When there is uncertainty in the Market I look for references that have worked in the past in order to try to understand the ongoing action. In this case, the question is, the weekly uptrend can continue or not?

Market Overview

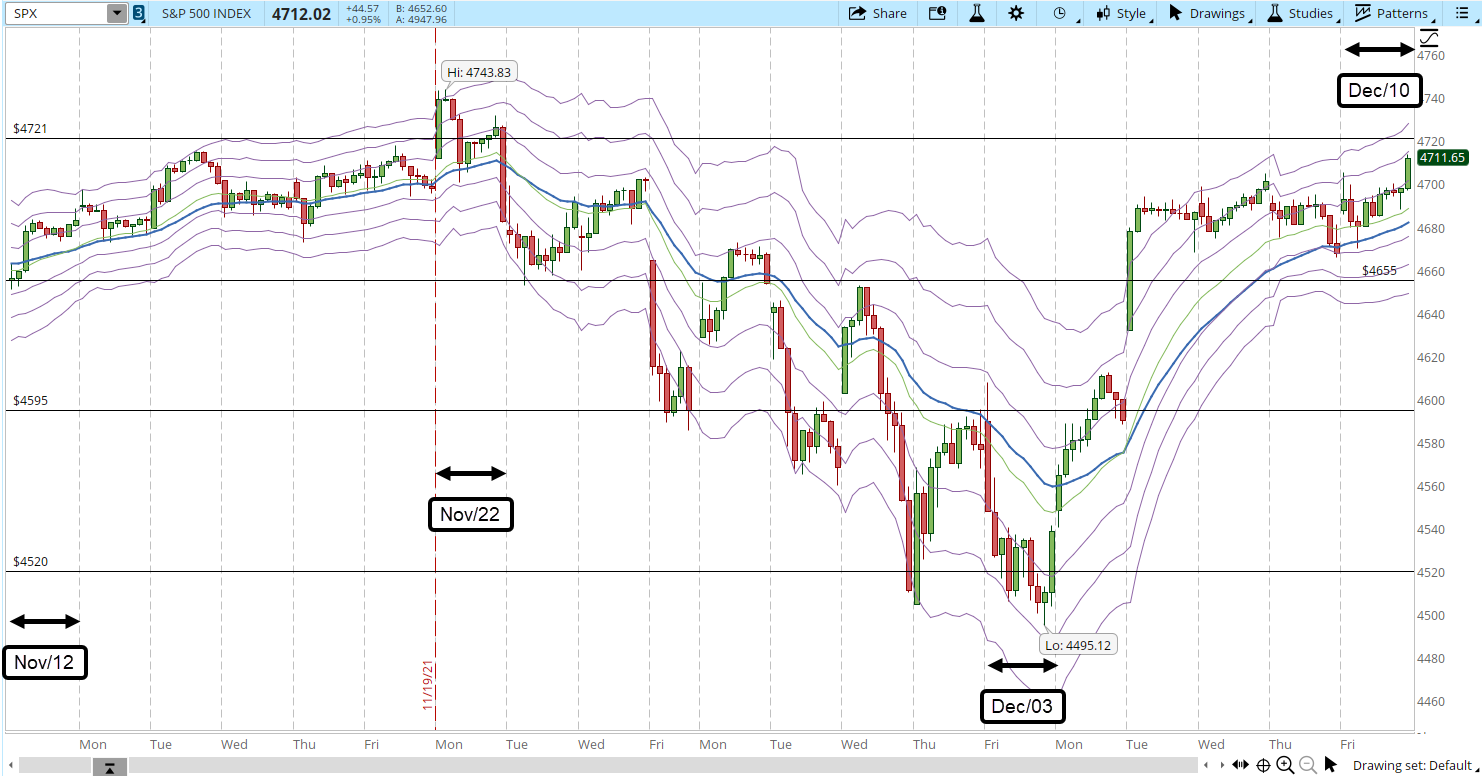

Let's zoom in and review the 39-min chart of the S&P 500. For this week, I have set the weekly resistance to 4,721 and the weekly support to 4,426. In order to better understand the price action of the last few days I have added short-term support and resistance lines at 4,655 - 4,595 - 4,520 (you can click the image below in order to magnify it).

