One of the most important things to learn while trading is that the Market is in control of everything. Whether we think it makes sense or not, there's no point in arguing against the Market actions. Currently the Market keeps rising at overbought conditions, while the underlying problems that triggered the Bear Market are still unsolved.

Market Overview

The greed and Fear of Missing Out (FOMO) the next Bull Market seem to be the predominant sentiment since mid-July. The question now is, how long can the Market keep rising at overbought conditions (+3 Keltner Channel or more) ? If we review the same behavior since Sept/2021 the Market has had sharp declines once it gets to that level (orange circled areas). The rally broke easily through the 4,200 resistance and now it's headed towards testing 4,300.

I can't deny that the S&P 500 broke easily the 4,200 resistance and that the most likely scenario that I posted during last weekend was wrong. Enjoy the party while it lasts, however a pullback is inevitable, nothing goes in a straight line in the Markets. Some risk factors to consider:

- How strong will the recession be as the Fed keeps trying to tame inflation?

- The tension between USA and China and Russia will likely continue.

- The supply chain crisis isn't solved yet.

- The earnings season isn't over.

- September is close and it's a month where the Market traditionally performs poorly.

Reviewing the weekly chart, the rally is displaying a surprising strength and it's about to reach the +1 Keltner Channel (KC). In order to reach this level, typically it means that there is enough demand to overcome the supply entering the Market. The last time the S&P 500 tried to break past the +1 KC we had a severe decline that sent the index to 3,636 (orange circled area).

If this is in fact a new powerful multi-month Bull Market, it will start breaking previous resistance areas like the +1 weekly KC. For the weekly timeframe, if Bulls are really in control, they should be able to break past 4,300 and get to 4,400 with ease. Eventually when the index gets to the +3 KC it's considered to be at overbought conditions and the selling pressure that starts entering the Market can make the index decline.

When the demand is so much bigger than the supply those pullbacks aren't significant and the index can continue at overbought conditions for a long time. It Happened during most of 2021, the weekly chart of the S&P 500 was most of the year moving in and out of the +3 KC.

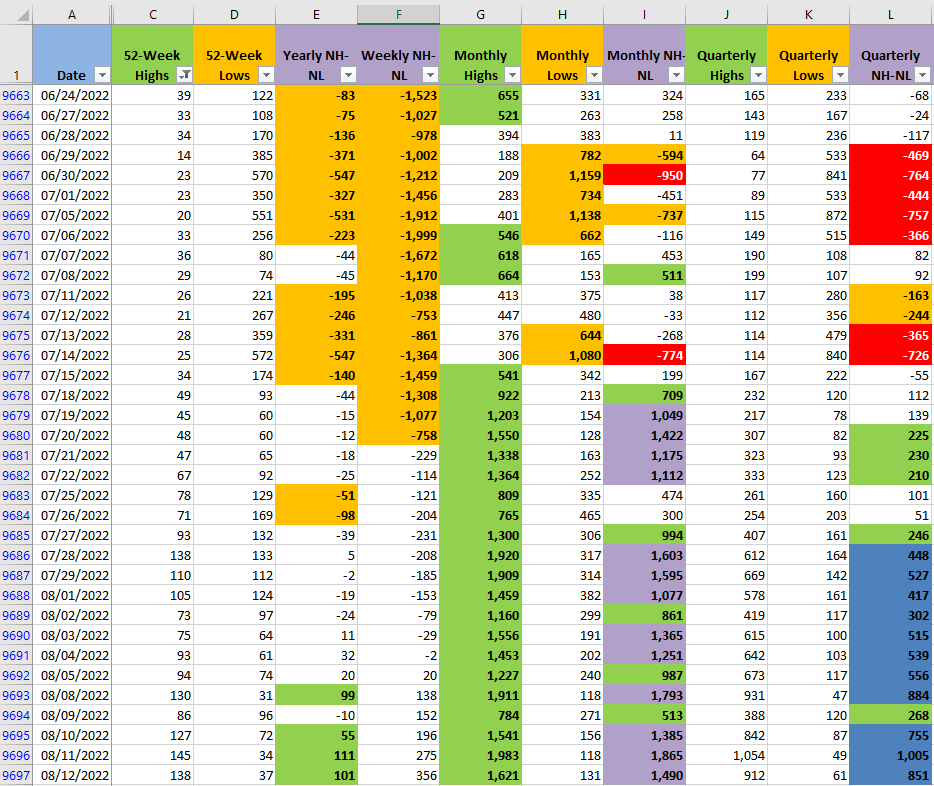

The New Highs and New Lows (NH-NL) indicator, in its different timeframes, is confirming the bullish movement. I'm always more interested in the Monthly timeframe (columns G, H and I) which is the one that moves faster from the ones displayed. When the selling pressure starts, this leading indicator will likely be the one that let us know that we need to be more cautious.

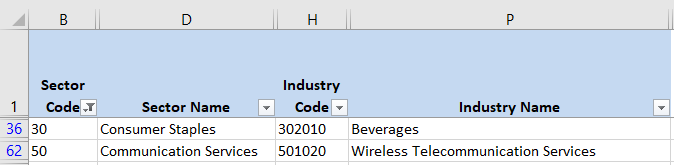

Industries

From the 68 Industries that compose the Global Classification Standard (GICS), there are just a couple of Industries that, from my point of view, still continue to perform strongly. One of them is in the defensive Sector of 'Consumer Staples'.

There's also an interesting breakout from the 'Construction & Engineering' Industry. If this is the beginning of a new and powerful Bull Market, it's important to monitor the different Industries to see which ones will lead the advance of the Market in the next few months. This one could be a good candidate if the breakout holds.

Scenarios

Scenario #1: I'm still skeptical about this rally, from my point of view at least a short-term pullback that takes the index to a level around 4,100 would be healthy. It's useless to fight the force that the rally has displayed since mid-July, however at some point it will need to at least pause before continuing. The most likely scenario for the trading week about to start is that the rally will stall below 4,400.

Scenario #2: In the second most likely scenario, the rally will continue. When there's no significant supply entering the Market, even little demand can continue fueling the rally. If the negative catalysts keep coming during the week and don't take the index down, as they used to do it with a lot of ease, that will be another signal of strength. If there are some good, surprising earnings results during the week that could continue fueling the rally.

Scenario #3: The least likely scenario is a pullback, defying all odds the Market just seems to keep going up. The pullback is inevitable, it will happen sooner or later, maybe it won't be significant, but it will happen. At some point people will start wondering how long will this rally last and some of them will decide to sell. When that supply starts to become significant the Market will pullback.

Summary

No one can't tell for sure at this point if this the beginning of a powerful multi-month Bull Market. We have seen a powerful rally that started back in mid-July. The impression I get from the pilot trades that I opened during the month of July is that this rally was mainly to the deep weekly oversold conditions once the S&P 500 got to 3,636. The power of the rally has been enough to damage the weekly downtrend structure that was traced from January to mid-July.

Now that we are far away from those weekly oversold conditions, there has to be something that keeps people and funds buying. That's where my main concern comes, suddenly in the last month we moved from a lot fragility to a buying spree and the big problems affecting the Markets are still there. Pullbacks are healthy and when the first pullback happens, whether it's next week or next month, it will give us some insight about how strong Bulls really are when things get tough.