The rally that started on Wednesday May/25 has gained 216 points already (taking as reference the closing price of May/24). We will have an abbreviated trading week in observance of Memorial Day, is this rally going to continue with that much force on Tuesday?

Market Overview

In the Markets everyone ends being wrong sometimes, even the most famous names, such as Bill Ackman that recently lost more than 400 million USD in his position on Netflix (NFLX) or Bill Hwang that lost 20 billion USD in only two days. The Market is a great equalizer, it doesn't matter if you studied in Harvard or you are considered a genius trader, you can still fall.

The Market has a way to deliver humility lessons, my point of view today is that the S&P 500 will reach its peak for the current rally at around 4,200. Could I be wrong? Definitely. The powerful rally is creating doubts about my analysis and I'm ready to change my mind when the price action gives evidence that I'm wrong.

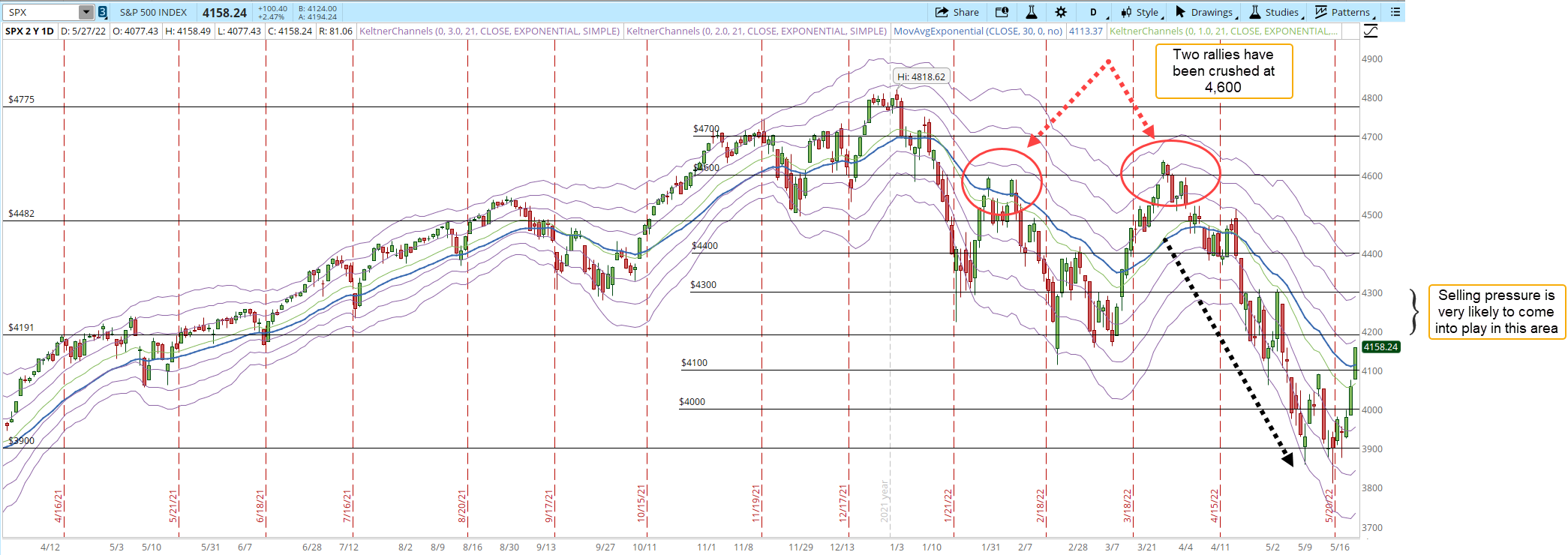

In the screenshot below, the S&P 500 daily chart shows how a decline that started on March/30 (black dotted arrow) broke one support after another, an amazing display of bearish power that ended on May/12. There were attempts to rally during that decline but they all failed.

Now the Bulls are attempting to recover some of the lost ground, there will be attempts from the Bears to kill the rally and it will be quite interesting to see if the rally continues or not. Two rallies have been completely crushed at 4,600 (red-circled areas). There is a congestion zone that will generate selling pressure at 4,200-4,300. That will be the first short-term test that the index will face.

