The S&P 500 gained +1.86% (80 points) and the other important indexes also had important gains. However, all I see so far is weakness, the S&P just stalled at the same level below 4,400.

Reviewing the 39-min chart, it's clear that the S&P still doesn't have the force to break the 4,400 resistance. If the selling pressure starts to increase again, the index will go down and test the 4,330 support.

The daily chart (removing almost all the indicators in the screenshot below), will give some clues once things start to improve. I'm waiting for the 30-day EMA (blue line in the daily chart) to start bottoming at the very least, a flat line, not a declining line. It would be even better if it starts to point upward. Another clue that would be bullish is that finally the price can hold above the 30-day EMA (blue line), right now is still way below that level. Finally a bullish signal would be that the S&P manages to rally and hold above 4,600 (upper black line in the screenshot below).

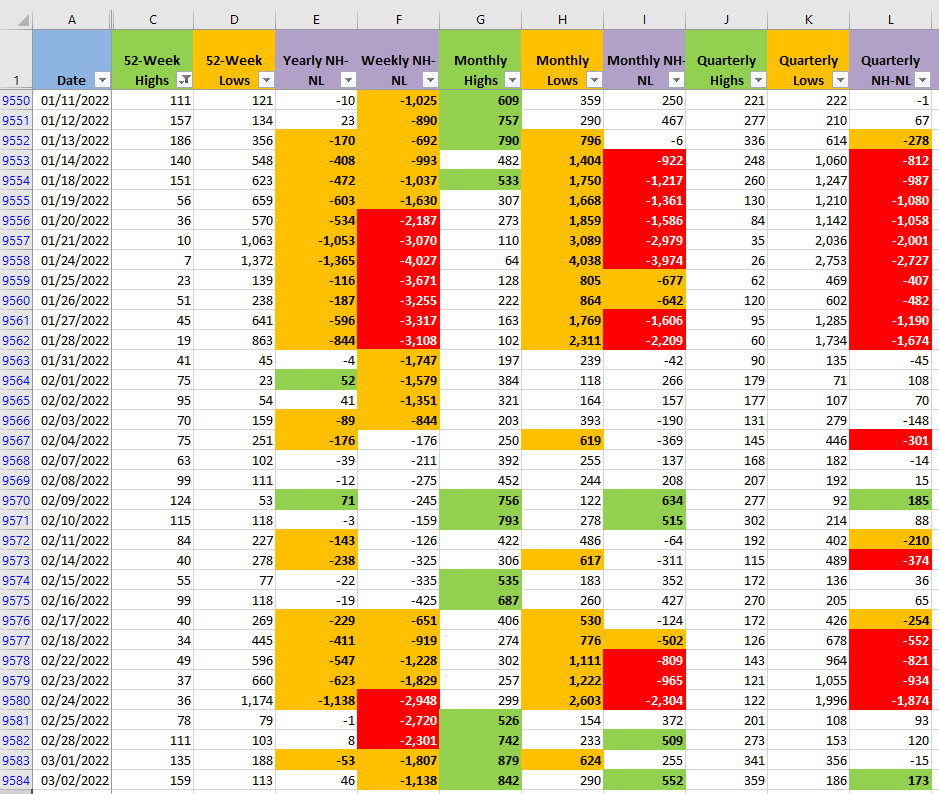

The only reason that keeps me thinking that this rally might still have a small chance is the number of New Highs and New Lows. If you take a look, especially to the Monthly timeframe (columns G, H, I), the New Highs have been strengthening since Feb/25 and the New Lows decreasing. The only issue is that this situation is not being reflected in the price action, the S&P simply can't get past 4,400. Let's see what happens during the last couple of trading days of the week.