We are in a trading range between 4,721 and 4,655. It can be traced back as far as Nov/04 (the screenshot only shows data from Nov/12 - Dec/10). In order to understand what will happen, if the weekly uptrend will continue or not we have to pay attention to the clues that the Market could give us next week. Nothing that interesting will happen until the Bears try to test the support line or the Bulls the resistance line.

The history of a ticker can be a valuable edge. The Bulls already tried in Nov/22 to break the resistance line and failed. Bears took control and were so strong that were able to break three support lines until they reached a bottom in Dec/03. I'm still bullish, the weekly trend is what is guiding my decisions, the 39-min chart helps me understand the price movement in the short term.

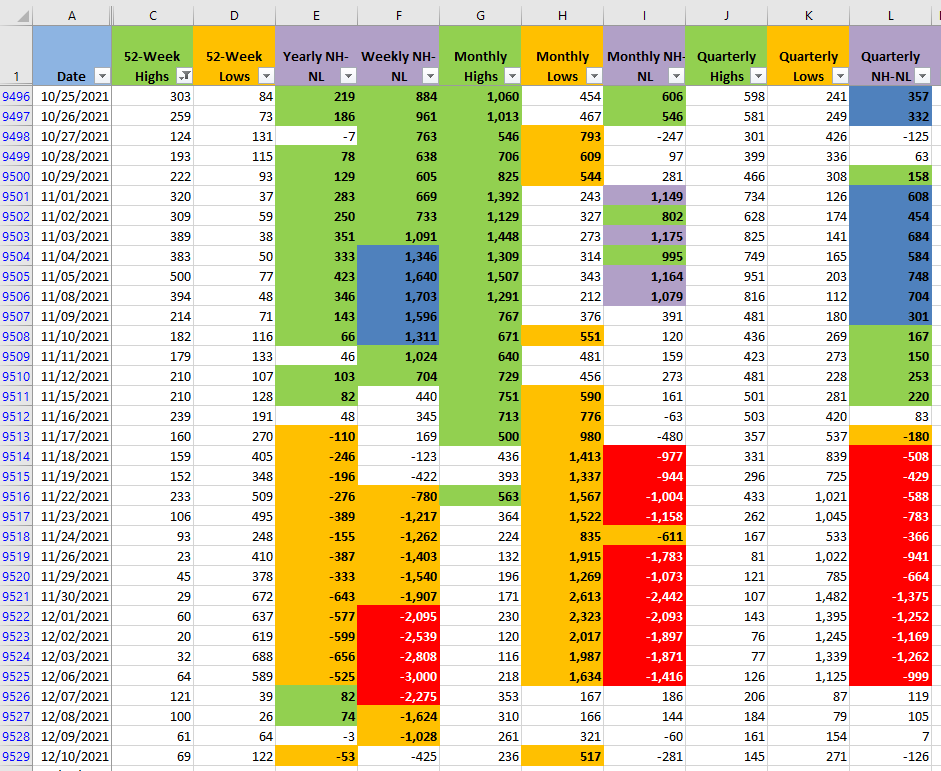

The Monthly New Highs or Lows also don't favor yet Bulls or Bears (columns G and H of the screenshot below). The forces of Bulls and Bears at this point seem at balance.

In this scenario where there is no clear winner yet, for my particular strategy trading the weekly charts, it's time to go back to the sidelines. I did trade ACC on Dec/08 and explained my reasons in a previous post (link below). However, the rally faded and now, until the conditions improve on the long side, there is no point in opening new positions for me.

