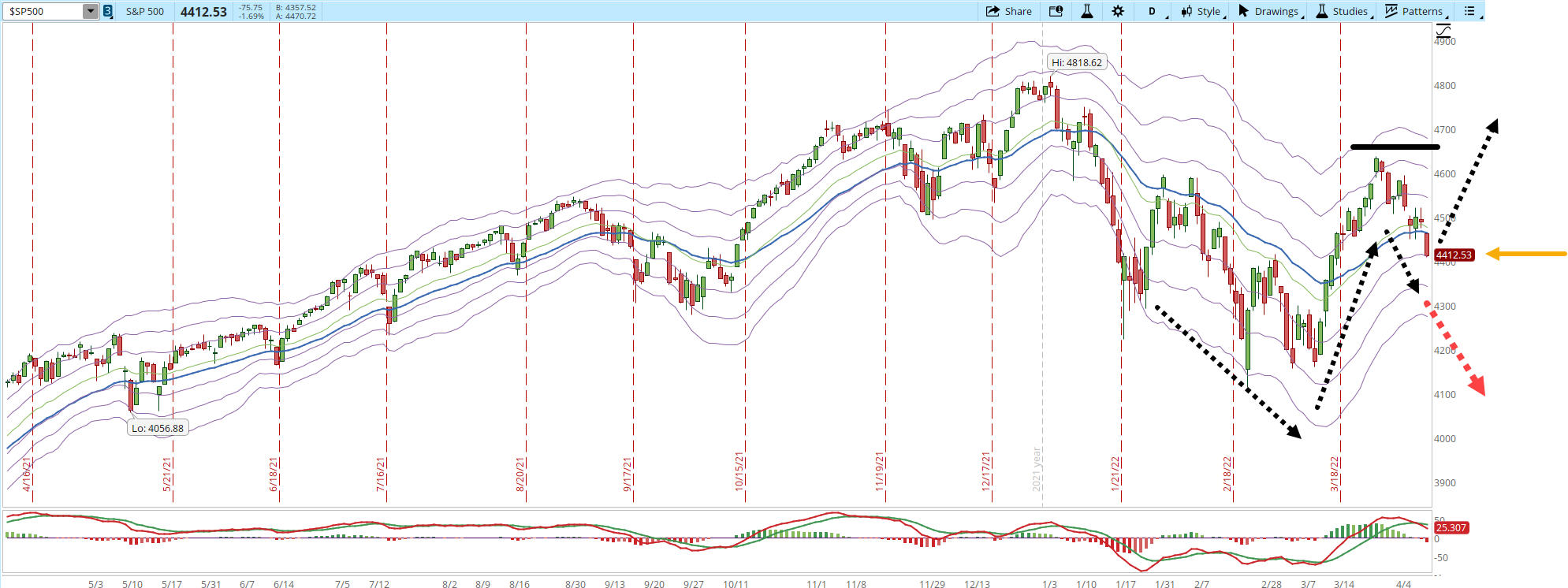

Today we saw a lot of selling pressure enter the Markets. We are getting close to a moment of truth, is the -1 Keltner Channel (KC) going to hold or not? (orange arrow in the screenshot below). I have been discussing the First Higher Low in my latest posts, the pattern hasn't completed yet. It's missing a false break out and the most important part, a rally that gets past the previous high at 4,637 (dotted black arrows).

The pattern will not form if rather than following the path of the black dotted arrows, it follows the path of the red arrow. No pattern works every single time and this is not the exception. If the supply keeps increasing and the demand is not able to absorb it, we will see lower prices.

The S&P 400 (mid-cap companies) could also potentially develop the same pattern, in the chart below I have marked the same points that for the S&P 500. If both indexes are able to hold above the -1 KC and rally from there the rally has a good chance to continue. If the -1 KC doesn't hold then we need to start monitoring which support is able to stop the decline.

The S&P 600 is not even close to develop a First Higher Low, it's already testing the lows around the -2 KC (orange arrow). If it keeps declining it will get into an oversold area (- 3 KC).

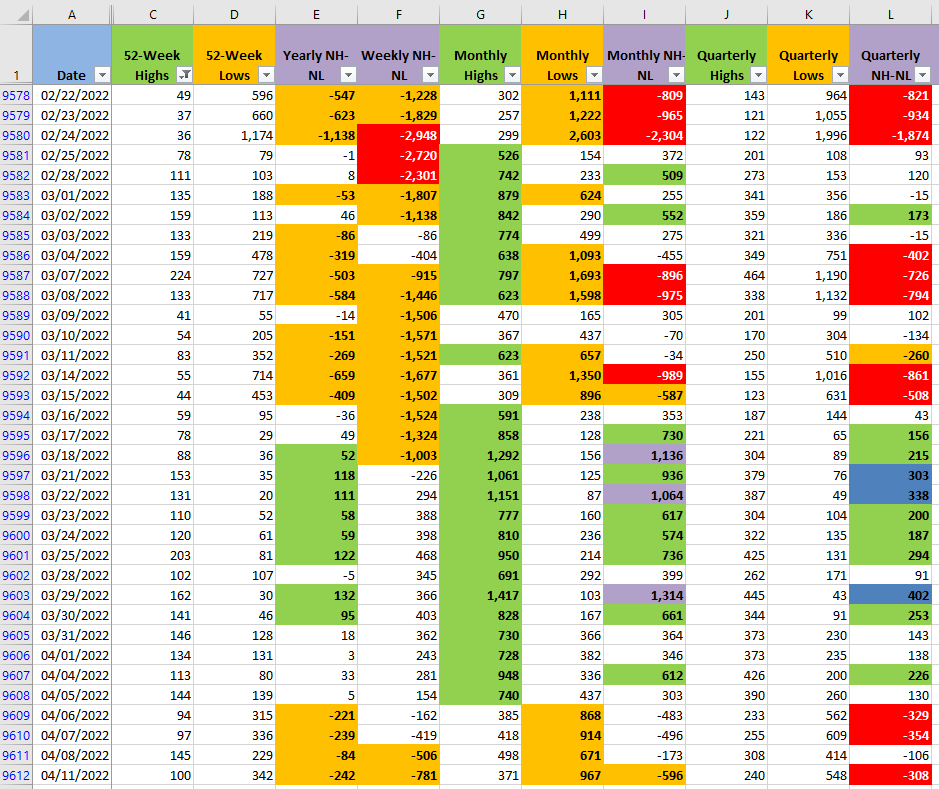

The New Highs and New Lows are confirming the increasing selling pressure. If the Monthly columns (G, H, I) don't improve, meaning that the Monthly Lows get below 500, the decline is likely to accelerate.