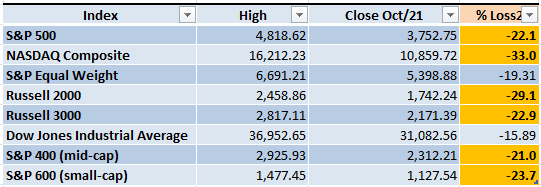

The trading week closed with a strong upward movement of 2.37% for the S&P 500, however it's important to add some perspective to that percentage. At this point, most of the important indexes are still in Bear Market territory (a loss of 20% or more from the previous high). The interesting part comes when we review the selling pressure, the NH-NL Indicator is displaying a reduced supply. The weekly chart of the S&P 500 is tracing a nice bullish divergence, and the question now is, could this lead to an important rally?

Market Overview

The first time I heard about divergences was from Dr Alexander Elder's book "The New Trading for a Living". As any other pattern, they work if you can control the risk and greed, otherwise you can end with no profits or some pretty bad losses. I did try it for a couple of years, but it doesn't fit my personality. Independently of the timeframe you choose to trade, it's a strategy mainly for contrarians.

The concept of a bullish divergence is actually very simple, that doesn't mean that it's easy to trade, but the idea is easy to understand. In the weekly S&P 500 chart below, there was a low reached on the week of Jun/13 and then a new low was reached on the week of Oct/10 (horizontal dotted black line). The term divergence is because despite the lower level reached in October, the indicators don't confirm that power.

There's a MACD-Histogram right below the price chart, in June the Bears managed to create a sharp decline and that was captured by the MACD-H. In October the level reached was even lower, however the MACD-H is just displaying a very small decline (black dotted arrows).

The same can apply for other indicators, the Keltner Channels (KC) are in the same situation. In June the weekly S&P 500 chart went down to the -3 KC. In October the S&P 500 is around the -2 KC. If the Bears are so powerful, why the indicators are no longer confirming that force? The bullish divergence signals a potential rally, which doesn't necessarily mean a change in the Market direction.

We are still going through a downtrend in the weekly S&P 500 chart, that means lower highs and lower lows. In order to damage the structure of the downtrend, the Bulls would need to take the index above 4,350 which is unlikely to happen in a single week. The way in which I interpret the current evidence is that the best-case scenario for the Bulls during the next trading week will be to reach 4,200.

If there's a reaction rally, which is just a possibility, I don't think it will get past 4,200 in a single week. Since mid-August none of the rally attempts has been able to get past the +1 KC (red dotted arrows). Even if some positive catalyst starts to move the Market in an upward direction, the daily chart will be at deep overbought levels around 4,000 which could trigger some selling ending in a pullback.

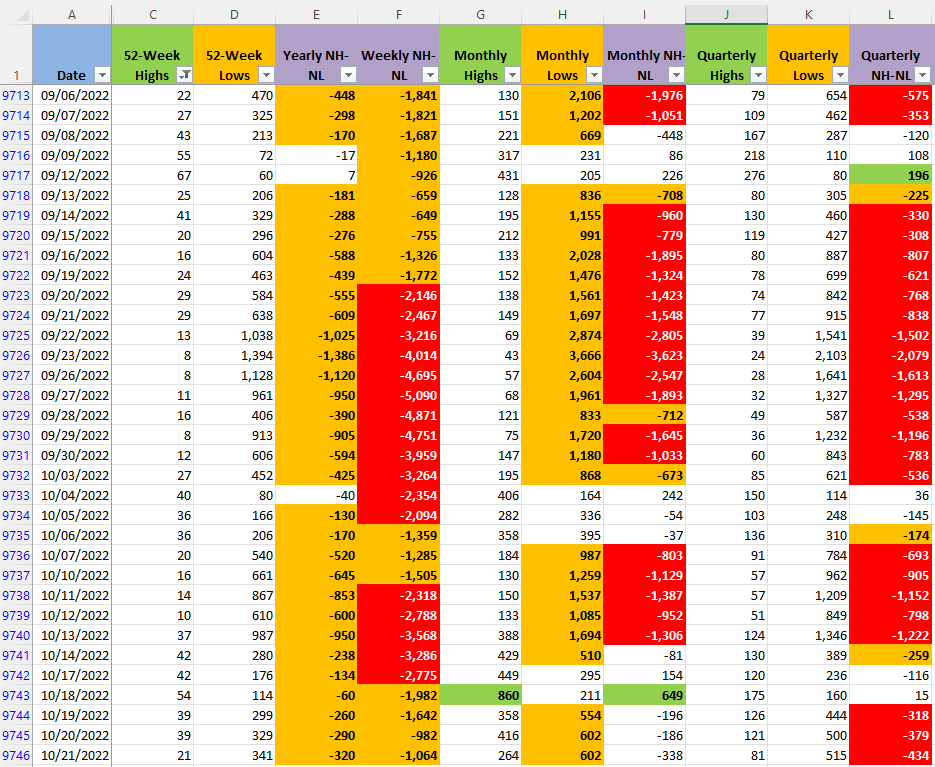

The New Highs and New Lows numbers reflect the lower selling pressure. The Monthly timeframe, which is the one that moves faster, is still displaying some force from the Bears, but not at the levels that we saw around Sept/23. Even if the selling pressure is decreasing, the demand doesn't display a significant improvement.

