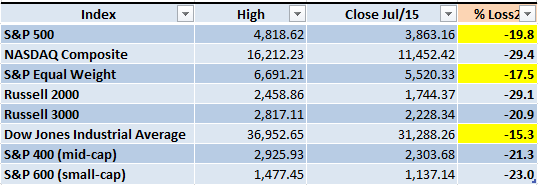

After closing another trading week it's evident that there's not much force from the Bulls. The Bear Market continues, the ones in yellow are the only important indexes that aren't in confirmed Bear Market territory (a loss of 20% from the previous high). The only difference I see this time is that since the low of June/17, the S&P 500 has been rejecting lower prices moving sideways between 3,800 and 3,900.

Market Overview

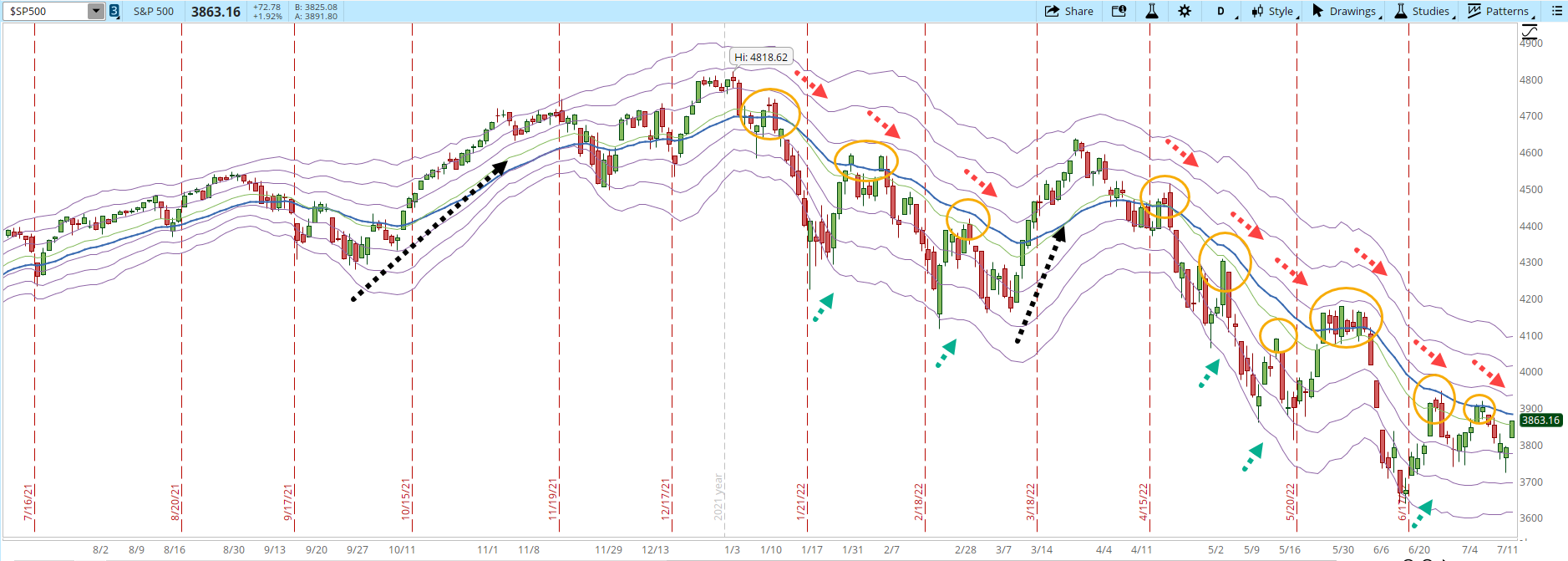

I have mentioned in the past that there are several repeating behaviors that characterize the daily chart of the S&P 500 during 2022. Eventually the Bulls will be able to create a meaningful rally that breaks those behaviors, at this point the index is still very consistent about them:

Behavior #1: Only two rallies, since Oct/2021, have lasted more than 4 days (black dotted arrows).

Behavior #2: Each time that the daily chart of the S&P 500 got to oversold levels (-3 Keltner Channel or below, signaled by the green dotted arrows), there was at least a modest rally that took the index out of the oversold zone.

Behavior #3: Almost every single time when the S&P 500 reached the 30-day EMA (blue line), there was a pullback (orange circled areas). Since June/28 the S&P 500 has tried and failed three times to get past the 30-day EMA.

