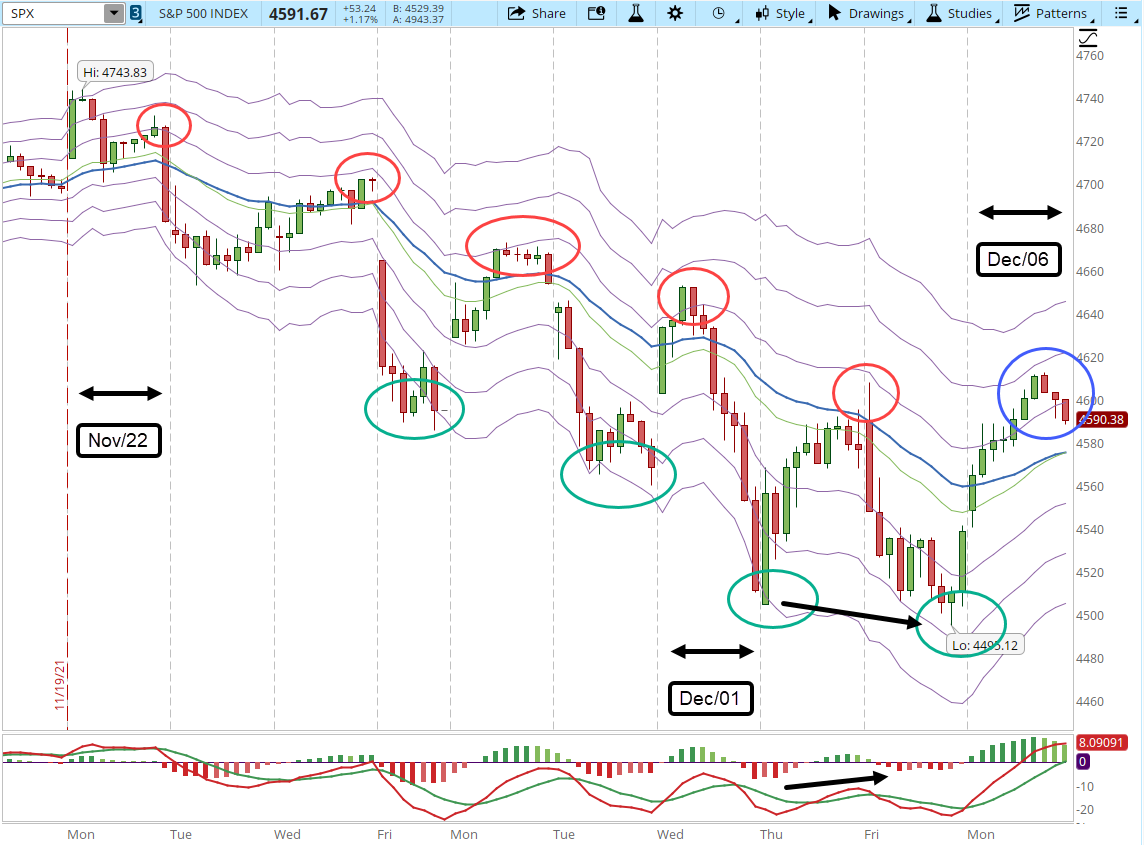

In my last post, I mentioned that there could be a rally in the early part of the week. It happened today and there are a couple of interesting things about it:

- The bullish divergence actually reached a higher level than expected, usually in the 39-min chart the S&P was touching the +1 Keltner Channel (KC) before collapsing and going to the -3 KC. This time it almost reached the +2 KC (blue circle)

- The MACD-H is also confirming the bull's strength

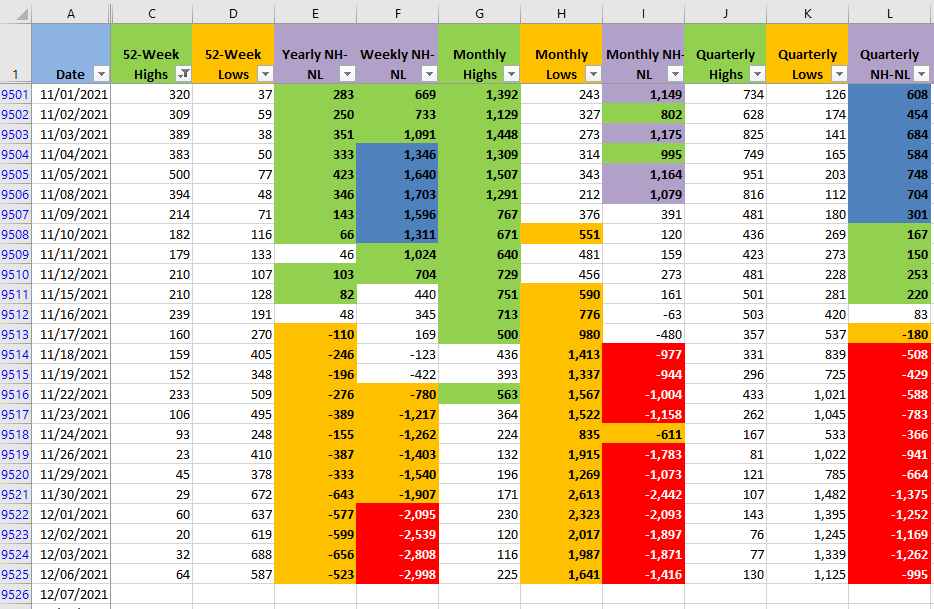

I don't want to be a party pooper but the bears are still pretty strong (barchart.com numbers are preliminary, they still might vary during the night, you can zoom in by clicking the images). In the next few days, it's important to monitor if the Market finally found support. In this scenario, the number of lows should decrease in order to show that the selling pressure is diminishing.

Right now, a very short term support could be drawn at 4,490 and a short term resistance at 4,620. Hopefully it won't fall until the weekly support discussed in my Weekly Post (4,418). For now, it's wait and see for me, until there is further evidence about this rally the bears are still in control of the Market action.

December/05 - Weekend Market Update