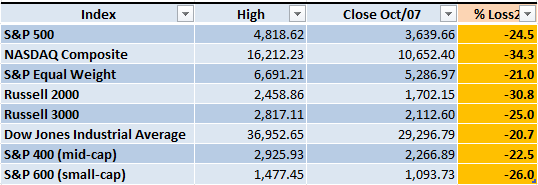

Last week I mentioned that the most likely scenario, from my point of view, was a reaction rally (not a change in the Market direction, just a reaction rally) with a realistic target of 3,950. There was only a feeble rally, the S&P 500 wasn't able to close past 3,800 and on Friday it ended losing most of the gains of the week. Every single important index is still in Bear Market territory (a loss of 20% or more from the previous high). The key part is try to get a better understanding of the balance of power between Bulls and Bears with the clues that were given during the trading week that just ended.

Market Overview

The weekly chart of the S&P 500 is the one giving the most relevant information at this point and the timeframe that I'm monitoring more closely. We are in a weekly downtrend (lower highs and lower lows, highlighted by solid horizontal black lines), and in order for the structure of the downtrend to be strengthened, the S&P 500 needs to close decisively below 3,600. The interesting part is that the index seems to be rejecting a price below that level with the current amount of supply.

A bullish Keltner Channel (KC) divergence is starting to form in the weekly chart, that means that the index is reaching a lower level than the one we saw on June/17 (3,636 vs 3,584) but in terms of the KC this time it got only to the -2 KC while back in June it was at oversold levels in the -3 KC. This is a factor to consider when the Bulls attempt to fuel another rally.

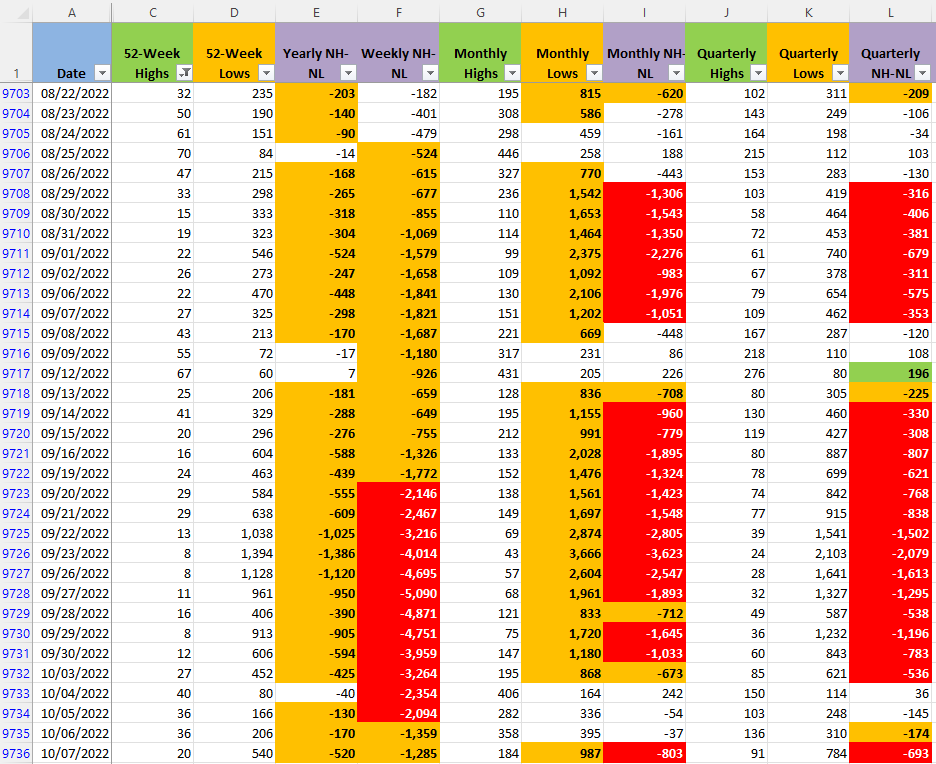

Since we don't have the advantage of a Market Maker in order to easily see the supply and demand and take action with that valuable information, we can look for proxies that give us some understanding about the amount of selling pressure and how it's being absorbed by the demand. One way to do that is the New Highs and New Lows indicator in its different timeframes (NH-NL).

The most important timeframe at this point is the Monthly NH-NL, that's the one that moves faster than the others. It will give us in a period of a month how many tickers made a New High or a New Low. The selling pressure had its highest point during Sept/23 (my birthday by the way). Only 43 tickers made a New High and 3,666 made a New Low (columns G, H and I from row 9,726).

If we review Oct/07 the amount of New Highs hasn't increased significantly, only 184 symbols made a New High, however, despite the losses that the Market suffered last Friday the amount of New Lows is only 987, a significant decrease in the amount of tickers making New Lows.

