The Buy and Hold strategy has the appeal that someone can buy a stock and then forget about it until it's time to get the his or her money back. The assumption on which the strategy is based is that on average the market has historically always went up, so just by holding until it's time to close the investment should guarantee a profit.

I'm not a fan of this strategy, it's highly dependent on the time of your entry and how lucky you are to catch bull markets. In order to illustrate my point of view I have prepared several simulations that show both extremes, an investment through powerful bull and bear markets.

One time Initial Investment

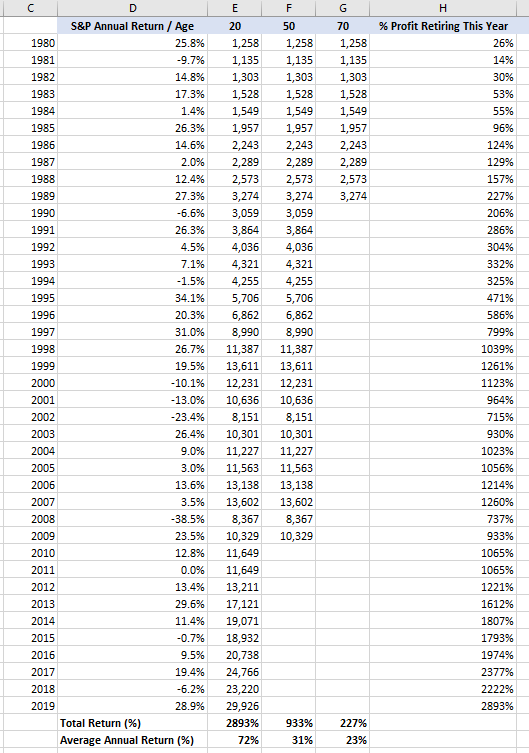

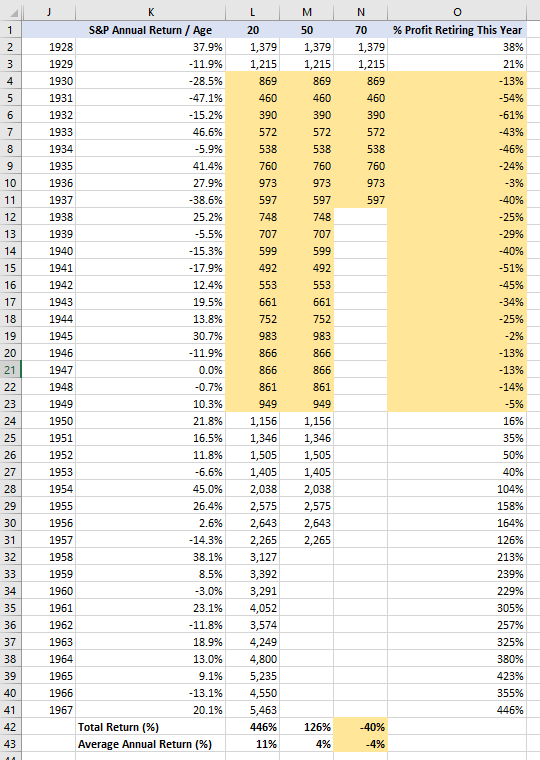

Let's review a simplified scenario where there are 3 people investing, one of them is 20 years old, the other 50 and the last one 70. Each of them invest $1,000 USD in the S&P 500 at the same time during the first year (for the sake of the sample dividends are ignored). Let's assume that the investment has to be closed when the person turns 80 years old, so that they have the chance to enjoy the money.

The S&P annual return rate was taken from the following source:

Historical S&P 500 ReturnsIf you have the luck of living through one or more powerful bull markets like the simulation below everything will be fine. The 20 years old guy investing $1,000 USD in 1980 has a gain of 2893% by 2019 assuming the person has the capacity to keep the investment during 40 years.

In column H is the percentage if the person decides to retire the money earlier than 2019. In this simplified simulation things are great, no matter what, all of the 3 individuals end with much more money than they initially invested.

What if instead of a powerful bull market the individuals aren't that lucky such as in the simulation below? I have highlighted the years where the investment has a negative return. I know this simulation is extreme; going back to the Great Depression is a completely different world than the one we are currently living, but for illustration purposes it works. Try simulating the Black Monday in 1987 or rather than using the S&P try with some stock from your portfolio.

In this second simulation the 70 years old person doesn't have time to recover during the 10 years that the investment lasted (remember the assumption that the investment gets closed at 80 so that the person has time to enjoy the profits) so this individual ends losing 40% of the capital after waiting 10 years.

Even the 50 year old, after 30 years of waiting only gets an average annual return of 4%. In this simulation the individuals weren't that lucky and just waiting and hoping wasn't the best strategy.

What about Averaging?

