The S&P didn't rally for a fifth day in a row, it closed marginally lower so the rally isn't dead yet, it's taking a break. I have repeatedly mentioned in many of my previous posts that no rally has lasted more than four days since Nov/05/2021, however the current rally still has a chance to continue.

Reviewing the daily chart, the rally attempted to break past the 4,482 resistance, but the attempt wasn't successful (red circle). I'll have more faith in this rally if it breaks the 4,600 level (ideally the resistance in the green circle). I have stopped opening new long positions, I still have the four long positions mentioned during my Weekend Market Overview.

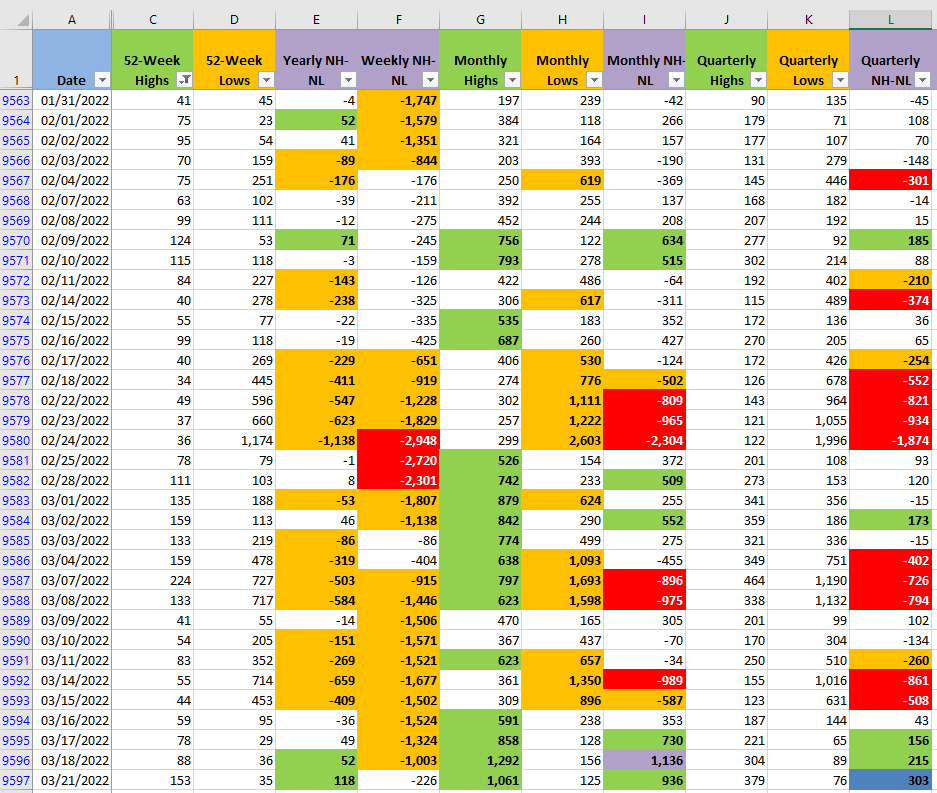

The number of New Highs and New Lows (NH-NL) didn't change significantly, that's another reason I think that the rally isn't dead yet. If the Monthly numbers (columns G, H, I) start to turn more towards the bearish side and the rally stalls or pulls back then that will be a warning that the selling pressure is back.