The tension between Russia and Ukraine continues to be a catalyst for the Market action. According to President Joe Biden, the invasion is imminent. Other bad news that were discounted are the unexpected rise in US jobless claims and the reiterated hawkish comments from Fed officials.

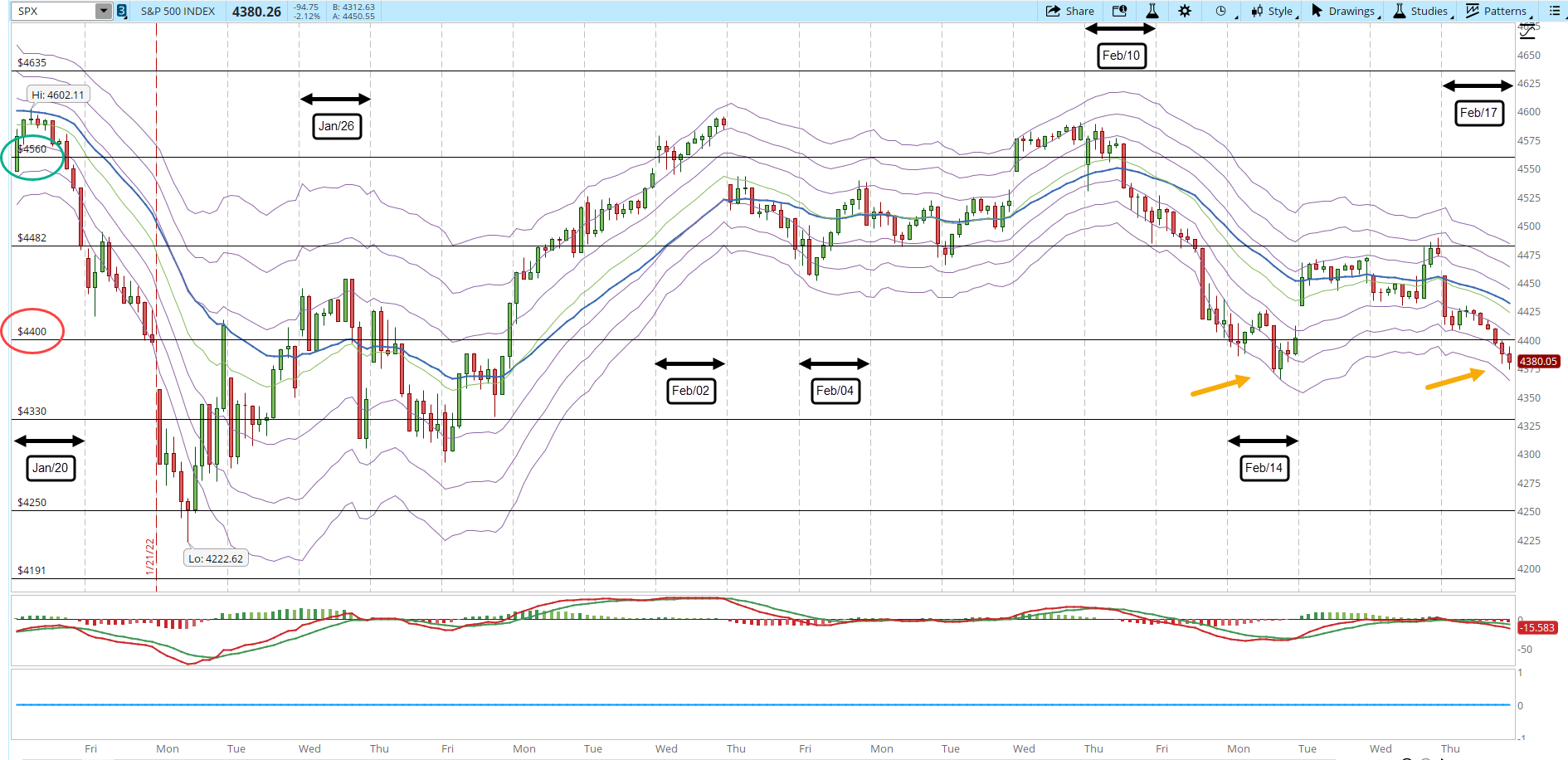

Reviewing the 39-min chart the 4,400 support is in jeopardy again, on Feb/15 the S&P rallied after testing that level, but after the first day there wasn't any more gains and we are back where we started (orange arrows in the screenshot below), another rally killed in less than four days. As I posted in my last Weekend Market Overview (link below), the most likely scenario was that the selling pressure would keep entering the Market and if the conditions don't change the S&P can easily decline to 4,250 next week. The way the S&P closes this week, will give some clues about what might be coming in the next few days.