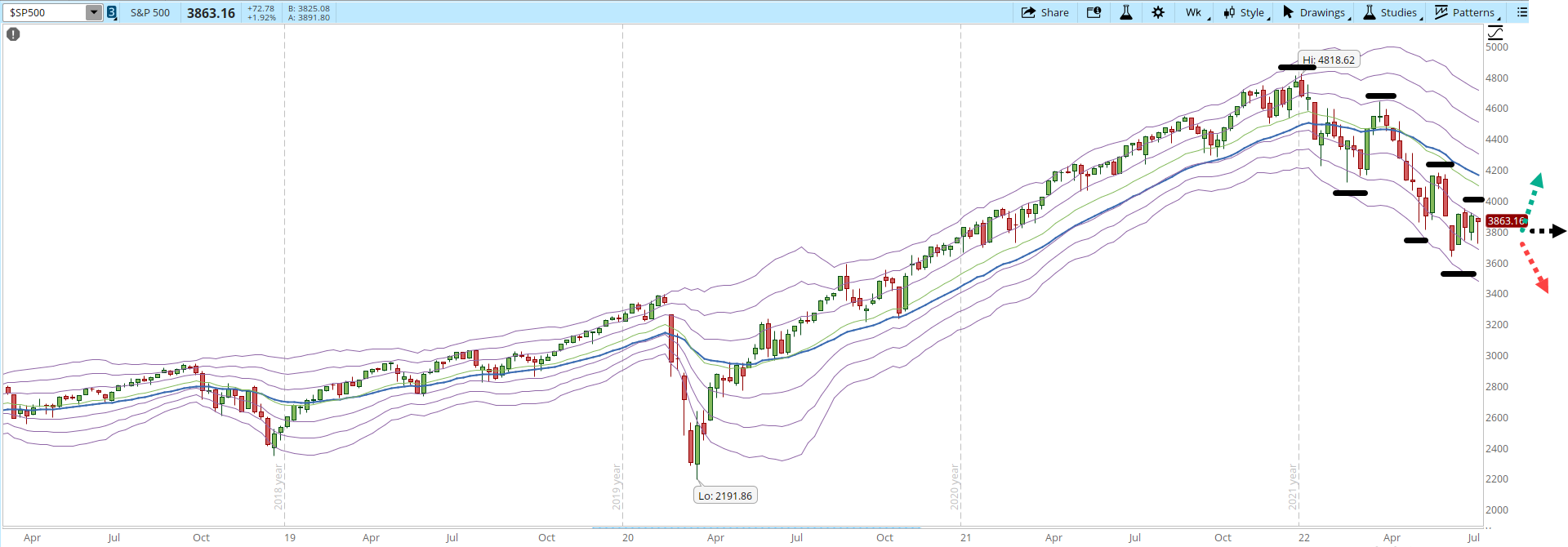

The downtrend of the weekly chart of the S&P 500 is still not showing signs of improvement. Lower highs and lower lows (horizontal solid black lines) that have the index around one thousand points below the historical high of 4,818 reached in Jan/2022. In order to start breaking that pattern the index needs to close decisively above 4,000 soon (green dotted arrow). If the index just keeps moving sideways it could start tracing a bottom, unfortunately lately there is an abundance of negative catalysts that keep affecting the Market. The longer the index fails to rally, the higher the probabilities of a negative catalyst is able to resume the decline.

