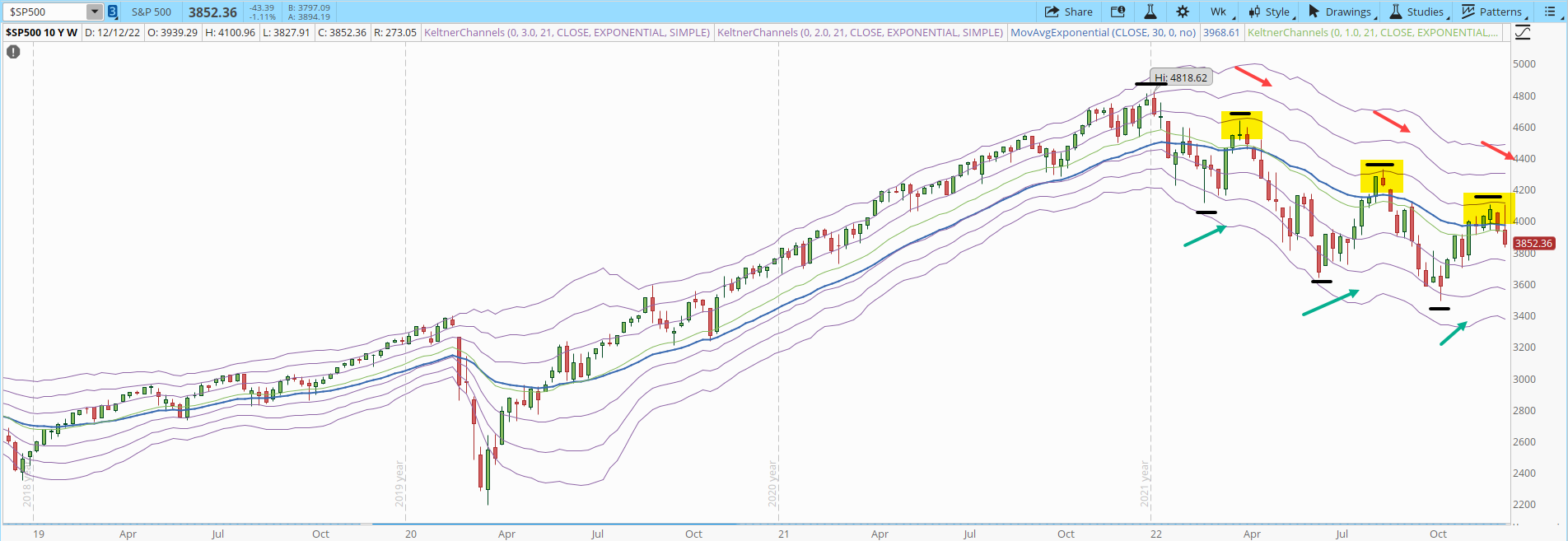

The weekly pattern that I have described multiple times during the year has been strengthened lately. The downtrend (lower lows and lower highs, highlighted by horizontal black lines) is respecting very well defined limits. The +1 Keltner Channel (yellow highlighted area) is acting as a strong resistance, there isn't enough demand yet to get past that +1 KC area. On the opposite side, the -3 KC is acting as a support where demand starts to enter the Market and there is a reaction rally.

Trading on the long side might be a source of frustration if this pattern continues. I have opened multiple pilot trades in the past few days, I was already stopped out from four of them and three are still open without spectacular results.

There are two important levels to monitor. The S&P 500 needs to close above 4,150 in order to be at a level above the weekly +1 KC. If the index closes above that level during the next trading week, the next step is to close above 4,350 which would damage the structure of the weekly downtrend.

The behavior that I have described in the past for the daily chart is still working. Only three times during 2022, the S&P 500 reached the +3 KC, which is considered an overbought level (yellow areas in the screenshot below). After that the index experienced a decline, the first couple of times, it was a very sharp decline.

A far more common behavior was that when the daily S&P 500 reached the +1 KC, then it pulled back (orange circled areas). Eventually this pattern will stop working, at this point in time, Bears are still in control and we need to see some evidence that the situation is changing.

