Is it the end of the correction? Just a pause before the decline resumes? Since there is no crystal ball that gives an accurate answer, we need to stick to technical analysis. Most importantly, maybe it doesn't even matter. If you are trading volatility, the current situation favors your strategy. If you are on a suicide mission trying to catch the bottom of the correction, good luck with that gamble, this correction still could turn in a Bear Market. Waiting on the sidelines, keeping your stops in place if you still have open positions, and your cash ready in case that a significant rally starts is a much safer option.

Market Overview

The last trading week gave some clues about what might be coming in the next few days. So far, the Bears are still in total control of the Market but the Correction either is paused or it's over. I'm keeping the same support/resistance levels than last week. The weekly levels are at 4,191/4,482/4,775 the rest are short-term support/resistance levels that I add for illustration purposes in order to understand the daily price action.

It's encouraging to see that the S&P 500 was able to close the week above 4,400. It will be interesting to see if it can hold that level and rally from there. During last week, there was a couple of days where it reached the 4,400 level but it couldn't even hold it until the end of the session.

If the S&P rather than holding above 4,400 closes below 4,300 then the selling pressure is likely to take the index even lower.

It helps to take a look at different timeframes in order not to get lost in the details, the 39-min chart and the daily chart are useful. Let's take a look at the weekly chart in order to see that despite the Bears are still in control of the Market, during last week lower prices were rejected. After the weekly trend was broken, these news give some hope, but the longer it takes for the Bulls to regain control my point of view is shifting more towards the Bearish side. If the weakness continues, the possibility that the Correction turns into a Bear Market is pretty much alive. It's not enough to just reject lower prices, there has to be a rally that show how strong Bulls can get under the current circumstances.

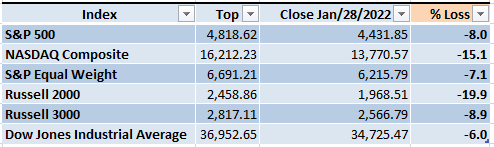

During my last weekend post I calculated the loss percentages for several indexes, here is an updated version, things haven't changed that much from last week:

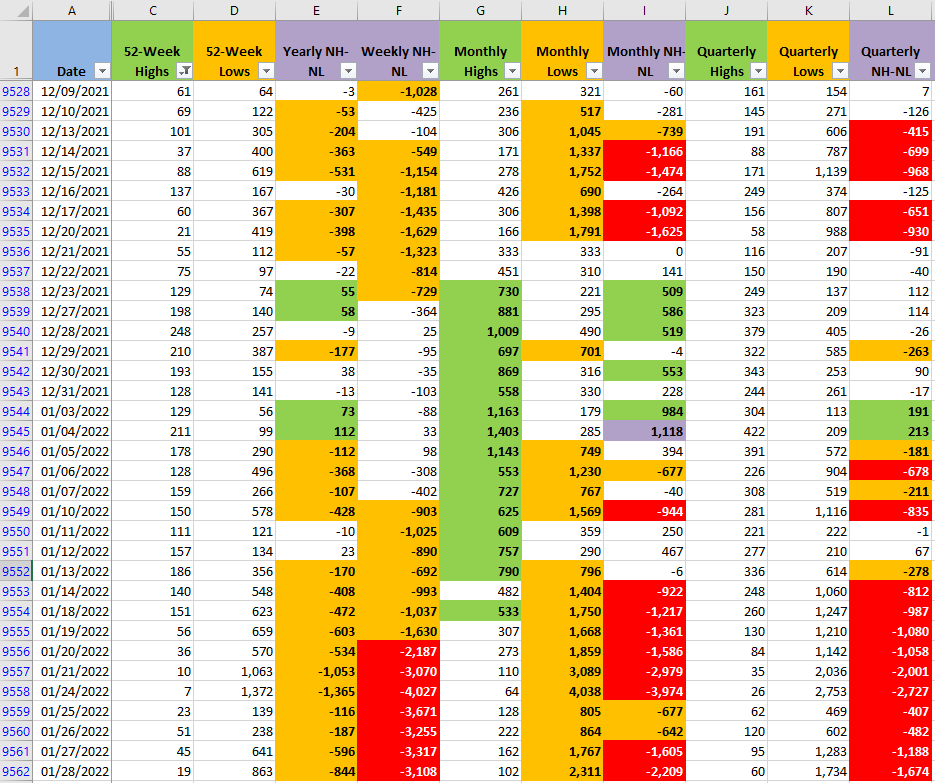

The New Highs - New Lows (NH-NL) numbers in all the timeframes I track are still not showing an improvement. The numbers confirm that the selling pressure is stronger than the demand. The price action, the volume and the Monthly NH-NL numbers (columns G and H) will be the first indicators of what is the direction that the Market could take in the next few days.

Industries

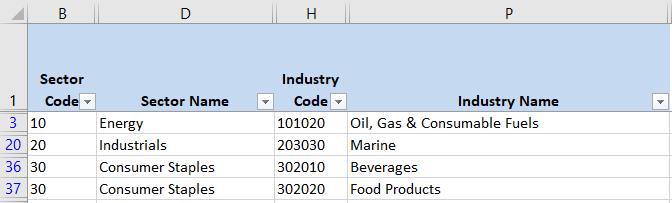

I track 68 Industries based on the Global Classification Standard (GICS). This week I only see four Industries still with strength. Unless there is a big improvement in the NH-NL Monthly numbers and the price starts to rally above 4,400, I'm not likely to start opening new long positions. Every trader has different strategies that work best under different conditions. My strategy won't work with the current levels of volatility and the weakness the Market is displaying.

Scenarios

- Scenario #1: I think the most likely scenario for this week is that the S&P will continue moving in the trading range of 4,250/4,482. That would mean that the Correction would continue paused, there is no catalyst strong enough to move the Market in either direction. If this happens, I'll stay on the sidelines waiting for a clear direction. High volatility Markets or trying to catch a bottom are not part of my strategy.

- Scenario #2: If the selling pressure increases, the Monthly NH-NL should reflect that Bear force. In this scenario, we could expect lower prices. Since I'm not shorting anything yet and buying during a decline is not something I would do, in this scenario I would also stay on the sidelines. If I get stopped out from the few positions I still have open I'm ok with that.

- Scenario #3: I see unlikely but not impossible that a bullish scenario develops during the week. At most, I would expect some relief rally that would take the S&P to 4,500 before pausing or declining again. Only if the S&P can rally above 4,500 I would consider opening new long positions. Currently I don't foresee some event that could trigger this kind of movement which most likely would require more than one trading session to develop. Anything can happen in the Markets, I'm not trying to forecast the future, I'll act based on the Market action.

Summary

The current situation is clearly favoring the Bears, a lot of weakness in the Market. So far, there isn't a clear Market direction, but in the next few days we might see the S&P breaking the support or the resistance. This price action, the volume and the Monthly NH-NL numbers will be great tools trying to determine what's coming in the next few weeks. Usually going long or short are what is mostly associated with taking a position in the Market. Moving to cash is, from my point of view, also a very important way of taking a Market position, one where you are preserving your capital until the circumstances favor your way of trading.