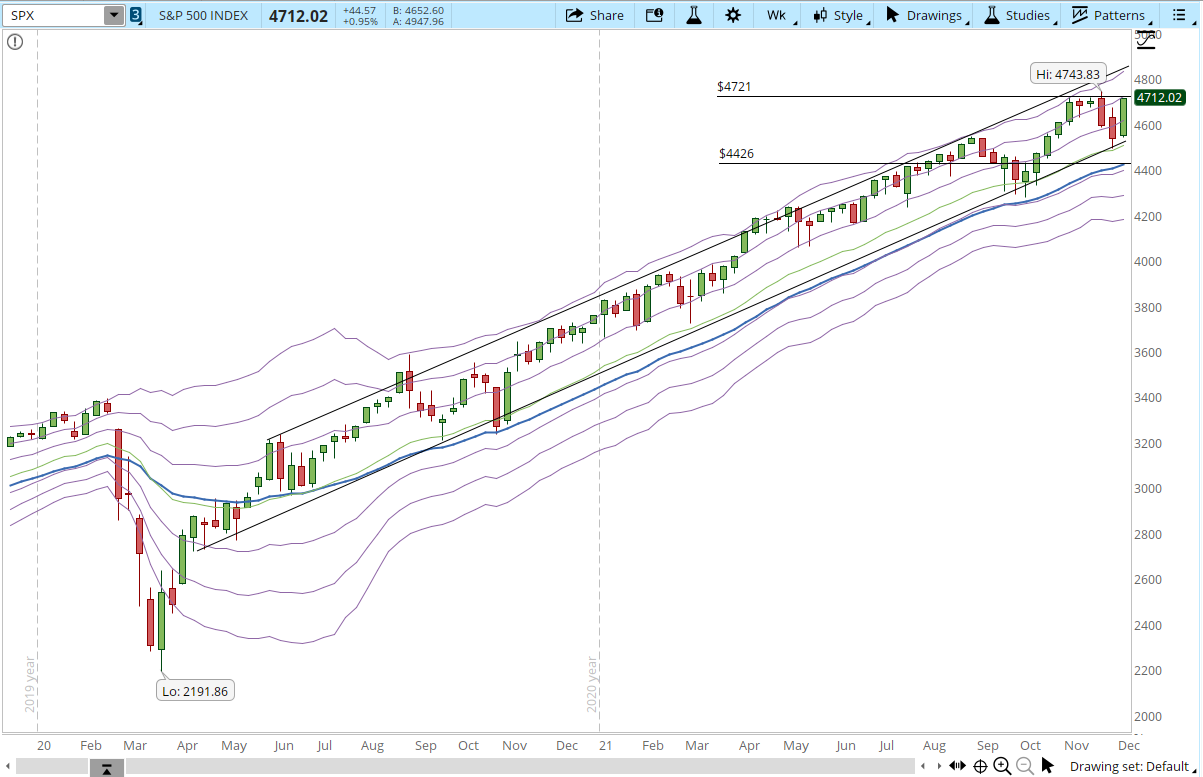

S&P Hits Resistance

In terms of the weekly trend, it still looks intact (click the image in order to zoom in), it helps to see different perspectives of the same data. The 39-min chart only shows the data that corresponds to the last five bars of the weekly chart below.