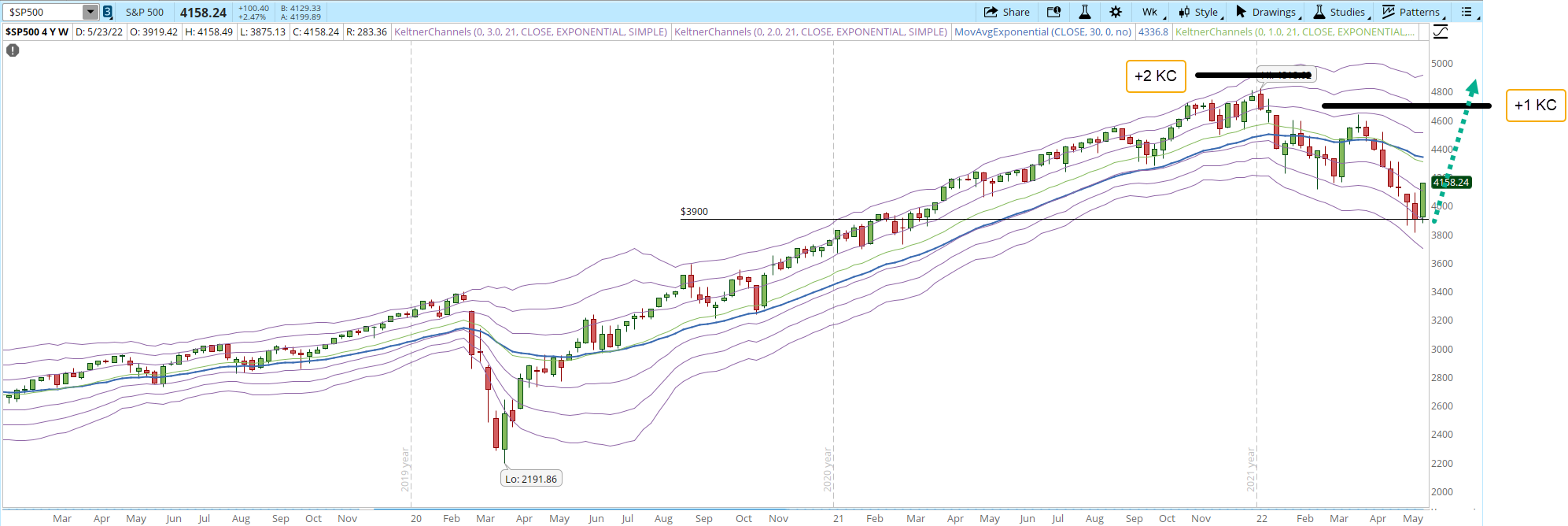

My main concern is still the weekly chart, it's a lot easier to be wrong on the daily chart since anything can move the Markets up or down. The weekly chart moves at a slower pace, and the downtrend pattern it's tracing, from my point of view, is something to worry about.

If the current rally, or the ones that come after that don't move the index above 4,650 it will be much clearer the downtrend pattern that the S&P 500 chart is tracing (horizontal black solid lines). Lower highs and lower lows that are also confirmed by the Keltner Channels (KC). When the S&P 500 reached it's historical high of 4,818 in Jan/2022 the price level reached the +2 KC. The next top was at 4,637, lower than the first and it only reached the +1 KC. The question now is how far the current rally will take the index? Can it break that pattern of weakness? (green dotted arrow).

