In a trending Market there will usually be good setups to trade in the direction of the trend. Looking at the S&P 500, which consists of the top 500 companies based on market capitalization, it appears to be experiencing an upward trend.. However, the companies that compose the index have a different weight, the most important companies have a much bigger effect in the index than the rest.

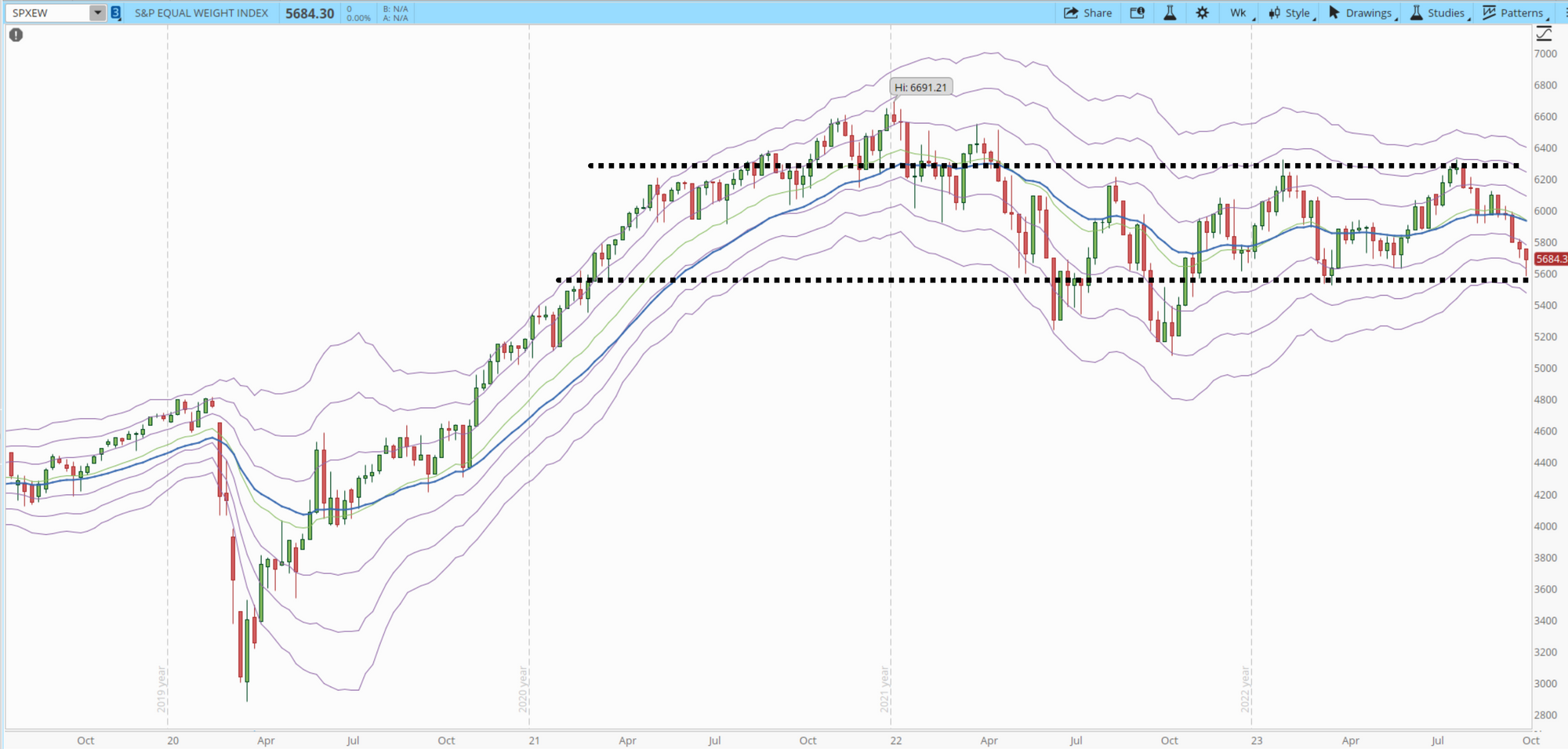

An alternative perspective is offered by the S&P 500 Equal Weighted Index (SPXEW), which assigns equal weight to every company. The SPXEW is currently displaying sideways movement. This lack of upward movement is mirrored in other indexes like the S&P 400 (mid-cap) and S&P 600 (small-cap), signaling a lack of substantial risk appetite.

