We are about to start an abbreviated trading week, on Monday the USA Markets will be closed in observance of Martin Luther King Jr. Day. Since the beginning of Nov/2021 the S&P has been consolidating between the weekly support/resistance levels I have mentioned in my previous posts, 4,482/4,775 respectively. This consolidation can last for a long time, until there is some catalyst that is strong enough to resume the weekly uptrend or to break the uptrend and start a big correction, maybe even a Bear Market.

Consolidations can be frustrating, the Market will keep going up and down, testing the short-term support/resistances but at the end it will stay more or less in the same trading range. After two and a half months of being in this consolidation there is still no clear direction only a few clues.

Market Overview

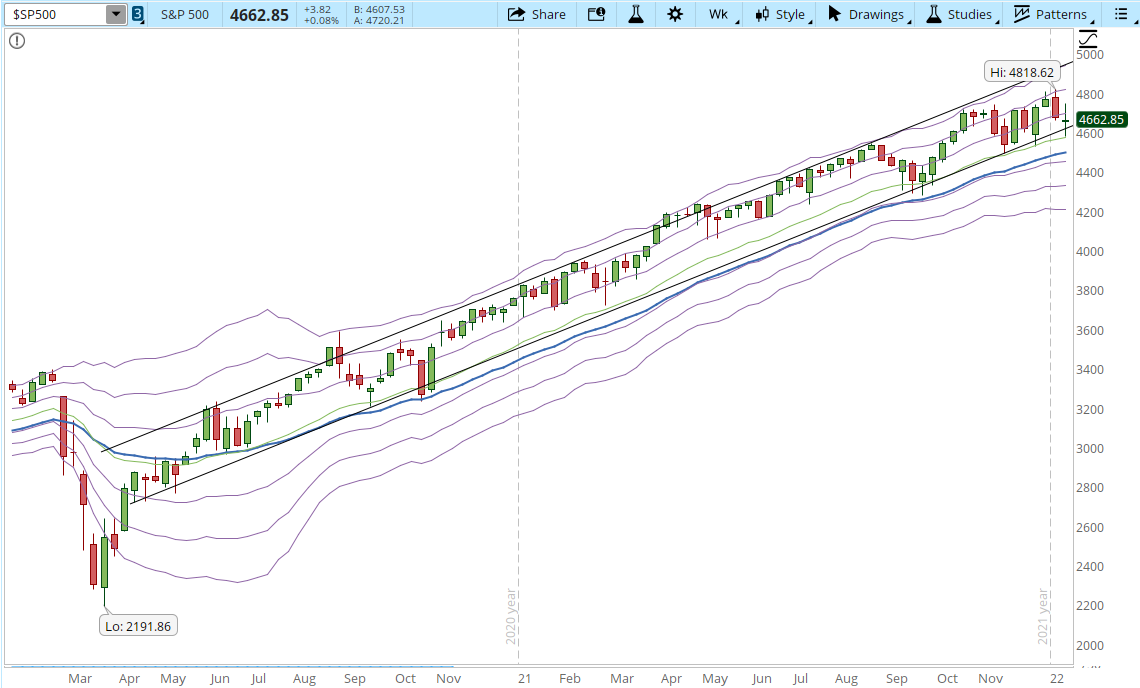

Usually I start with a 39-min chart but as the S&P just keeps moving inside the range 4,482 - 4,775 this week I see more relevant to study the daily chart. When the S&P was finally able to break the 4,482 resistance and it became the new weekly support on Oct/19/2021 (red arrow in the screenshot below) the consolidation started and we will have very few bars outside the weekly range of 4,482 - 4,775.

We can try to guess where the Market will go during the week that is about to start but from my point of view that is useless. As long as it stays in the trading range some days it will go up and others it will go down. The interesting part is where the Market is headed once it finally breaks the trading range, will it go above 4,775 or below 4,482.