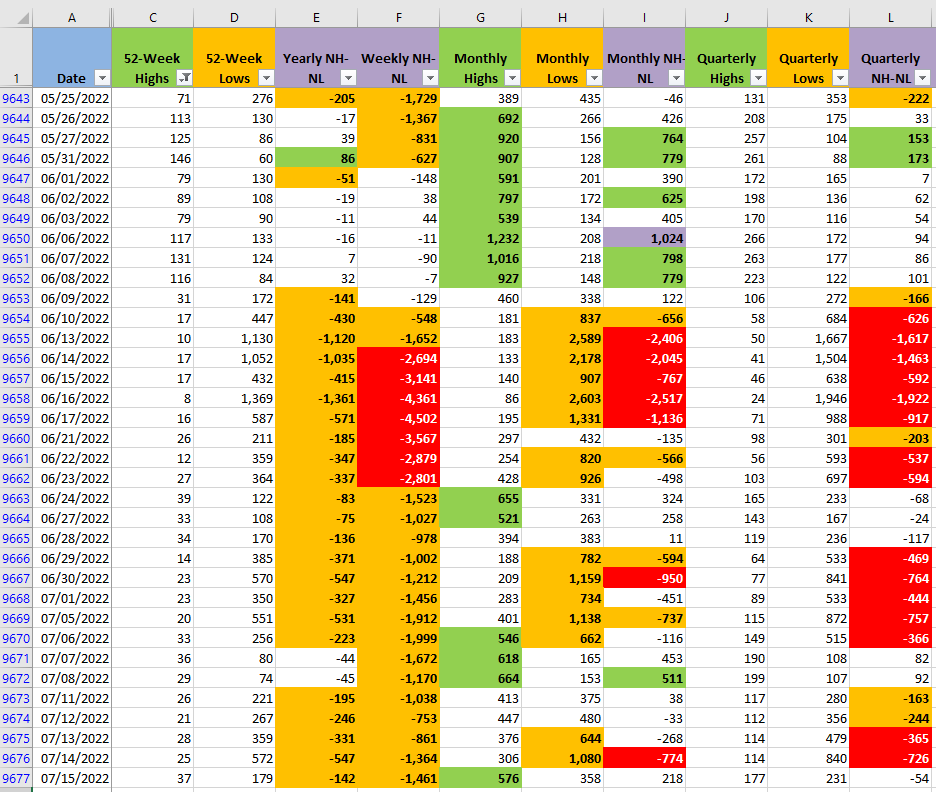

The numbers from the New Highs and New Lows indicator keep showing a diminishing selling pressure. The timeframe that moves faster from the ones that I track is the Monthly timeframe (columns G, H and I). In the Monthly timeframe, the Bears aren't able to elevate the number of New Lows above 1,200 since mid-June. The selling pressure that we saw during April, May and part of June hasn't come back at those levels. Unfortunately, the New Highs aren't increasing significantly. The lack of force in the New Monthly Highs is confirmed by the lack of power in the latest rallies.

Industries

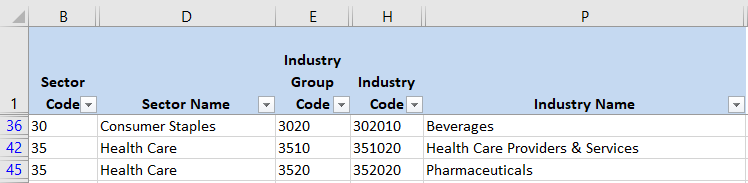

Out of the 68 Industries that compose the Global Classification Standard (GICS) this weekend I found three that I consider strong Industries. One of them is in the defensive sector of 'Consumer Staples', the other two in the 'Health Care' sector.

It's still a low number, however it's important to keep monitoring the different Industries during the Bear Market to eventually be able to recognize the leaders that could trigger the next Bull Market.

Scenarios

Scenario #1: The most likely scenario, from my point of view, is that the index will decline next week. It might attempt to break the 30-day EMA but with the lack of demand, it's unlikely to succeed. Whenever the index is finally able to rally with strength, it will require a catalyst that lasts at least a couple of weeks. With the current situation (inflation and recession, Ukraine war, China tensions, supply chain crisis, etc.) I can't think of an strong positive catalyst that would keep the Market rallying for at least two weeks. Maybe as we enter the earnings season, if the reports are encouraging, that could trigger a change in the Market direction.

Scenario #2: The second most likely scenario is that there's a rally that takes the index to a level around 4,000. I'm still optimistic that this could happen, however with the current situation I see this less likely than Scenario #1. The Market seems to be rejecting lower prices in the main indexes. The S&P 500 is moving consistently around 3,800 and 3,900. Unfortunately that's all Bulls have managed to do, there hasn't been a real challenge to the Bears dominance. Bears might be losing a little bit of their power, but Bulls don't seem to be getting stronger.

Scenario #3: I see very unlikely that the Market keeps moving sideways for an extended period of time. Fear is still dominating the Markets, they might have calmed down for the last couple of days, that doesn't mean the Bear Market reached a bottom. If the Market continues with the sideways movement, it could potentially start tracing a bottom. It could even be a signal of strength, if the negative news keep coming during the week and the main indexes keep rejecting the lower prices, things might start to change. The reaction to the news might be more important than the actual news when trying to assess the Market health.

Summary

We started the trading week that just finished with a decline based on the negative expectations generated by the inflation and the risks of recession. The week closed with a slight up movement because the fears of a recession moderated towards the end of the week.

If you keep following the news you will go crazy, one day the news are negative the next day things weren't that bad after all. We are in a Bear Market and a thousand points below the January/2022 historical high. The S&P 500 has been unable to close decisively above 3,900 since the beginning of June. The rallies and pullbacks will continue, however the Market direction is still clear, Bears have the control and the Market keeps declining.

Throughout this article I have tried to convey certain references that help me to keep the right Market perspective. We are bombarded by news and feelings when the Markets open, our own ideas can be detrimental to our trading performance. It's time to follow our trading plan and keep a strict risk management that prevents us from damaging our trading accounts. If volatility spikes, we better be prepared now rather than letting fear and anxiety cloud our judgement. Trust the chart and trust your plan rather than all the noise generated during the trading session.