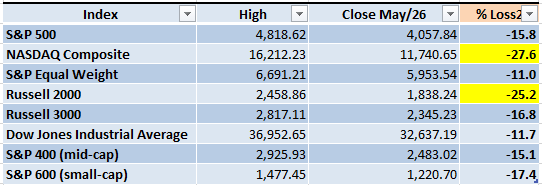

There were good news from retailers today, Dollar Tree (DLTR) posted gains of 21.87% and Macy's (M) 19.31%. That seems to have been interpreted by the Market as a good signal in terms of consumer spending. Some of the indexes distanced a little bit from Bear Market territory (a loss of 20% or more from the previous high, the ones in yellow are already in a Bear Market).

Why did I pick the range of 4,100 - 4,200 as a reasonable target for the rally? During 2022, the 30-day EMA (blue line) seems to be acting as a resistance (pink dotted arrows). As usual, nothing works 100% of the times in the Markets but it was a pretty good indicator of pullbacks. Eventually it will stop working but at this point the Bulls still have a long way before proving that they can at least match the power of the Bears.

Another important statistic to remember is that since Oct/2021, only two rallies have lasted more than four days (orange dotted arrows). Bears are still in control, and a rally of a couple of days still doesn't prove that the situation already changed. It's not impossible that the Bulls gain control of the Market, but there isn't enough evidence yet to back that up.

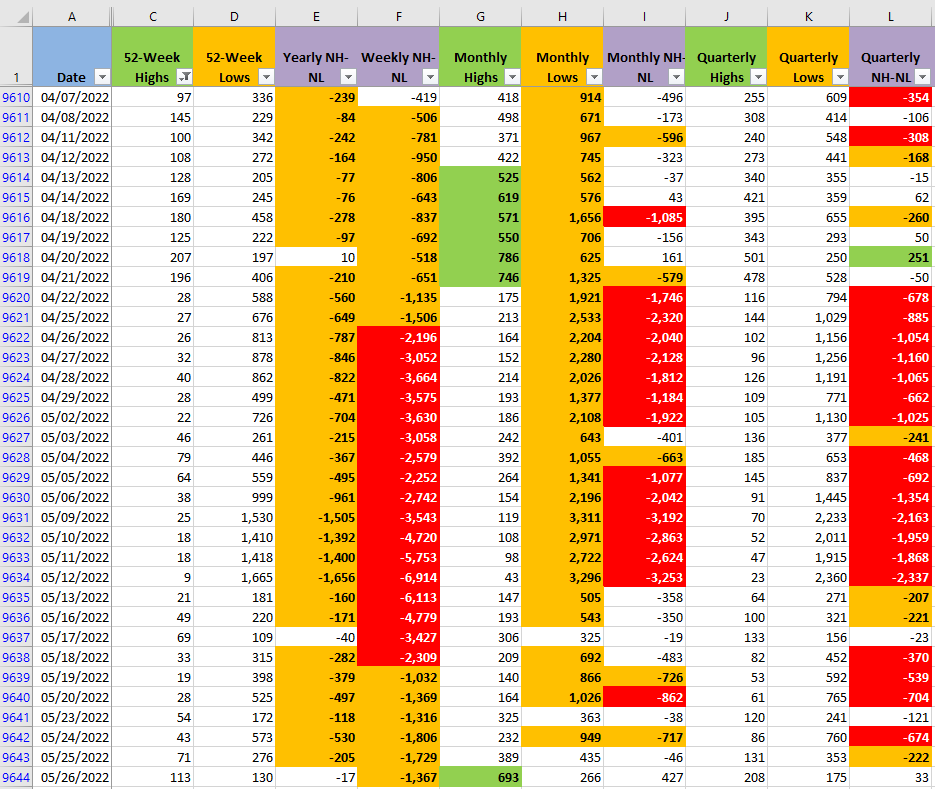

Next week it will be an abbreviated trading week, on Monday the US Markets will be closed in observance of Memorial Day. Let's see if the current bullish sentiment doesn't change during the weekend. The New Highs and New Lows numbers (NH-NL) improved. The Monthly columns, which are the fastest ones from all the ones displayed (column G, H and I) displayed a glimpse of bullish power with the New Monthly highs going almost to 700 and the New Monthly Lows below 300.

I'm still on the sidelines waiting for the Market conditions to become conducive for my trading style based on Mark Minervini's books. We have seen rallies during 2022, just one of them was a significant movement during mid-March and it got crushed by the end of the month (a decline of 700 points). When you think some stock might be going to the moon, validate first if you are not being a victim of FOMO (Fear of Missing Out) and if that stock really complies with your trading strategy or it's just the Market playing tricks on your mind.