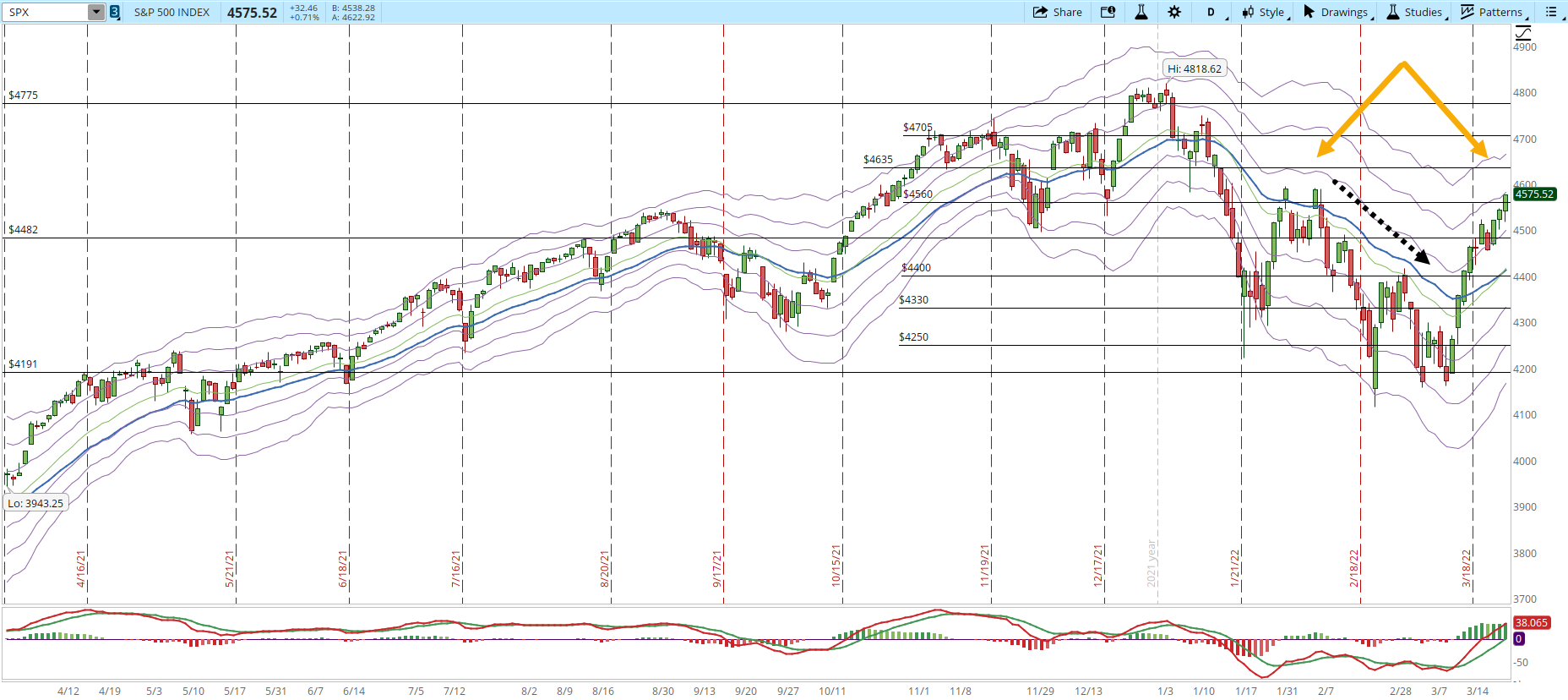

The S&P 500 has been able to continue the rally that started back on March/15, at this point we are back at the level where the S&P started to decline on Feb/10 (orange arrows in the screenshot below). If there isn't enough force to break past and hold above 4,600 then some selling pressure might start to enter the Market.

Reviewing the daily chart of the S&P 500 we can see the bright side, which is the continuation of the rally. The not so bright side is that we are close to a level where there is a lot of congestion and the S&P 500 has failed recently right at that level.

