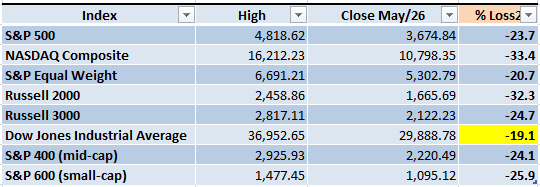

Next week could be a tricky moment for the Markets. It will be an abbreviated trading week in observance of Juneteenth. Only the Dow Jones isn't in Bear Market territory (a loss of 20% or more from the previous high) and the indexes are at oversold levels in the weekly and daily timeframes, which could generate a reaction rally that gives a false sense of bullishness.

Market Overview

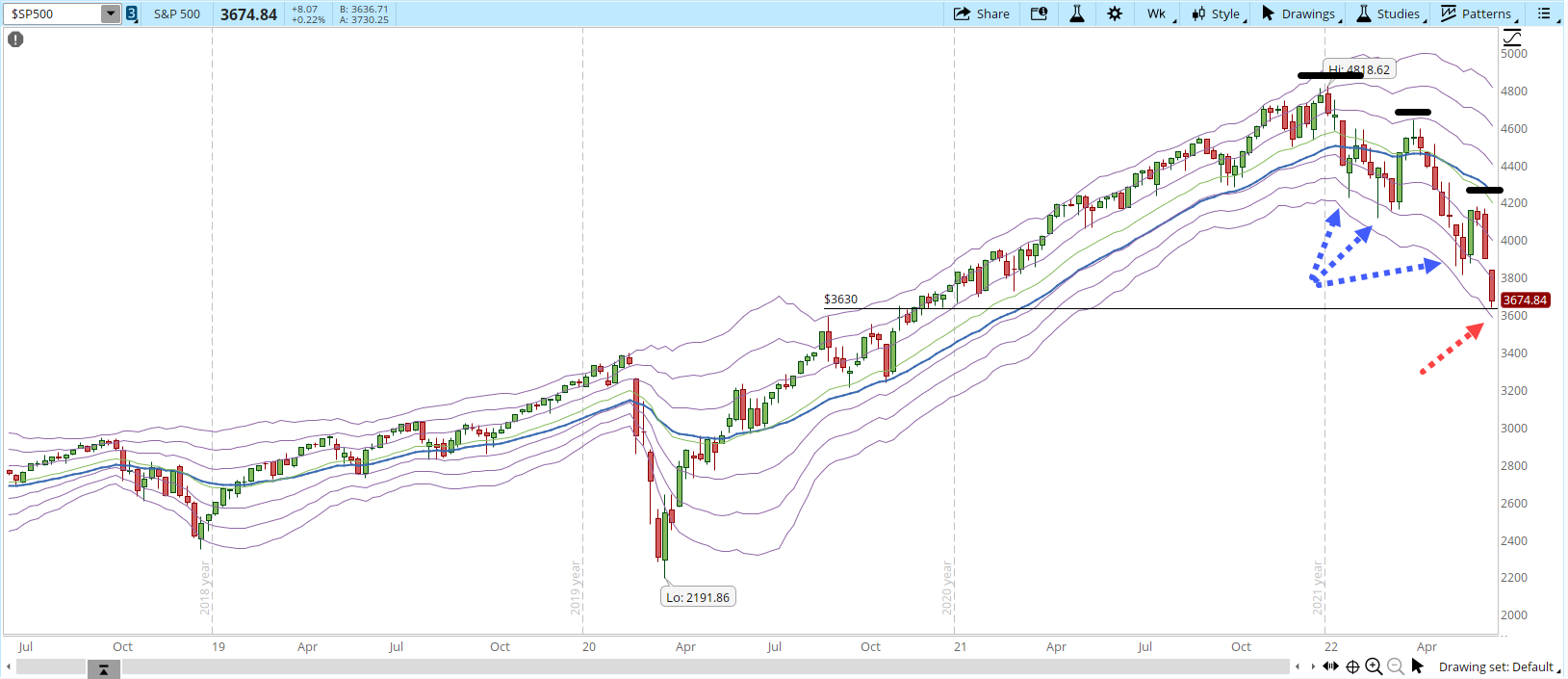

The chart that I'm more concerned about is the weekly chart of the S&P 500, I have continuously mentioned in previous articles that a pattern of lower highs and lower lows was more evident every day (horizontal black solid lines). Additionally when the index reached an oversold level (blue dotted arrows), the index rejected the lower price and had at least a small reaction rally. The trading week that just finished was different (red dotted arrow), the index closed at its lows near the bottom of the -3 Keltner Channel (KC), the lower price levels weren't rejected.

