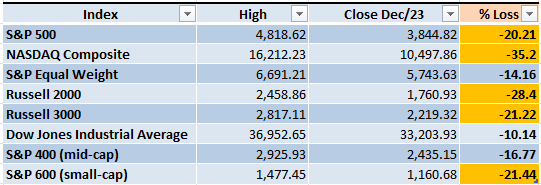

The year is almost over, and the Bears dominated 2022. The numbers didn't change that much from the ones I published last week, most of the main indexes are still on Bear Market territory (a loss of 20% or more from the previous high). Like anything else in life, nothing lasts forever, the Bear Market will eventually end and even if it takes weeks, months or years, we will get to see another Bull Market. The highlight of the week is the beautiful structure of the weekly downtrend, completely intact and respecting very clear boundaries.

Weekly Market Overview

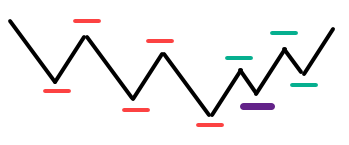

The Bulls have tried and failed so far in gaining control of the Market. In hindsight everything becomes incredibly easy to analyze. Every time the S&P 500 hits the -3 KC (green arrows) there is a rally, every time the index reaches the +1 there is a decline (red arrows). In every oscillation the S&P 500 gets to lower highs and lower lows (horizontal black lines). Things get complicated when we try to figure out what's coming next.

As a technical trader I only care about the charts, and there is not much evidence yet that the Bulls have a good chance of a powerful rally during the last week of the year. In order for the downtrend to continue intact it has to go down to a level around 3,400 in the next four to six weeks.

What if some demand starts to enter the Market? Then there is the opportunity of a First Higher Low to form. I first heard about this pattern from Kerry Lovvorn from SpikeTrade. The idea is actually very simple and it makes a lot of sense. Every downtrend eventually ends, at some point there's not enough selling pressure to keep fueling the decline. Eventually the Bulls get the chance to break the pattern and make the first higher low (purple line). Does this pattern work every time? Definitely NO, nothing works in the Markets every single time, that's why there are entire books about risk management.

Textbook like charts aren't that useful, a real sample illustrates the pattern much better. A relatively recent and famous sample would be during the subprime mortgage crisis. Even with the violent move and the fundamental economic factors that got the global economy to the brink of collapse, the selling pressure decreased by March/2009 and that lead to a powerful Bull Market.

Moving the Market takes time, let's take a widely known ticker like Apple Inc. (AAPL). At the moment of writing, my broker has available 15,211 stocks (not counting other instruments like Futures, Options, Crypto, etc.). A single daily bar of AAPL (Dec/13/2022) implied a movement of more than 93 million stocks, assuming a price of around 147 USD the amount traded that day equals 13,801,265,667 USD. A single bar was a battle between Bulls and Bears (Bears won that day) and implied billions of dollars traded, it's not easy to change the direction of Apple, it's even harder to change the direction of the entire Market.