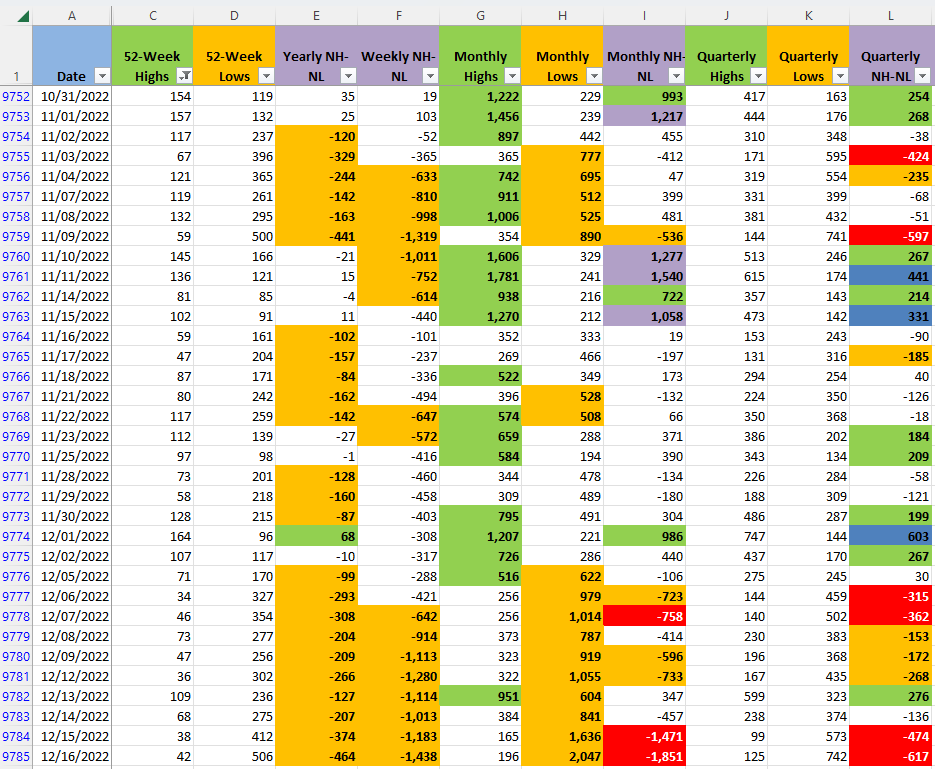

The New Highs and New Lows numbers are just confirming the shift in the balance of power between Bulls and Bears. The fastest timeframe that I track is the Monthly NH-NL (columns G, H and I). The Bears are slowly but consistently displaying more force.

Industries

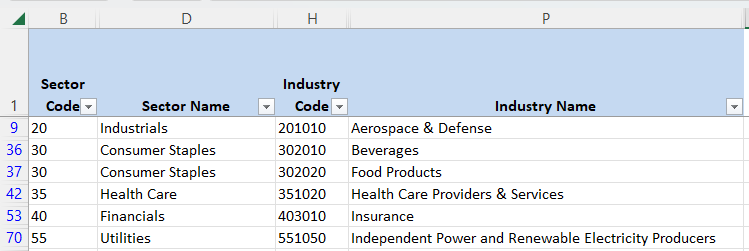

There are only two Industries that, from my point of view, are displaying some interesting potential on the long side. Out of the 68 Industries that compose the Global Industry Classification Standard (GICS), 'Construction & Engineering' Industry ($SP1500#201030) and Biotechnology ($SP1500#352010) are the ones that could eventually start a strong uptrend.

In the table below, there are some additional Industries that could have a breakout. The problem is that half of them are in defensive Sectors. That's not a great indication of risk appetite. We can't predict the future, but this section will eventually give some good clues about the leaders of the next Bull Market. At this point it seems that the leaders won't come from the Technology Mega Caps.

Scenarios

Scenario #1: After four straight days of pullback where the Bears managed to kill the hope of finally closing above the weekly +1 KC I think that there is still room for the decline to continue at least another 50 to 100 points during the next trading week. There is the possibility that 3,800 is a strong enough support to stop the decline and maybe even trigger a reaction rally (this is not a change in the Market direction).

Scenario #2: The second most likely scenario is that the selling pressure stops and the main indexes start to move sideways, waiting for a catalyst to give a clear direction to the Market. The S&P 500 daily chart is close to be oversold (-3 KC or below), that could give a little bit of help for the Bulls when some demands enters the Market.

Scenario #3: The least likely scenario is that we will see a comeback from the Bulls in the form of a powerful rally. As the weekly and daily patterns are still intact, the negative news keep dominating the media, if a powerful rally is to start next week, it would require some really positive and surprising good news. Some great news about the inflation or the potential end of the War of Ukraine might be able to do the trick. It's an unlikely scenario, but nothing is impossible in the Markets.

Summary

The current situation of the Market, where the Bears are still in control, restricts the effectiveness of certain strategies. Even if you have the best plan to trade on the long side, most of the stocks aren't having amazing rallies that end turning into powerful uptrends. This Bear Market won't last forever, the complex part is to figure out when it will end. I'll keep opening pilot trades to get a better grasp of the Market situation, a price to pay in order to get onboard the next Bull Market early.

Whatever is your Market strategy, respect the risk, as I mentioned in my last week's article 'Bears aren't done yet'. Risking too much too early could turn into a fatal blow to your trading account. Even before thinking about profits, the first step is to avoid blowing up an account. If you don't preserve your capital, there's no way to continue playing this game.

My suggestion is, be patient, keep looking for the Industries where the next winners are likely to appear. When the situation starts to turn into something more favorable for your trading plan, keep looking for some candidates to trade. Until then, wait for your time to come, stay on the sidelines or use pilot trades to control the anxiety and see how they work.