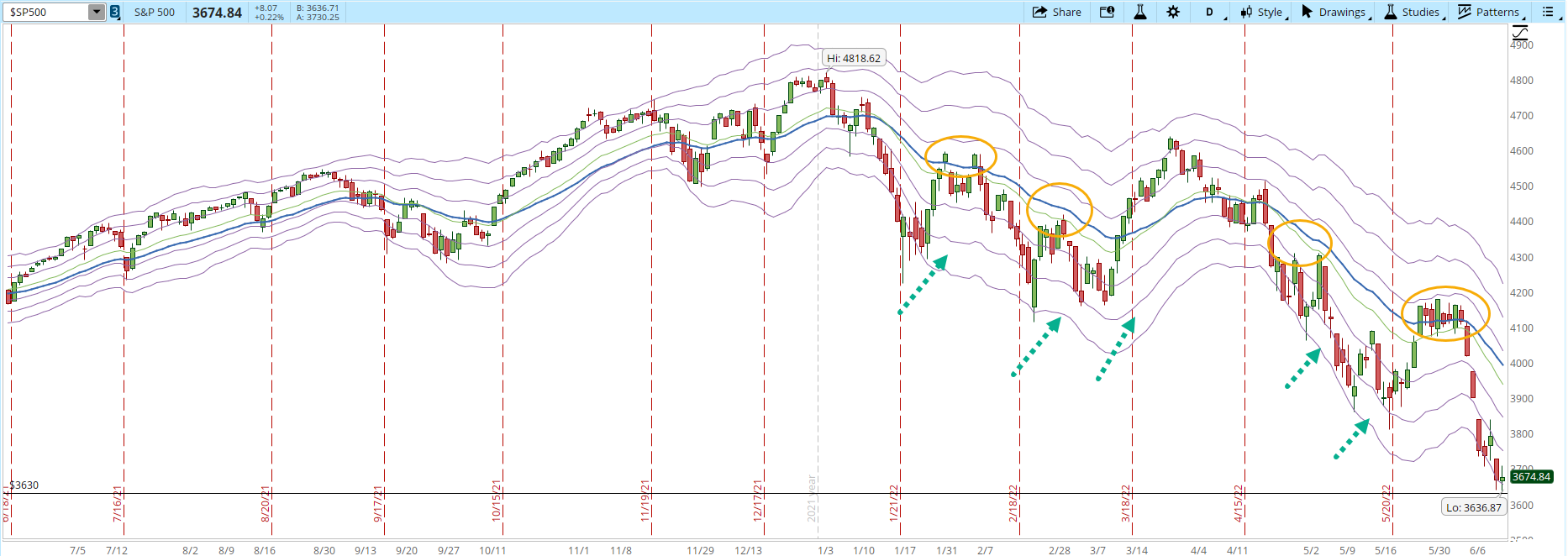

Reviewing the daily chart, the possibility of a reaction rally is high, that doesn't necessarily mean a change in direction, Bears are still in control. Five previous times, the daily S&P 500 has reached the -3 KC in the daily chart (green dotted arrows), four out of those five times the index rallied to the 30-day EMA (blue line) and only once it rallied above the upper band of the +2 KC. A realistic target, if there aren't extraordinary events, would be 4,100.

