The S&P closed higher for a second day. Some dovish Fed comments from the Cleveland Fed President and lower T-note yields gave a boost to the Market. The earning season is going well, 76% of the 317 companies that have reported earnings from the S&P 500 beat estimates. What is the issue then? I don't like that the S&P can't get past the same level where it displayed weakness a week ago.

Right before the 4,600 level, the selling pressure starts to enter the Market, is it going to be the same this time? Tomorrow we are likely to have the answer. If we review the behavior from Jan 18-20 in the 39-min chart below (red arrow), the level right below 4,600 was serving as a support, it could only hold for three days before the Correction resumed.

The same level is now serving as resistance, a week ago, on Feb/02 the S&P gapped up and then the next day it went down. Today we get the same behavior, another gap up that can't get past the 4,600 level (orange arrows).

Reviewing the daily chart of the S&P 500 gives a better perspective of why I keep mentioning in my last few posts that the S&P could be tracing a bottom. The blue line is the 30-day EMA, which seems to be flattening, this isn't a guarantee that the Correction can't resume its course, but we aren't facing the same power from the Bears as the one we saw on Jan/05.

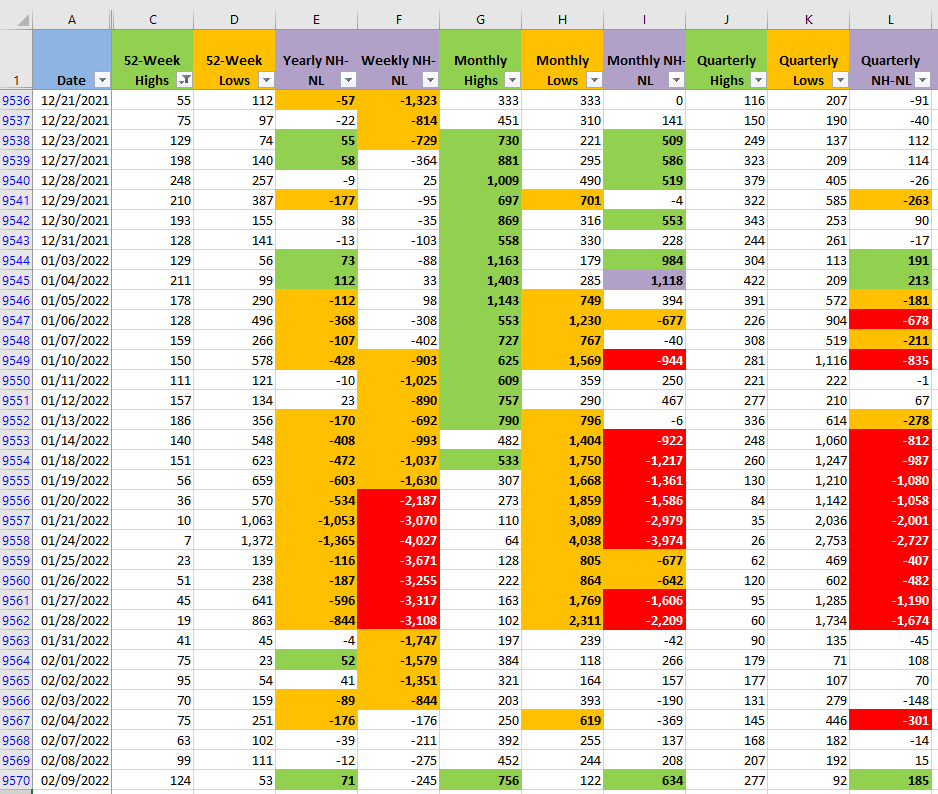

The New High and New Lows numbers improved for all the timeframes I track. In terms of the NH-NL the situation is not the same as it was on Feb/02, the selling pressure looks much weaker now than a week ago. If the New Highs keep increasing and the New Lows stay more or less at the current levels, the rally has a chance to live for several days. The last important rally we had was in Oct/14/2021, after that every single rally has been killed in four days or less. Get ready for the clues that the Market could provide on the last two trading days of the week.