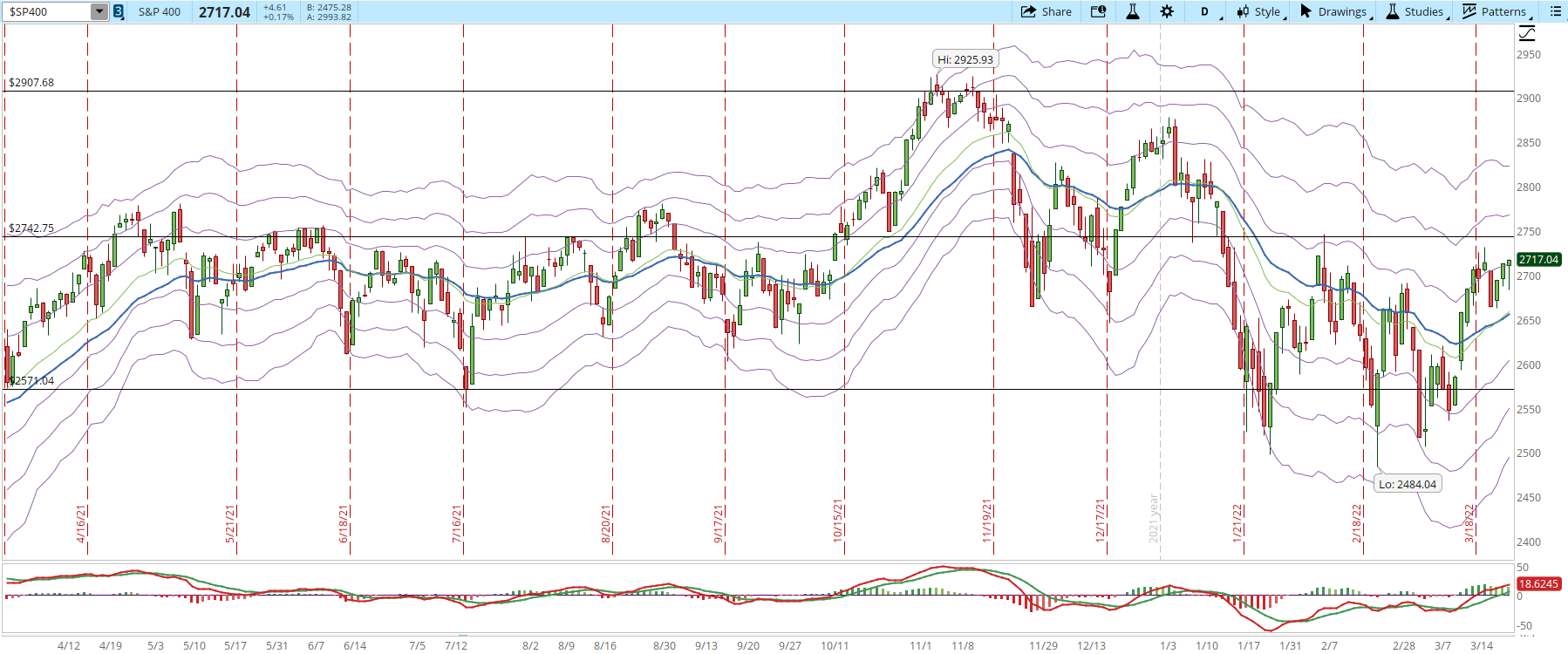

Another not so bright side is that the S&P 400 (mid-cap) and S&P 600 (small-cap) indexes are not joining the large-cap rally. The chart below displays a more modest advance from the S&P 400 companies. It doesn't seem that the current movement is attempting to challenge the 2,742 resistance.

The S&P 600 doesn't even look like it will get close to the 1,378 resistance. This scenario where only the large-cap companies are the ones moving with force, makes me wonder if the party can continue without the rest of the companies pushing the Market up.

If we take a look to the S&P 500 which is the weighted index and compare it to the SPXEW index where each of the 500 companies weights the same, the results are very different. The S&P 500 weighted index advanced today 0.71% which translates into 32 points. The SPXEW advanced only 0.26%, suggesting that the most heavily weighted companies within the S&P 500 are the ones moving the index.

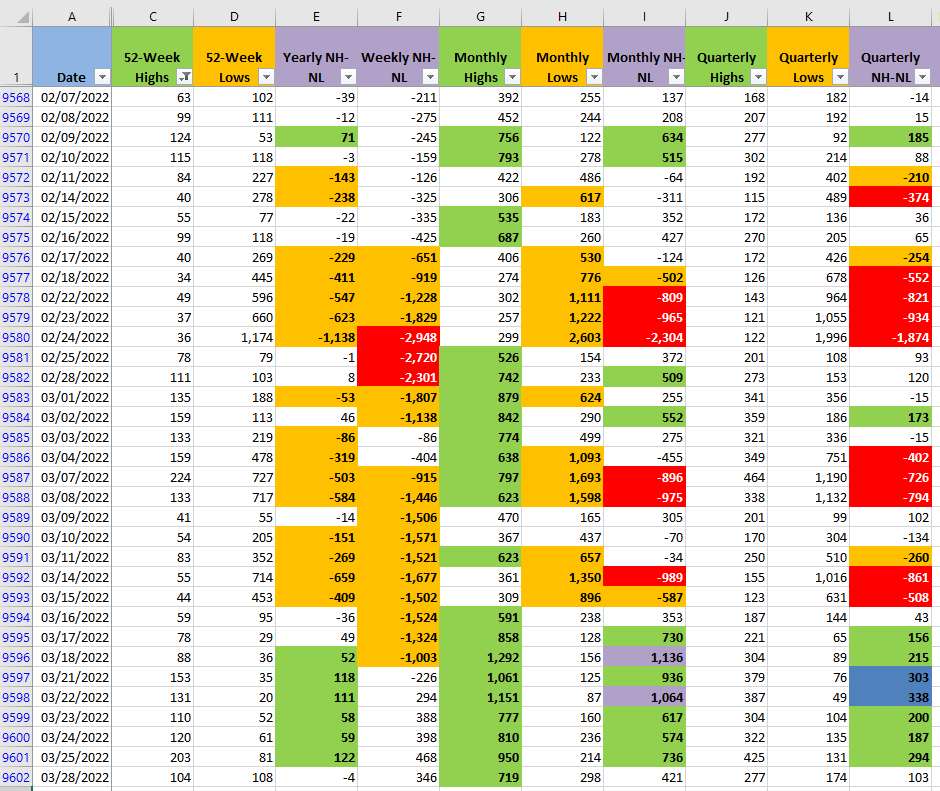

Another warning signal that contrasts with the rally continuation, is that the New High and New Lows (NH-NL) numbers, in all the timeframes, started to deteriorate. If the Market is moving up, underneath is seems that there is some fragility that could cause issues in the not so distant future.

The Market never moves in a straight line, eventually there will be at least a pullback. I can see already some signals of weakness, strict management will be key in order to keep some of the profit generated during the rally. I wouldn't only focus on the rally, it's more important, from my point of view, to focus on what's the plan when the Market starts to pullback.