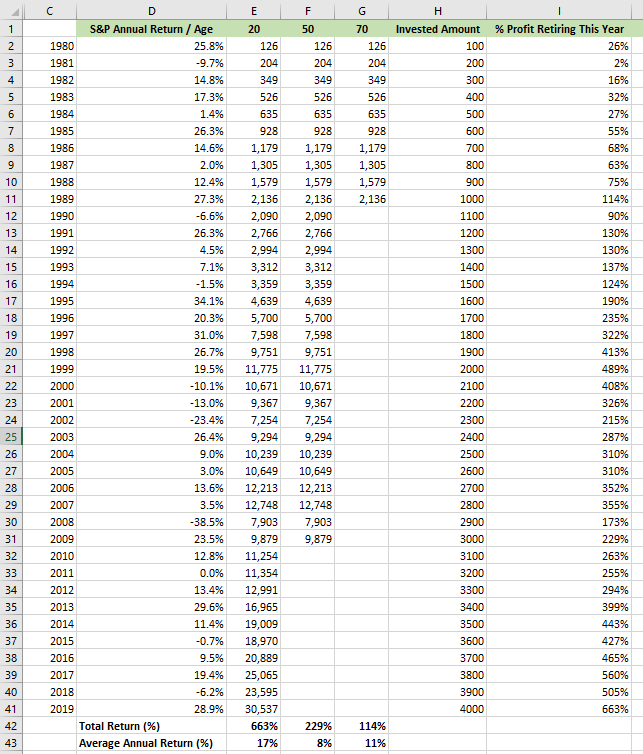

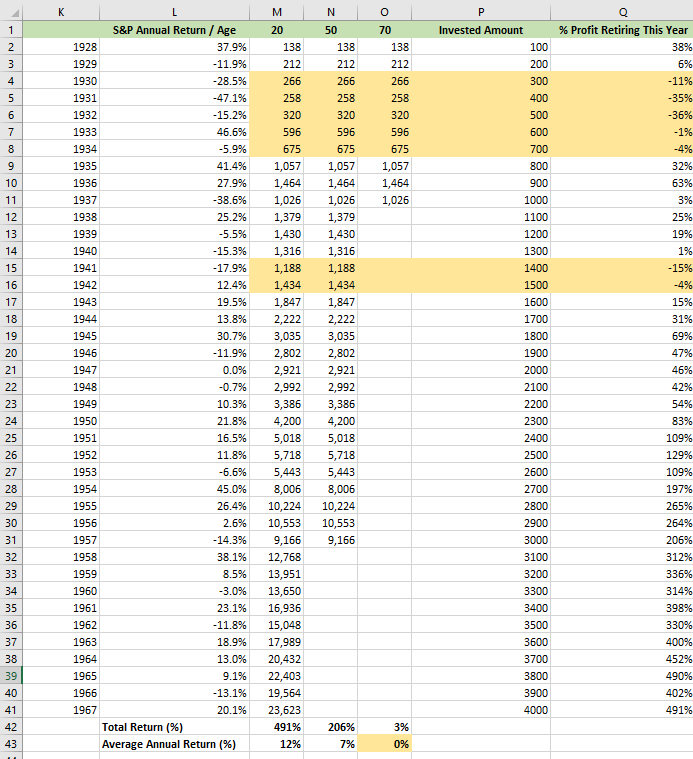

In the first section, the assumption was that each person invested $1,000 USD during the first year and then no more money was added. Averaging is another common way to invest in this strategy where the idea is that no matter what the market is doing the person keeps adding money to the investment.

When the market is up the person invests since the idea is that the market has historically went up, so even buying the S&P at an expensive price there will eventually be profits. If the market is on a downtrend it doesn't matter because you are getting a cheaper price and the person assumes again that eventually the market will go up as it always has. On average the expensive and cheap stocks are supposed to end with a net profit.

In order to simulate averaging imagine that rather than investing $1,000 USD during the first year, the person invests $100 USD each year. Using the same period of 1980-2019 everyone still end with profits, not as amazing as in the first scenario since the investment was growing slowly year after year, but it was profitable. The 20 years old individual ended with an average of 17% annual return in 2019 which is great.

Averaging when bears are in control didn't produce the same results. The 70 year old after waiting for 10 years gets nothing out of the investment.

Conclusion

Buying and holding works under certain circumstances. When you have a good entry and a bull market taking care of the investment then it will work. Every strategy has weaknesses, what I don't like about this one is that you can control very few things. You can only decide when and how much to invest and when to close the investment. Whether you profit or not will be decided by the direction of the market in the following years and the capacity of holding during difficult times.

If the person needs, for whatever reason, to close the investment earlier, the results could be very different than what the person imagined as can be seen in the simulations.

The purpose of the post is only to create awareness, if Buy and Hold is the only strategy that fits someone's personality and time constraints, at least being aware of how it behaves under different market conditions can lead to a more profitable strategy.