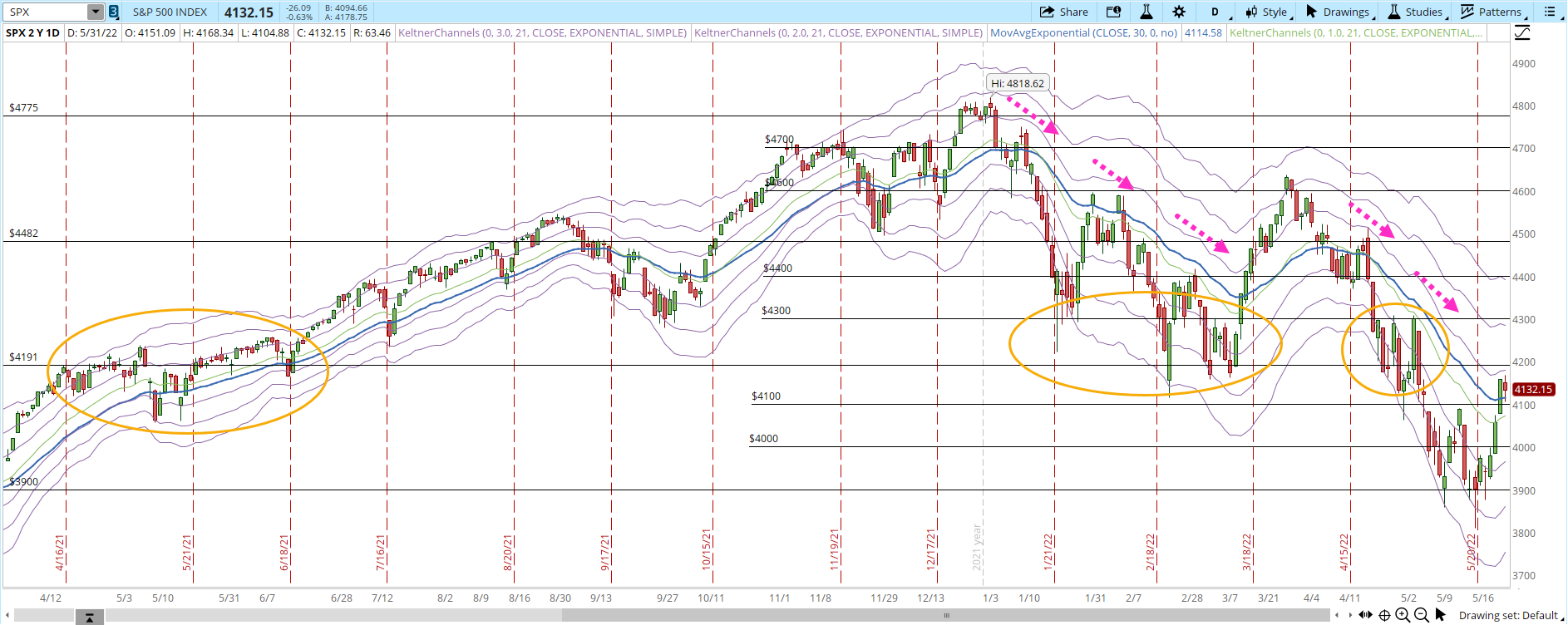

It wasn't that surprising to see the S&P 500 and other indexes pause after having a powerful three-day rally. I have been mentioning that a realistic target for the rally was between 4,100-4,200. If the powerful uptrend continue I could definitely be wrong, however it was easy to see that selling pressure was going to at least make the rally stall for a bit.

If you check the orange circled areas in the screenshot below, there was been a lot of congestion around 4,200 that's one of the reasons it will take some extra force to overcome the resistance. The other reason is that during 2022 the daily chart of the S&P 500 hasn't been able to go very far from the 30-day EMA (blue line). Once that it's near or crosses that blue line, it tends to pullback (pink dotted arrows).

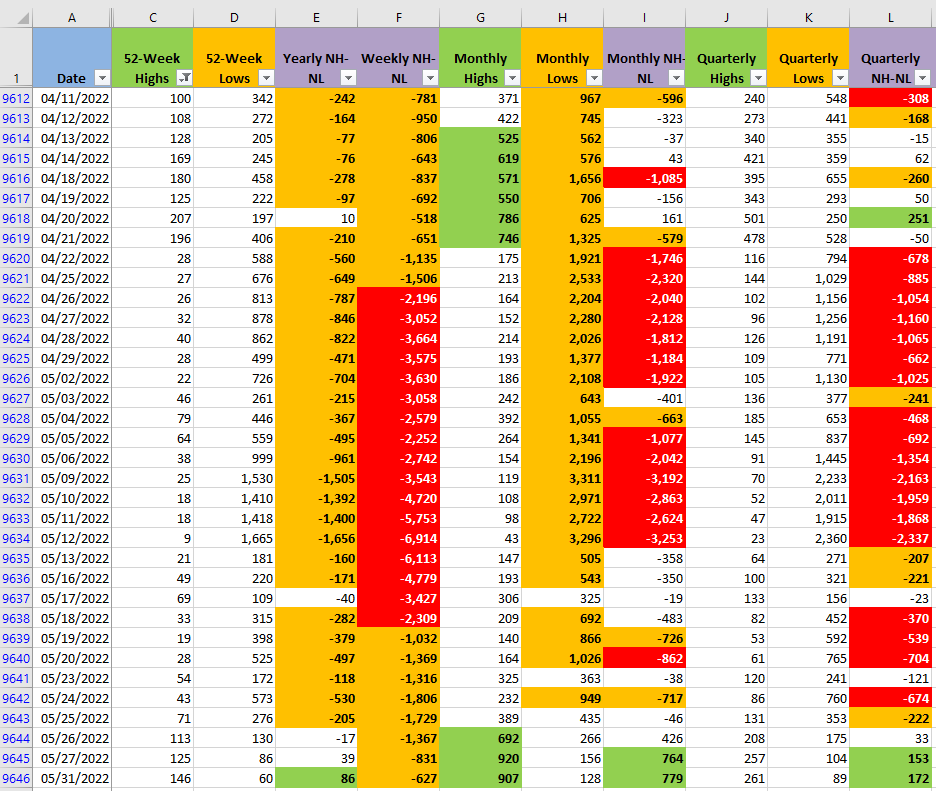

Reviewing the New Highs and New Lows indicator (NH-NL) the numbers are still bullish. If the Bulls are able to sustain and improve those numbers, the rally has a chance to continue. Bears were able to keep those numbers in their favor for months, three days of bullish NH-NL numbers isn't significant yet.

The rally isn't necessarily over, in fact, at some point (not necessarily this rally) there will be a rally that is so bullish that starts tracing higher highs and higher lows and nothing will be able to stop it for weeks or months. Before the rally, the Bears were in total control for 7 weeks, not a single rally was able to challenge the Bears in a significant way. Let's see if the Bulls are able to come up with a movement with such a force that makes it clear that they can also take control of the Market.

Today we saw that the inflation news again were a Market concern. Same old news affecting the Market, the Bulls still have three more days to show that there is still fuel on this rally. Otherwise, it will be a good clue that the Bears are still in control.