Weekend Market Overview - Testing the Support - Market WeaknessThe current action is very bearish, see how the S&P gapped down, it hold for a few bars before resuming the decline and stopped at the exact same point than in Feb/14.

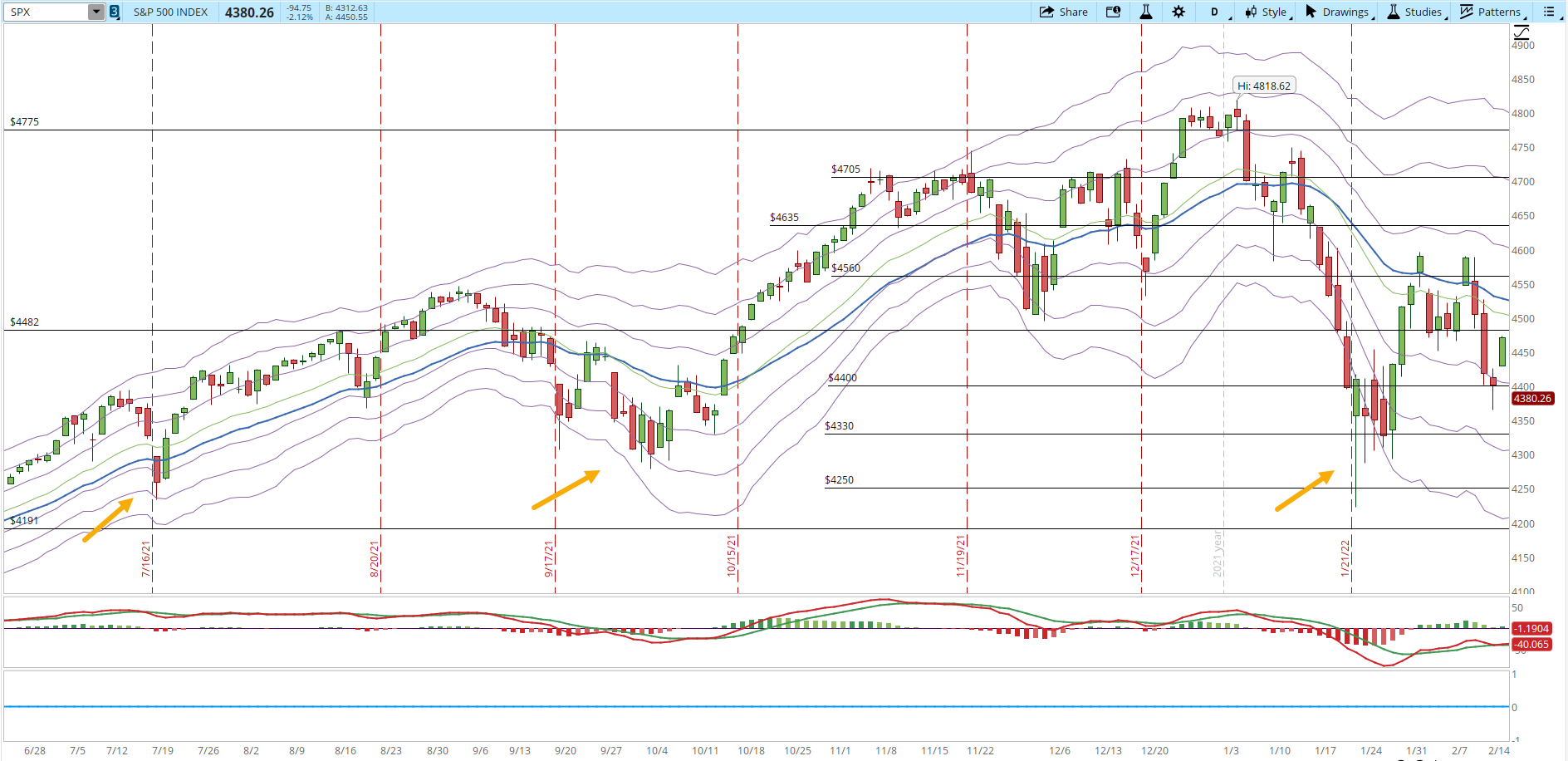

Reviewing the daily chart, the important part is around the 4,330 level, when it has been tested in the past nine months, there have been important rallies (orange arrows). Even if the S&P continues on its way down, 4,330 should provide a descent level of support. If that support is also broken, we are in unknown territory, we are heading towards a confirmation of a Bear Market in the S&P and it will be a matter of which support is strong enough to stop the decline. We are not there yet, right now is about monitoring the 4,400 support and see how the Market closes the week.

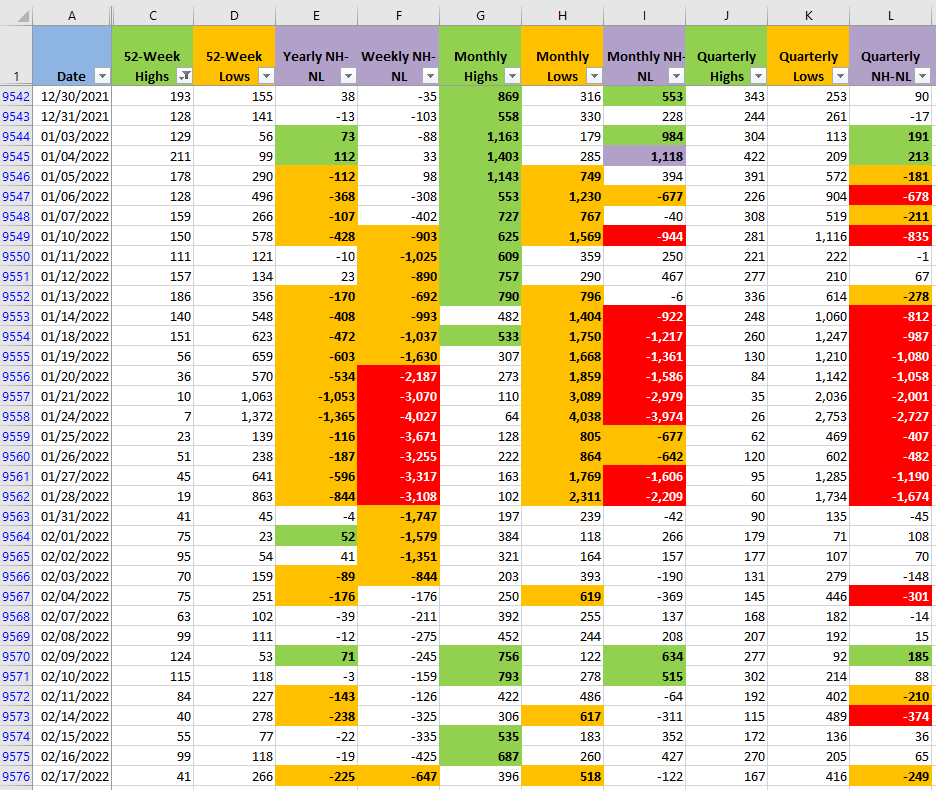

The New Highs and New Lows (NH-NL) declined in all the timeframes, reflecting the Market weakness, where no rally has survived more than four days.

As a summary, the Market continues dominated by the Bears, the Correction might resume if the selling pressure keeps increasing. Persistent bad news show how fragile the Market is. It will be important to see how the S&P closes the week. Does it has a reaction rally? it stays flat? the decline continues?

I'm not opening any new long positions, the last one was on Jan/11/2022, Marathon Oil, which I still own. The sidelines are proving to be the safest place right now for me, until there are more favorable conditions in the Market. The way the Market is behaving right now is great for some trading styles, but I trade trends that last weeks or months and I avoid trying to pick the bottom of a Correction, while I wait I'll work on my side Market projects.