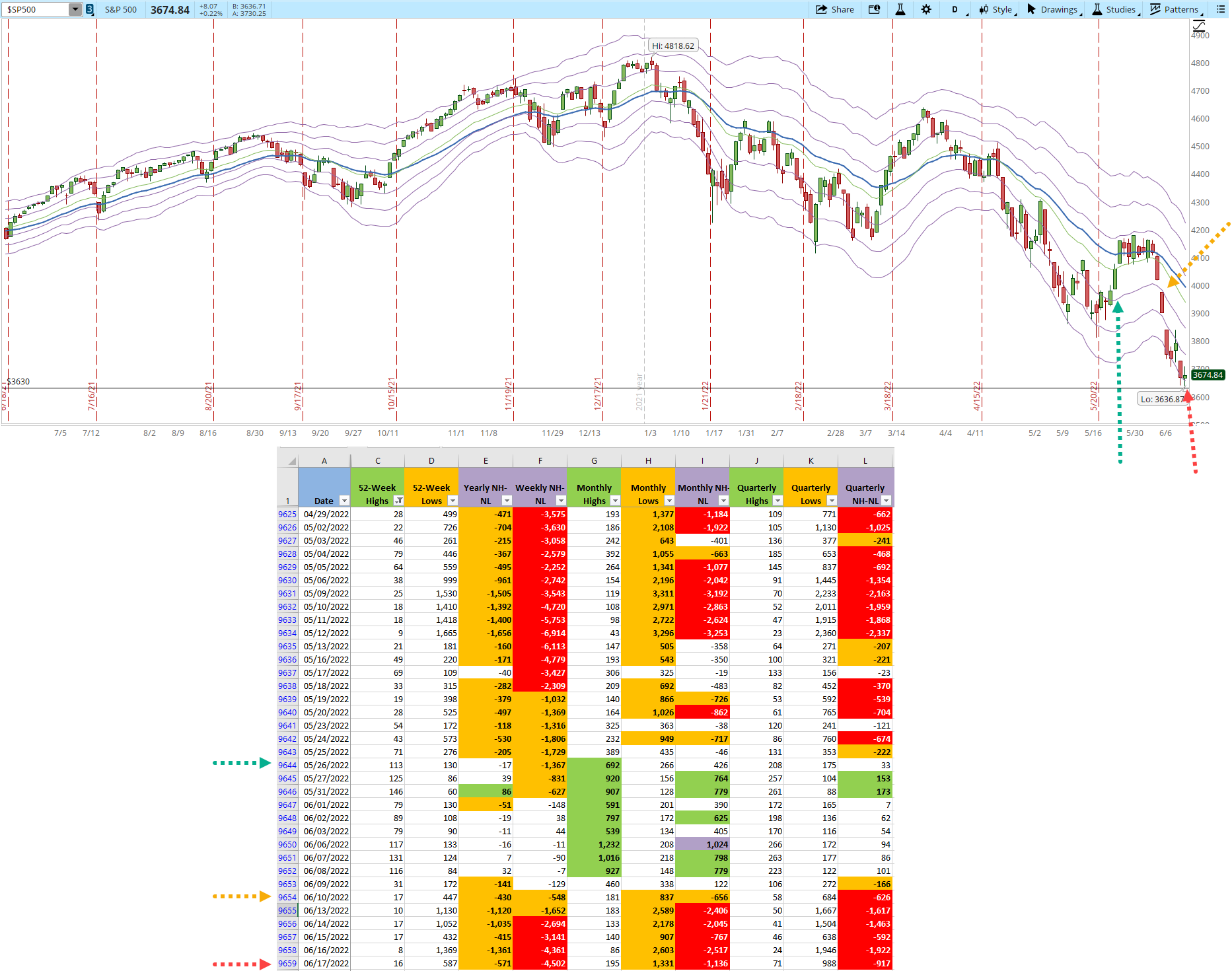

The New High and New Low numbers confirm the power of the Bears. The most interesting part is that when the Bulls tried to take control of the Market (green dotted arrow), the rally lasted only three days before stalling, despite the NH-NL numbers were bullish in the Monthly timeframe for almost two weeks, the price action didn't confirm the bullishness in the indicator. However, when the Bears attacked, the price action confirmed the selling pressure, which sent the index to oversold levels.

Industries

This week I reviewed the 68 Industries that compose the Global Classification Standard (GICS) and I couldn't find a single one of them that could be still considered strong. The "Oil, Gas & Consumable Fuels" Industry had been appearing every single week for the past month, but not even that one escaped from the Bears' power.

Scenarios

Scenario #1: The most likely scenario, from my point of view, is that there will be a reaction rally. Any good news or the lack of a strong negative catalyst could trigger some demand from bottom pickers or people covering their shorts. A realistic level for the rally would be 4,100. I like to differentiate a reaction rally from a change in the Market direction. A potential change in Market direction requires a lot more than rallying to 4,100. I would start to consider a change in the Market direction if the S&P 500 closes decisively above 4,300. That's a lot of resistance to overcome, going from the -3 KC to the +3 KC on the daily chart.

Scenario #2: The second most likely scenario, is that the decline continues. None of the strong negative catalysts seems to be close to a resolution (Inflation, Ukraine war, China tensions, Covid, Supply Chain crisis, etc.). During 2022 the Market has reacted strongly to the negative news and poorly to the short-lived good news. I don't think that the Bear Market is over, I'm only suggesting in Scenario #1 that there could be a natural reaction rally which is part of the normal oscillations in the Market. In Scenario #2, there is no pause, the decline continues until there is a strong support that can stop the fall.

Scenario #3: The less likely scenario is a V-shaped recovery. Nothing is impossible in the Markets, but not everything is equally likely. Since October/2021, only two rallies have lasted more than 5 days (black dotted arrows). At this point, I can't imagine a catalyst, strong enough to trigger a rally that would last at least a couple of weeks. It would have to be something like the end of the Ukraine war or some really surprising news about the inflation. It's not impossible, in fact, some day it will happen. Eventually a new Bull Market will begin, I just don't see evidence that it will happen during the next trading week.

Summary

I moved weeks ago my positions to all-cash. I did try a few small long trades since then to test the Market. They weren't successful, I was stopped out of all of them. The demand is just to weak to absorb the existing supply, the dominant emotion is still the fear, so the decline could still continue.

Capital preservation and risk management sound boring, but the adrenaline of blowing up a trading account is completely unnecessary. If your trading account is compromised, you can't keep playing this game. Bottom picking is a very risky business, for my personal style of trading, my plan demands that I stay on the sidelines until a strong trend emerges in at least an Industry, an Index or at the very least in a few interesting stocks.