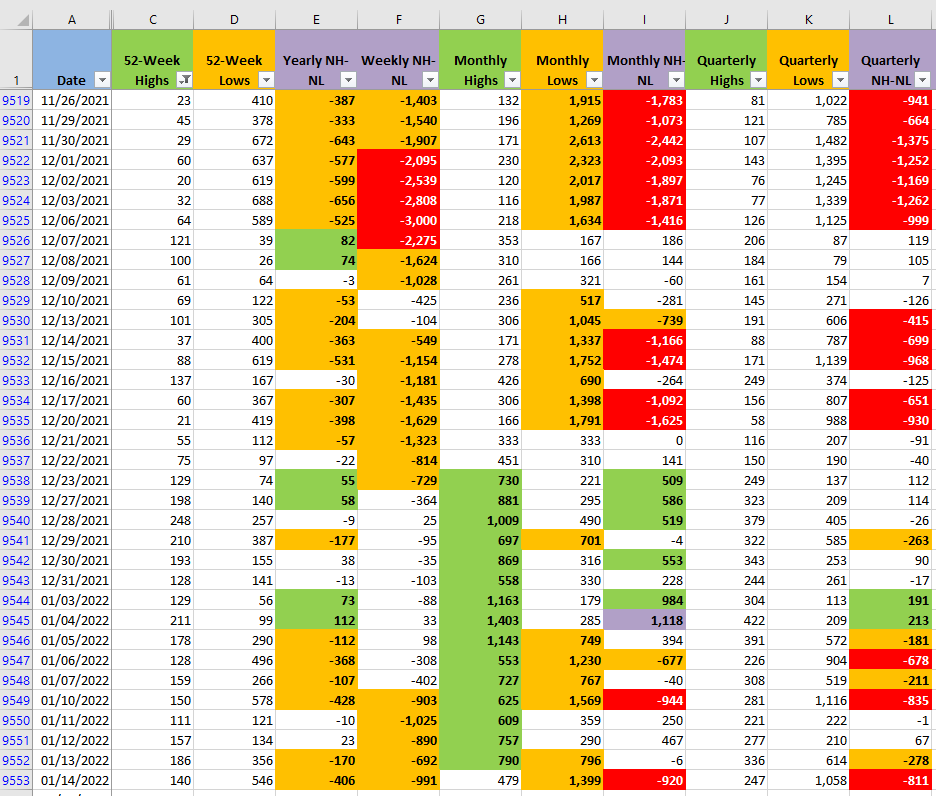

Unfortunately, there are only a few clues and right now they favor the Bears. There was a rally in Oct/2021 that lasted practically the entire month. After that, every rally has been killed in four days or less. Reviewing the latest numbers from barchart.com the New Highs vs New Lows it shows the dominance of the Bears in all the timeframes displayed in the screenshot below. If there is a chance that the S&P resumes the weekly uptrend, it needs to show some force similar to what was since during Oct/2021 and for the past two months and a half we haven't seen that.

The weekly trend is still intact, however if it closes at 4,550 or below that level, the structure of the trend could be damaged or broken completely. If the Bulls are going to do something (I'm still on the bullish side) it needs to be soon, in the next couple of weeks. The rally needs to decisively take the S&P above 4,800 at least. Unfortunately it doesn't look like there is something right now that will be strong enough to move the Market in that direction in the next few days.

Long time ago I read the book 'A Complete Guide to Volume Price Analysis' from Anna Coulling. One of the candle shapes described in the book is called the Long Legged Doji Candle, that candle looks like the last candle in weekly chart below (red arrow), and it describes pretty well the current situation we are living in the Markets.

'In itself the doji candle signifies indecision. The market is reaching a point at which bullish and bearish sentiment is equally balanced. In the context of what actually take place in the session, it is something like this. The market opens, and sentiment takes the price action in one direction. This is promptly reversed and taken in the opposite direction, before the opening market sentiment regains control and brings the market back to the opening price once more. In other words, there have been some wild swings in price action within the session, but the fulcrum of price has remained somewhere in the middle.

Once again, the price action reveals the sentiment, which in this case is indecision and therefore a possible reversal. The long legged doji can signal a reversal from bearish to bullish, or bullish to bearish, and the change in direction depends on the preceding price action. If we have been in an up trend for some time, and the long legged doji appears, then this may be the first sign of a reversal in trend to bearish. Conversely, if we see this candle after the market has been falling for some time, then this may be signalling a reversal to bullish.'

Anna Coulling

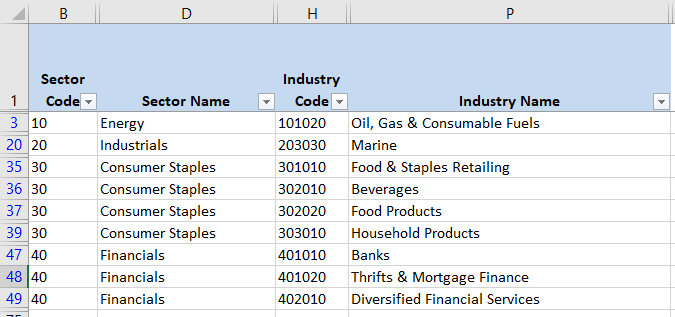

Industries

As if the bad news weren't enough, the amount of Industries where I see strength drastically got reduced and half of those Industries are on the defensive stocks. I track 68 Industries from the Global Industry Classification Standard (GICS) and only 13% of those Industries are showing some real strength. That's a low number if there is a chance that the weekly uptrend continues. You can do your own analysis depending on the timeframe you trade and your particular strategy trading the Markets, I still think that the number will be low.

Scenarios

- Scenario #1: If the Bears keep the control of the Market either the S&P will stay in the trading range or it will eventually break the 4,482 weekly support. This one, from my point of view, is the most likely scenario. If there is a relief rally, it will most likely get killed in a matter of two to four days. Under this scenario I'll tighten my stops and maybe start closing the positions that are not performing that well in order to reduce my risk and be able to open positions in other Industries. If the 4,482 weekly support is broken I'll start looking for attractive shorts.

- Scenario #2: If there is nothing relevant during the abbreviated trading week, the S&P might just keep going up and down within the trading range. A few good news and there will be a relief rally, some Fed or virus news and it will go down. In this scenario I'll stay on the sidelines since there is no clear direction for trend trading, if things don't look that bad maybe I'll think about swing trading a couple of positions.

- Scenario #3: If there is finally some real Bull strength, that means first closing above 4,700 and then go and test the 4,800 level, then it's time to see which of the tickers I track looks attractive. I might even close a few positions that are not performing that well in order to get into more attractive setups. Anything can happen in the Markets, but this scenario seems to be the least likely of the three.

Summary

As long as the Market keeps consolidating and there is no clear direction about where it will go in the next few months the best thing for my particular way of trading is stop opening new positions, prioritize risk management and keep monitoring the indicators I trust. At this point Bears have the control, that doesn't mean that there can't be a significant rally but I don't see what could trigger it.

I'm not trying to forecast what will happen in the Market or I'll go crazy trying to follow the volatility that the news are generating. I'll just stick to the scenarios described above and act accordingly.