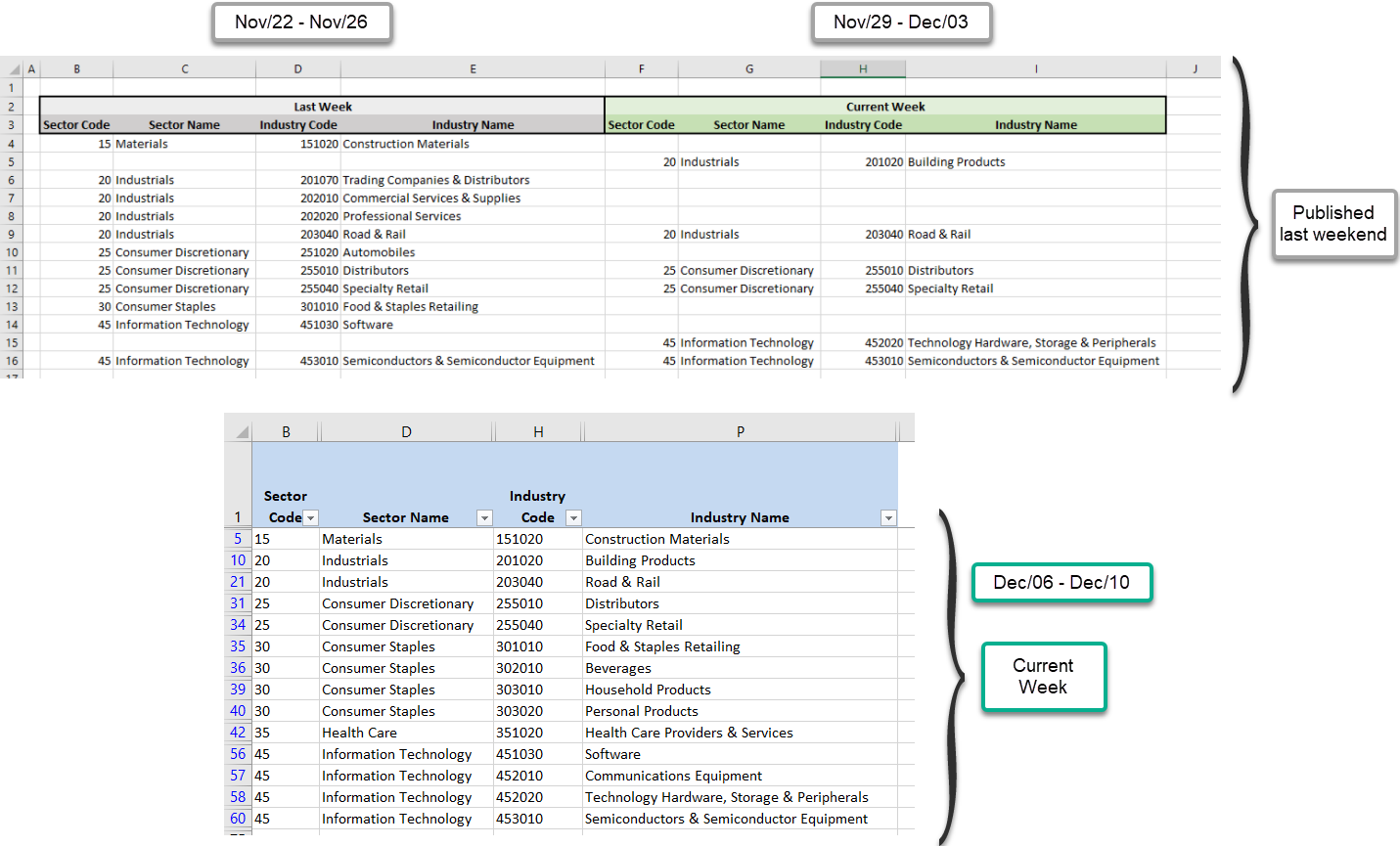

Industries

Another encouraging reason for which I'm still bullish is that the Industries that I consider to be strong increased from last week. Two Sectors, 'Consumer Staples' and 'Information Technology' are gaining traction.

Scenarios

- Scenario #1: If the New Lows increase and the support is broken, I'll just let my stops do their job if any of them trigger. Wait for a rally and see if Bulls can regain control.

- Scenario #2: If the New Highs increase and the resistance is broken with the Bulls being able to close above the resistance line, not just test it, then I'll consider opening new positions if any of the symbols I'm tracking trigger an alert.

- Scenario #3: If the S&P continues in the trading range discussed in the first section of the post, then I'll just wait on the sidelines. The price could keep going in that range for a few days, maybe more, if there is no catalyst that moves the price above or beyond the resistance/support lines.

Summary

Currently there is no short-term clear direction in the Market. The S&P is moving in a trading range and the trading week that is about to start could give further clues about what could happen next with the weekly uptrend. There is no need to rush your trades, sometimes it's better just wait for a clear direction and better market conditions. When the time is right and the opportunities present themselves then it's time to pull the trigger. In order to determine what an opportunity is and what favorable market conditions are you need to have a plan, like the blueprints of a house, it will give you clarity to your trading.