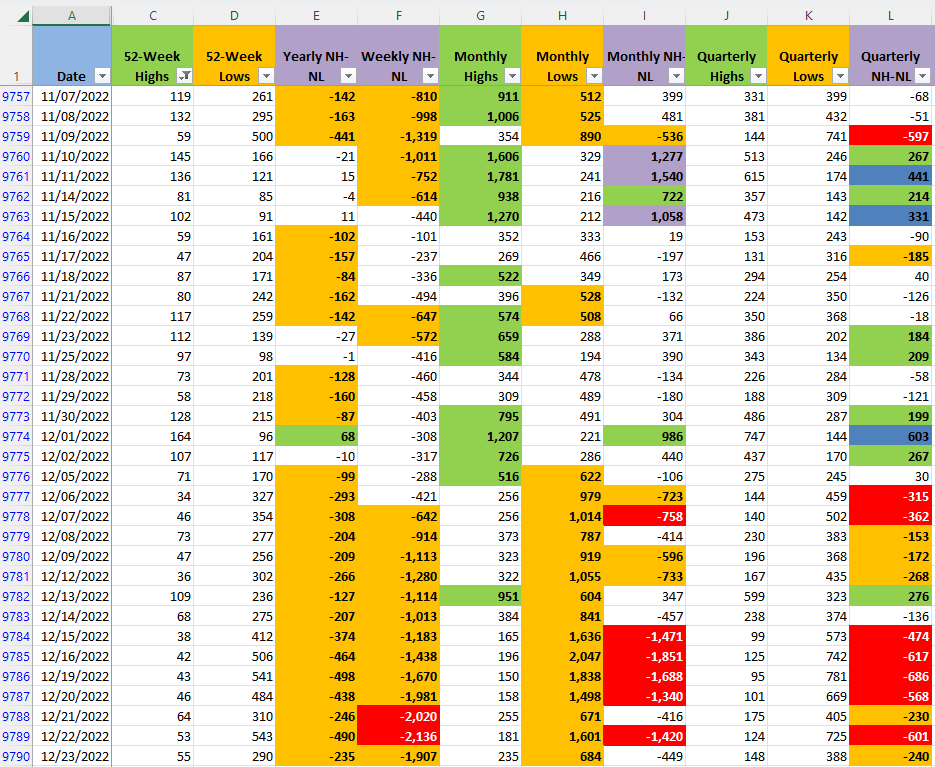

The numbers for the New Highs and New Lows confirm that the Bears are in control in all the timeframes that I track, but at least in the short term, they are struggling to take the Market to even lower levels. It's important to track the Monthly columns, they will be the first to change if the Market starts to move in any direction.

As a summary of this section, the weekly downtrend continues with little evidence that the situation will change in the last week of the year. If the Bulls manage to stop the decline and some demand enters the Market, a First Higher Low pattern could form. There is no pattern that works 100% of the time, any trade without managing risk is suicide.

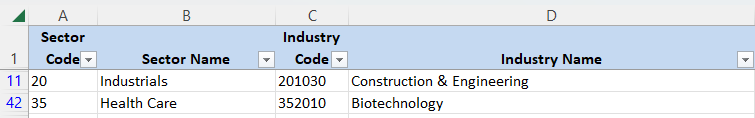

Industries

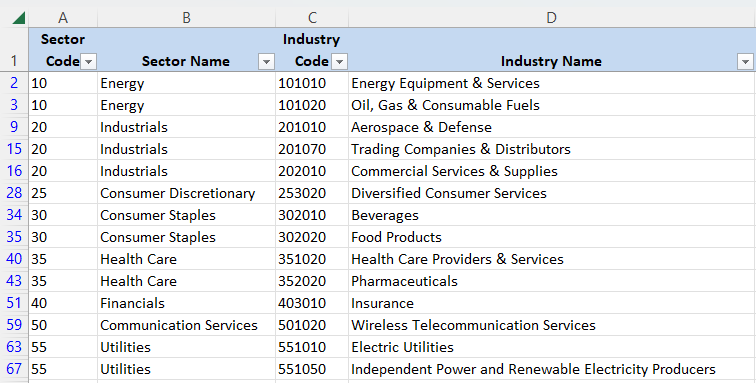

There are a couple of Industries where I see some force already to trade on the long side. Out of the 68 Industries that compose the Global Industry Classification Standard (GICS), 'Construction & Engineering' Industry ($SP1500#201030) and Biotechnology ($SP1500#352010) are the ones that could eventually start a strong uptrend.

There are a few other Industries that could eventually have a breakout movement. It's too early to tell, the idea of this section is to look for the potential Industries where the winners of the next Bull Market could be. The last Bull Market had a lot of influence from the Tech giants, it seems that the next Bull Market is likely to have a different leadership.

Scenarios

Scenario #1: The last week of 2022 will be abbreviated in observance of Christmas. I don't think there will be any strong catalyst that causes major movements. Most likely the S&P 500 will be oscillating between 3,850 and 4,000. I still don't see a clear path towards trading long positions. I have four long pilot trades open, and I was already stopped out from five positions. This week I traded long Permian Basin Royalty Trust (PBT), let's see if the Energy stocks start to rally.

Scenario #2: The second most likely scenario is that we see a reaction rally, a movement that could take the S&P 500 to a level of around 4,100. This is not a change in the Market direction, the weekly downtrend is in place and if this scenario is realized, it would be just a natural oscillation, the expected ups and downs that any Market chart has.

Scenario #3: The least likely scenario is that the decline will accelerate during the last week of the year. The weekly downtrend is intact, but the selling pressure seems to be decreasing temporarily. If fear spikes and a significant amount of supply hits the Market, the S&P 500 could end going to 3,400 in the next few weeks, strengthening the structure of the downtrend. I'm not saying that this won't happen, I'm stating that during the next week, the amount of selling pressure is decreasing and it's very likely that we might need to wait until 2023 to see if the Bears can resume the decline with significant force.

Summary

It's nice to see a pattern that has lasted all year long even if it's not in the direction that I want. The weekly downtrend of the S&P 500 continues and the Bears seem to be losing some force towards the last week of the year. For my particular trading strategy, the current environment isn't conducive to trade aggressively long or short positions. I have a few pilot trades in order to get a better understanding of the Market situation, even if I get stopped out of all of them that wouldn't significantly hurt my trading account. They also help to control the anxiety of waiting until something happens that changes significantly the current Market conditions.

Merry Christmas, enjoy the holidays and hopefully 2023 will bring some interesting opportunities. We might be playing the most expensive and elaborate game in the history of humanity. Preserve your capital or you won't be able to continue playing.