Trying to outsmart the Market is a risky business, there is this dream that the future can be consistently predicted and so far it's still a dream. Warren Buffett has been considered by some a genius and one of the best investors in the history of the Markets. Even him doesn't try to predict the future, he values a company, sets a margin of safety and then if his analysis is correct, eventually he will profit from that company.

The S&P 500 is struggling to get past 4,100. One option is trying to forecast whether it will break the resistance or not. Another option is just wait and see, act accordingly to the Market action. The Market had a limited pullback last week and this is a great opportunity to see how strong the Bulls really are.

Market Overview

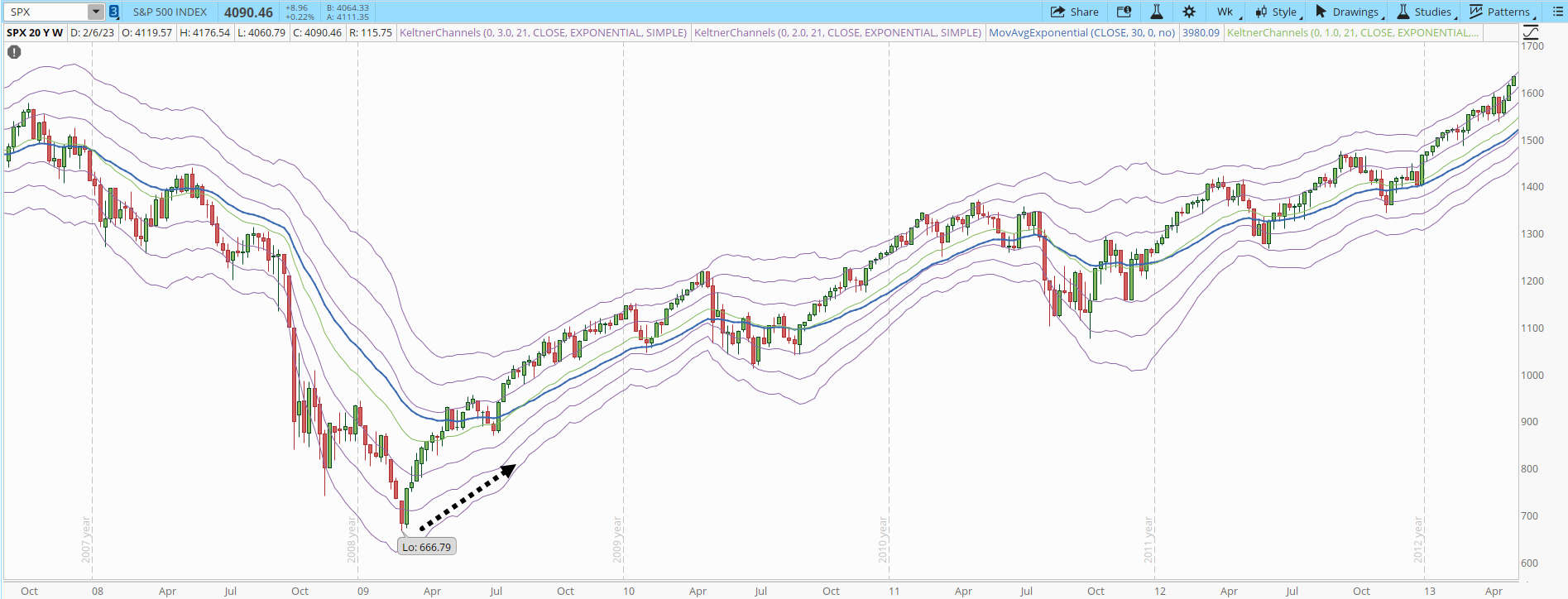

The S&P 500 weekly chart is again at a point where it has suffered sharp declines since the beginning of 2022, the +1 Keltner Channel (KC) of the weekly chart continues to act as a strong resistance (yellow highlighted areas). The interesting part is that when this pattern started in Mar/2022, the selling pressure sent the index as low as the -3 KC. The next decline, in Aug/2022, went only to the -2 KC. The last one in Nov/2022, only to the -1 KC. The Bears are losing power, but the Bulls aren't strong enough yet to create enough demand to get past the resistance of the +1 KC.

I have mentioned multiple times in my previous articles that I monitor closely two milestones in the S&P 500 chart. I have highlighted them in the daily chart below, which are 4,150 and 4,350 (horizontal black dotted lines). When the rally is strong enough to start breaking past those milestones, then things will get very interesting when trading on the long side.

The Bulls are also achieving more and more often the levels of +2 and +3 KC in the daily chart (yellow highlighted areas). But no rally so far has been able to cross and hold above those levels.

Industries

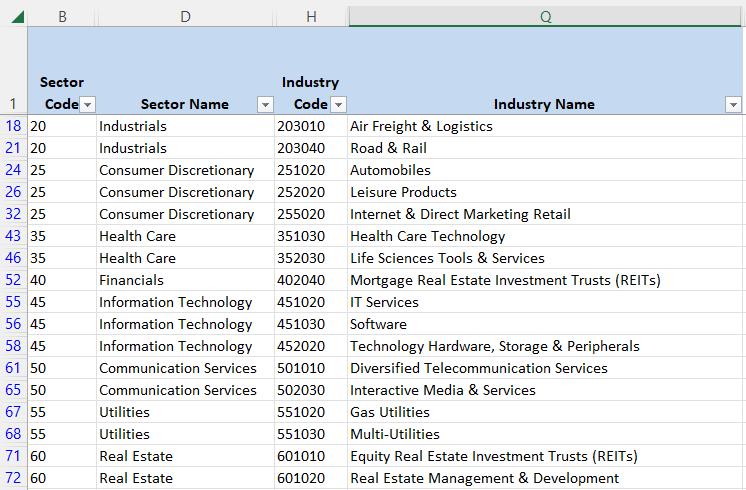

From the perspective of the Global Industry Classification Standard (GICS), there are now only 17 Industries out of 68, with a clear weekly downtrends (screenshot below). Sometimes we look for instruments to trade, which is eventually the goal of this game. Part of a profitable strategy is also to understand what to avoid. I'm not touching any stock classified within the Industries displayed below.

Scenarios

Scenario #1: The most likely scenario for the trading week about to start is that the volatility is likely to increase, at least during the first half of the week. The decline is likely to continue to at least a level around 4,000 in the S&P 500 chart. On Feb/14 the Consumer Price Index report (CPI) will be released and the risk of a severe Market reversal exists.

Scenario #2: There's always the chance that the Bulls are finally strong enough to withstand the difficult conditions that might present next week. I see this scenario as less likely because the Bulls haven't proved anything yet. At some point they will, but that could be next week or next year. If the rally can at least close the trading week above 4,150 that would be a signal of strength.

Summary

Bulls are finally fighting back with limited results. We can compare the current rally to a powerful recovery like the one that happened after the Subprime Mortgage Crisis. A v-shaped recovery where the Market rallied for more than a year before its first important pullback. In more recent times, after the sharp decline caused by the Covid pandemic in 2019, that was also a powerful recovery with a rally that lasted almost two years before the most recent Bear Market started.

It's too early to tell if we will see something similar, or if the Bulls will take their time to gain back the control of the Market. No one can consistently predict the future, if you already have a profitable trading plan, follow it instead of trying to follow the Market noise. I'll play the probabilities game rather than trusting a crystal ball or the so-called experts and trading gurus. There is a lesson in humility when even Warren Buffett trades with a safety margin, despite having a mountain of cash estimated at $147 billion USD.