My expectation is that we may witness a rally in the next couple of weeks, but it's likely to be more of a reaction move as the indexes are currently oversold at daily levels. To prompt genuine buying interest, key resistance levels will need to be breached. My personal trading strategy isn't constrained by market direction; I'm positioned for both bullish and bearish scenarios. Lately, selling short has been more profitable than trading on the long side.

To navigate the market effectively, I recommend scrutinizing each index for support and resistance levels across daily, weekly, and monthly timeframes. For example, the S&P 600 has remained relatively stagnant for over a year. When anticipating market movements, it's essential to identify the catalysts that can drive the indexes in the expected direction. While we don't trade indexes, they provide valuable insights into the overall market sentiment.

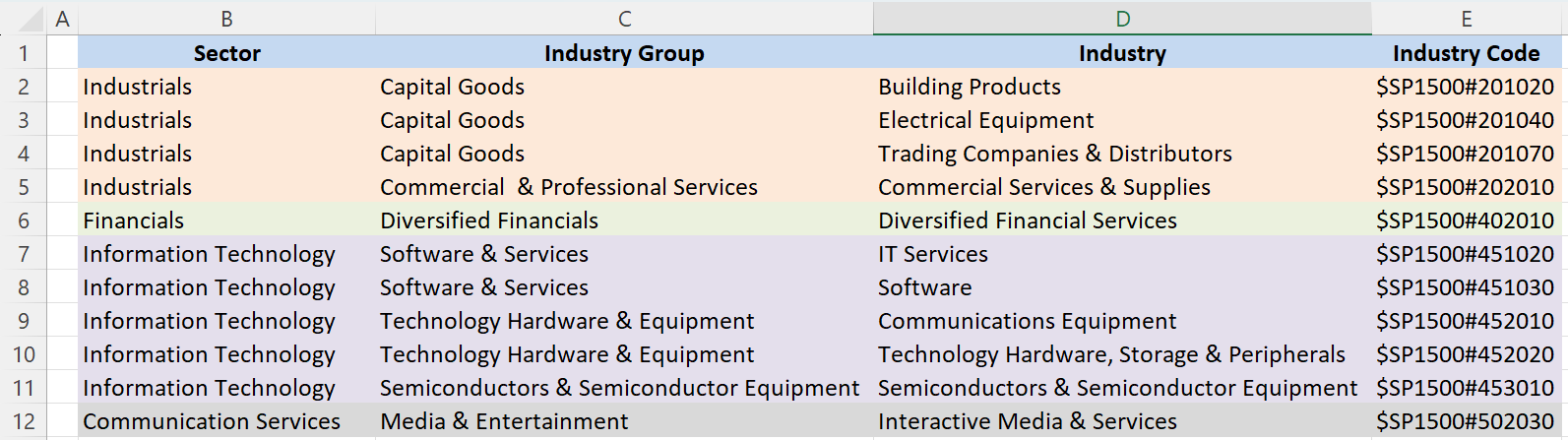

Certain industries have shown resilience amidst recent market downturns. Whether these industries can lead the broader market into a multi-month Bull run remains uncertain. Factors like earnings season, the potential impact of geopolitical conflicts, decisions by the Federal Reserve, and events like the US debt ceiling negotiations will give good tips of where the Market might be headed.

At this point the options are limited. Hitting a home run in the current Market became very difficult. Breakouts are failing, trends don't get to form or they don't last long, sometimes the best strategy is just wait for better conditions. If you can't, then trade with a very small risk size, something that can't really hurt your account. I have 25 trades open (9 long and 16 short positions) and I can still lose money in 5 of those trades.

Even if things don't go my way, I have 15 positions that have a profit of 3 Keltner Channels or more, those should compensate for the losses. My risk management is very tight, when I start pyramiding positions I just use the realized and unrealized profits of that trade. That keeps me in a very comfortable place, in the best case scenario I keep increasing my positions, the worst case scenario, I lose zero dollars.

In conclusion, volatility is on the horizon, and the market's future direction remains uncertain. No one can predict with absolute certainty whether it will move up or down or when this will occur. However, you don't need a crystal ball to trade successfully. Stick to your trading plan, maintain an updated journal, and be patient for optimal conditions to find better trading opportunities. Best of luck, and trade safely.