It takes some time after sharp declines for the stocks to start reaching New Highs, unfortunately from Sept/01 - Oct/21, the average of New Highs is 226. If you want to interpret that number, it means that in the last couple of months the average of companies making a new high in a trading day is 226. In the same period the average of companies making a new low in a day is 1,210, more than five times the number of new highs.

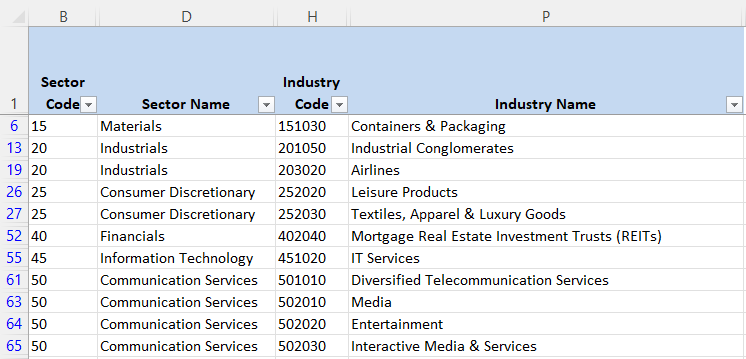

Industries

From the 68 that compose the Global Classification Standard (GICS), this week I couldn't find a single Industry that I would classify as being in a strong uptrend. In the last few weeks, I have displayed some sample Industries that have been severely affected by the decline, even with the gains that we saw last Friday, they are still at very low levels, and the possibility that they can go even lower it's still there.

The importance of this section as I have mentioned in other articles is detect potential leaders that eventually, despite the force of the Bear Market, will be able to rally. That could happen weeks or months before the Market actually turns into an uptrend. Those Industries will contain the potential leaders of the next multi-month Bull Market. There's no way to know when those outliers will start to appear, it could be next week or in a year, that's why every week I keep reviewing every single Industry until something starts to change.

Scenarios

Scenario #1: Since I'm waiting on the sidelines, that means not a single position open, it's easier to wait for the rallies. Even if I'm wrong my account is still protected. I see some chances that a rally occurs, a simple reaction rally, with a goal of no more than reaching a level of 4,200 in the S&P 500 during the next trading week. That's an ambitious goal, even 4,000 would be a great movement from the Bulls. The indicators displaying a reduced selling pressure and the potential for a rally based on the bullish divergence, give some hope. The Bears are still in control, the risk appetite is low, and the decline could resume at any time. That's why I'm being very clear that a reaction rally, if it happens, would likely be just a temporary movement with a realistic goal of 4,000 and with some luck, maybe 4,200.

Scenario #2: The second most likely scenario, from my point of view would be that the decline resumes its course. The Bear Market isn't over, the negative news keep dominating the media (i.e. inflation/recession, Ukraine war, supply chain crisis, China tensions, etc.). If we add to those negative catalysts that we are still in the Earnings season, there is always the potential that the Bears are able to continue taking the Market to lower levels.

Scenario #3: I like the idea that the Market starts tracing a bottom, in fact if we take only the last couple of weeks, the majority of the movement is happening between 3,600-3,800 in the S&P 500. If that behavior continues an additional week, it could start resembling a bottom, something that could be a healthy platform for a powerful rally in the future.

Summary

During the last couple of weeks I thought that the most likely scenario was a reaction rally, there have been attempts but they have all failed. The Market is giving some clues that the selling pressure is decreasing, with the proper catalyst and some force from the Bulls, that reaction rally could happen next week. Unfortunately, the Market has it's own timing, and the shortest the timeframe, the less accurate the predictions are.

Being on the sidelines isn't fun, not in the Markets at least, it gives me the impression that it's harder to sit and do nothing than actually open positions and enjoy the ride. However, we are in the middle of a hurricane, I rather wait for it to be over before risking any capital. The pilot trades that I have opened haven't worked very well, until I see an improvement in the Market conditions, I'm ok waiting.

Preserve your capital, without funds in your trading account you won't be able to keep playing this game. I have learned a lot about risk management during this Bear Market, and hopefully your trading plan is keeping you safe too.