The daily chart of the S&P 500 only confirms the power of the Bears, certainly it seems that they are losing some power, at least temporarily, but in terms of results they are in control. If we review the behavior of the index since Aug/16 the Bears have been able to kill every rally, each time faster and with a sharp decline.

The Bulls took the index to the +3 KC on Aug/16 but then the Bears started a sharp decline that ended in Sept/6 on the -3 KC. The next rally the Bulls were only able to take the index to the +1 KC and again the Bears started another sharp decline that ended on Sept/30 again on the -3 KC. The final and feeble rally only got to the -1 KC and lasted two days before the Bears stopped it.

The faster the timeframe the harder is to predict what's going to happen, especially during times of high volatility. However, the daily chart is useful to understand when the index is getting to oversold/overbought levels and identify potential divergences that could contribute to the next rally or pullback.

Industries

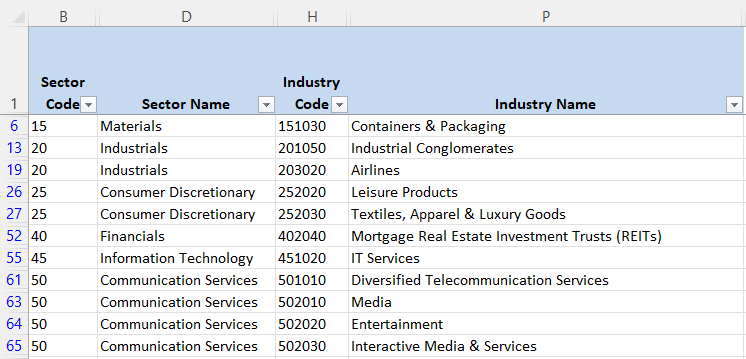

The concerns about the inflation were again an important negative catalyst for the Market. The week started with a potential rally that was displaying some strength, but it only lasted two days. After that, the Bears managed to kill the rally and we are almost back to the same levels that we saw last week. Since we didn't get a decent rally, this weekend again I couldn't find a single Industry from the 68 that compose the Global Classification Standard (GICS) that I would consider strong.

Last week I published a list of a few sample Industries that have had very sharp declines (screenshot below), none of them has recovered. It could take some time in order for the Market to start tracing a bottom, a V-shaped recovery isn't impossible, but at this point it's unlikely without a surprisingly strong positive catalyst that would fuel the Industries during a few weeks at least.

I want to stress that even if this section doesn't change that often, we might still have a few more weeks without strong Industries, it's very important to keep an eye on it at least on weekly basis. Eventually a small group of Industries will deviate from the bearish behavior that we have seen during the past few months. That small group could include the companies that will lead the next powerful Bull Market weeks or months before the rest of the Market follows.

Scenarios

Scenario #1: I keep the same idea from last week, the most likely scenario, from my point of view, is that in the next few days we will see a rally that is more significant that the failed attempt from Oct/03. The Bears are in control and there's no evidence that even if the Market rallies next week, there will be a change in direction. However, that the S&P 500 gets back to a level around 3,950 isn't a crazy idea for a reaction rally.

Scenario #2: Unfortunately, we have to be prepared for the possibility that the Bears recover their strength and resume the downtrend. A sentiment of fear or even panic could start to dominate the Market if the Bears are able to take the S&P 500 below 3,600. The next strong support that I see is around 3,400.

We also need to consider that fear moves the Market in a much faster way than greed, but greed can last much longer than fear. If the Bears recover their force, hopefully you have a strict risk management in place with a proven plan behind your trades. A violent move in the Market could start to trigger stops quickly with very little time to react.

Scenario #3: The least likely scenario that I foresee is a sideways movement. I don't dislike the idea, if the Market starts to trace a bottom it would be healthy in order to form a base for the next rally, it might also reduce the volatility. The reason I don't see this as a very likely scenario is that we have very strong negative catalysts that are far from being solved (i.e., inflation/recession risks, Ukraine war, supply chain crisis, tensions with China) and the earnings season will add another factor to consider.

Summary

The Market is a tricky place to navigate, if we see that there is a rally that lasts a few days it might give the impression that things are getting better. If we see a company that we like and suddenly it losses 50% or more of its Market value it becomes an attractive idea to buy it at "discount", after all it's a company that it's not likely to go out of business soon. A few years ago, I would follow that kind of generic ideas that only end generating losses.

With this article I tried to display the evidence that the rallies are getting less powerful in the daily chart even when the selling pressure is showing a significant decrease. Despite our personal convictions about the future of the Market, I still don't see strong evidence of a recovery, I even think the Bears still could gather some force and take the Market lower.

I'm waiting on the sidelines until there's a more conducive environment for my trading plan. Strict risk management is a must even for the pilot trades that I might open in the next few days/weeks. Whatever your plan is, preservation of capital is the highest priority, otherwise you are out of the game. Even if the current situation isn't very encouraging it won't last forever, the Market will continue to bring new Bull and Bear Markets and we should trade accordingly.