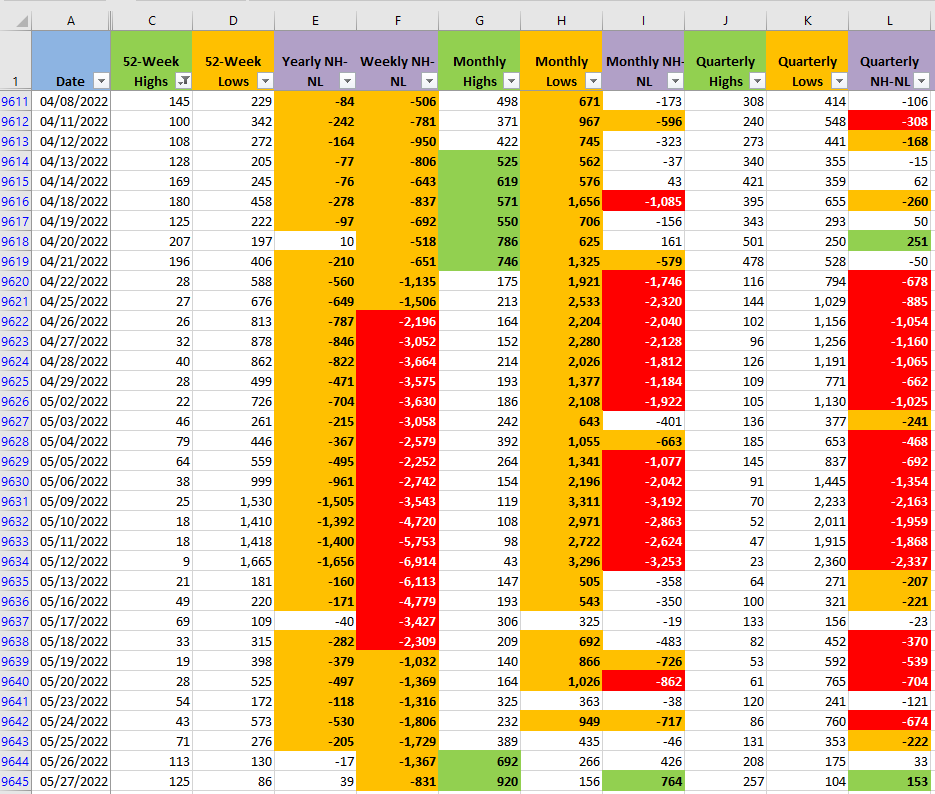

The New Highs and New Lows numbers (NH-NL) turned bullish in the Monthly and Quarterly timeframes for the first time in more than a month. If the Monthly New Highs can sustain or improve the numbers and the New Monthly Lows stay below 500, the rally has a chance to break the 4,200 barrier. I have serious doubts that the good news will keep coming for the next one or two weeks but the NH-NL indicator gives some hope to the Bulls.

Industries

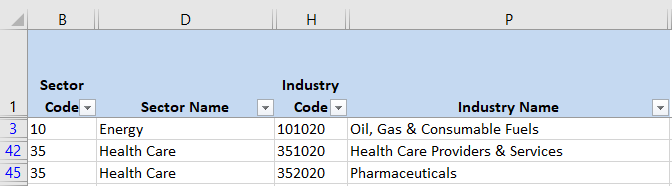

The Industries where I still see strength are the same ones from last week. From the 68 Industries that compose the Global Classification Standard (GICS), I consider only the three Industries below as strong. That's only 4% of the entire list. It will take some time to revert the damage done by seven weeks of continuous decline. I consider important to track the Industries with strength, eventually there will be a few of them that will lead the stocks into a new Bull Market. At this point, it's still too early to tell which Industries will become those leaders.

Scenarios

Scenario #1: The scenario that I see most likely next week is that the rally will begin to stall. At this point of bullish sentiment, I think a lot of people think that the S&P 500 is ready to go to the moon. Anything can happen in the Markets, so that's a possibility that can't be discarded, however there will be selling pressure sooner or later. If the Bulls don't have enough force to absorb all the supply that will start entering the Market at 4,200-4,300, the price is likely to stall or decline.

Scenario #2: The second most likely scenario, from my point of view, is that before the end of the next trading week, the S&P 500 will pullback. We have seen three days of good news that have been able to move the index more than 200 points. We cannot forget that there are also negative news that have been around for months, they are the ones that sent the index almost to 3,800. The inflation problems aren't solved, the Ukraine war is still an active issue, China's financial problems and its tensions with the US are still there. The earnings season hasn't delivered the best results, the supply chain problems are still far from over. All those are catalysts that have severely affected the Market.

Scenario #3: The third scenario, which I see as the least likely to happen, is that the S&P 500 will break the 4,200 barrier with force. That movement could send the index to 4,300-4,400. If this happens, it will be a signal of strength from the Bulls. I would start to take more seriously the upward movement and it will be a real threat to the Bears if it can make a move past 4,650. That will require that the good news keep coming during at least the next couple of weeks.

We have seen that behavior only once this year, when the S&P 500 rallied for 11 trading days on mid-March. After that, at 4,600 the Bears killed the rally and the index declined 821 points.

Summary

Eventually there will be a new Bull Market, no one can say for sure if the current three-day rally that we witnessed this week is the beginning of that Bull Market. The Bears have given a lot of evidence this year that they are in control, I wouldn't rush to say that the Market direction is changing yet until I see further evidence backed up by the price action.

Some trading strategies might benefit from the current situation, most likely day-traders and swing traders. I need a multi-week uptrend in order to really profit from my trading strategy. I'll continue watching from the sidelines, monitoring closely the situation, if there's enough evidence that this is really the beginning of a new Bull Market I'll start opening new long positions.