It's still too early in the week to guarantee that there won't be a rally that recovers part of the losses of this Correction, however today there was no force from the Bulls at all. All of the important indexes closed with small losses, only the Nasdaq Composite had a bigger loss of -1.20%.

In my Weekend Market Overview, published yesterday, I detailed my reasoning about why I think the Correction isn't over yet and that in my mind the most likely scenario for this week is that the rally would stall (link below).

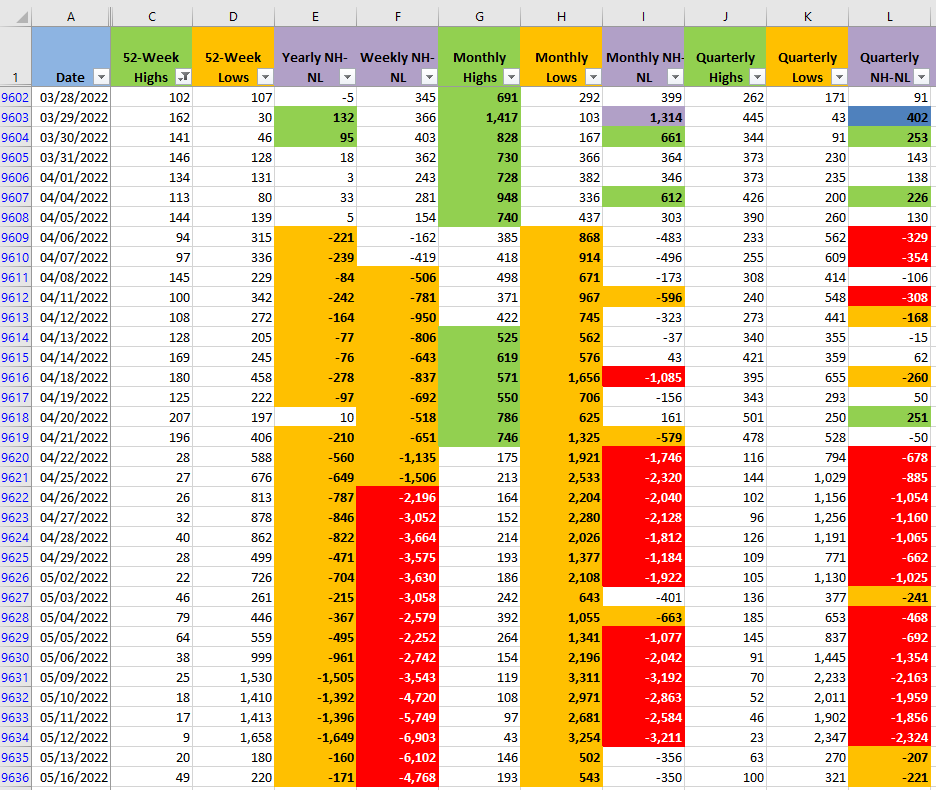

May/15/2022 - Weekend Market Overview - Fake Until Proven RealThe New High and New Lows numbers, which have been an important part of my analysis in the last few days, didn't move much. The change in the NH-NL numbers in May/13 was very significant, however, today that power seems to have disappeared.

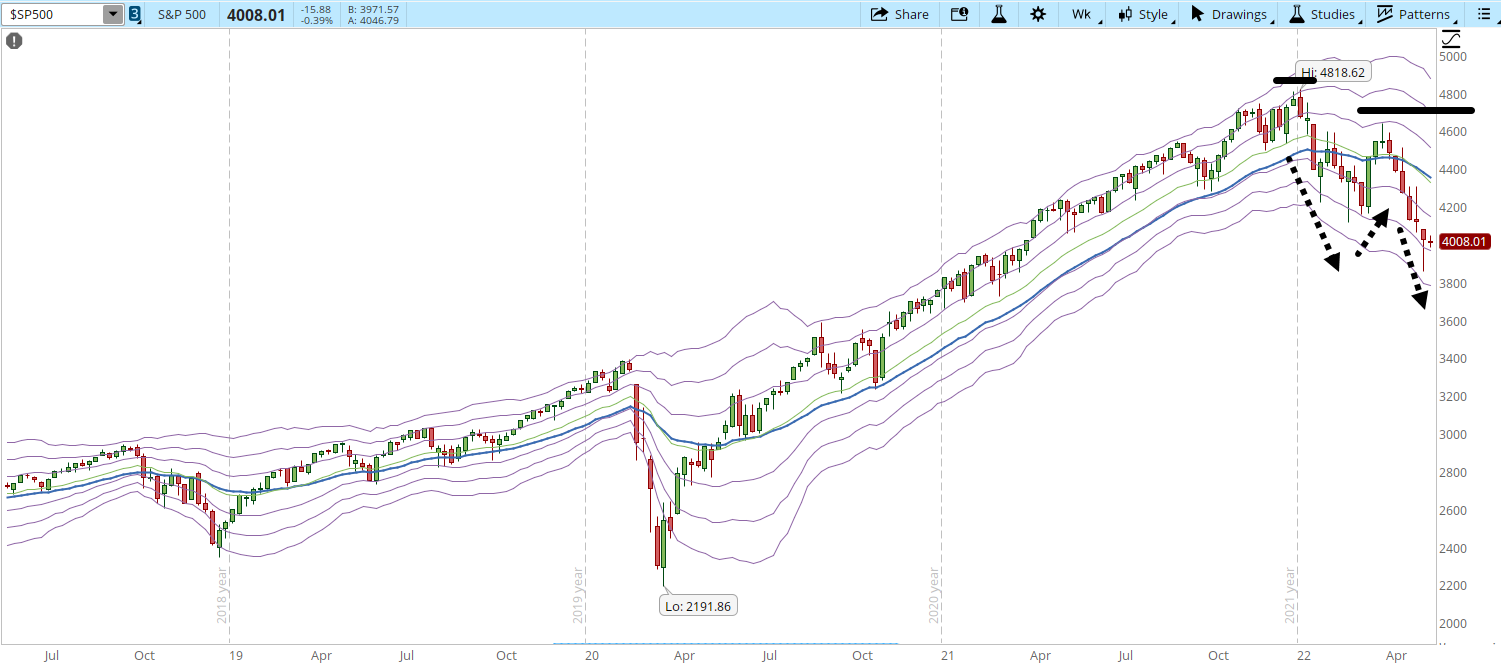

If there is a multi-day rally this week, I would see 4,200 as a reasonable target before it pulls back again. In the recent history the 30-day EMA (blue line) has been serving as a resistance most of the times when the S&P 500 went down to oversold conditions (-3 Keltner Channel or below) in the daily chart (green dotted arrows). Once it reached the 30-day EMA, the index usually declined again (red dotted arrows).

Whether S&P 500 goes up or down in the next few days, is of less concern to me than the downtrend pattern that the weekly S&P 500 weekly chart is tracing. Lower highs and lower lows (horizontal solid black lines) is what we can start to see more clearly in the screenshot below. In order to break that patter the rally has to go even higher than 4,200. At least to 4,650 which is a level that we haven't seen since mid-January.

If there is a rally, that would be great for the Bulls, I still think that the Correction eventually will resume, so I'm waiting on the sidelines, very attentive to the Market action in order to start opening new long positions. What we saw today isn't a display of power from the Bulls, it looks more as an attempt to hold above the 4,000 support despite the ongoing selling pressure.