The latest rally in the Market served the purpose of stopping, at least temporarily, the decline of the main indexes. Some of them got to Bear Market territory like the Nasdaq and Russell 2000, others were on their way to move from a Correction to a Bear Market. After the current rally reached it's high at 4,637 a pullback started to develop. At this point, the decline has been moderate, however there are some suspicious factors around this Market movement.

Market Overview

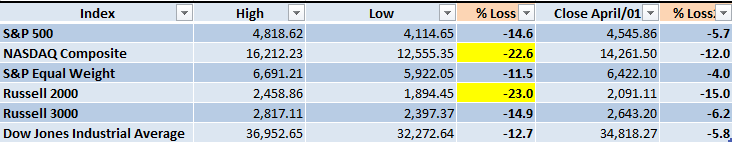

If we review the highest levels that the main indexes reached in the past few months and compare them with the lowest and current levels, we can see that we are far from the Bear Market territory in almost all of them.

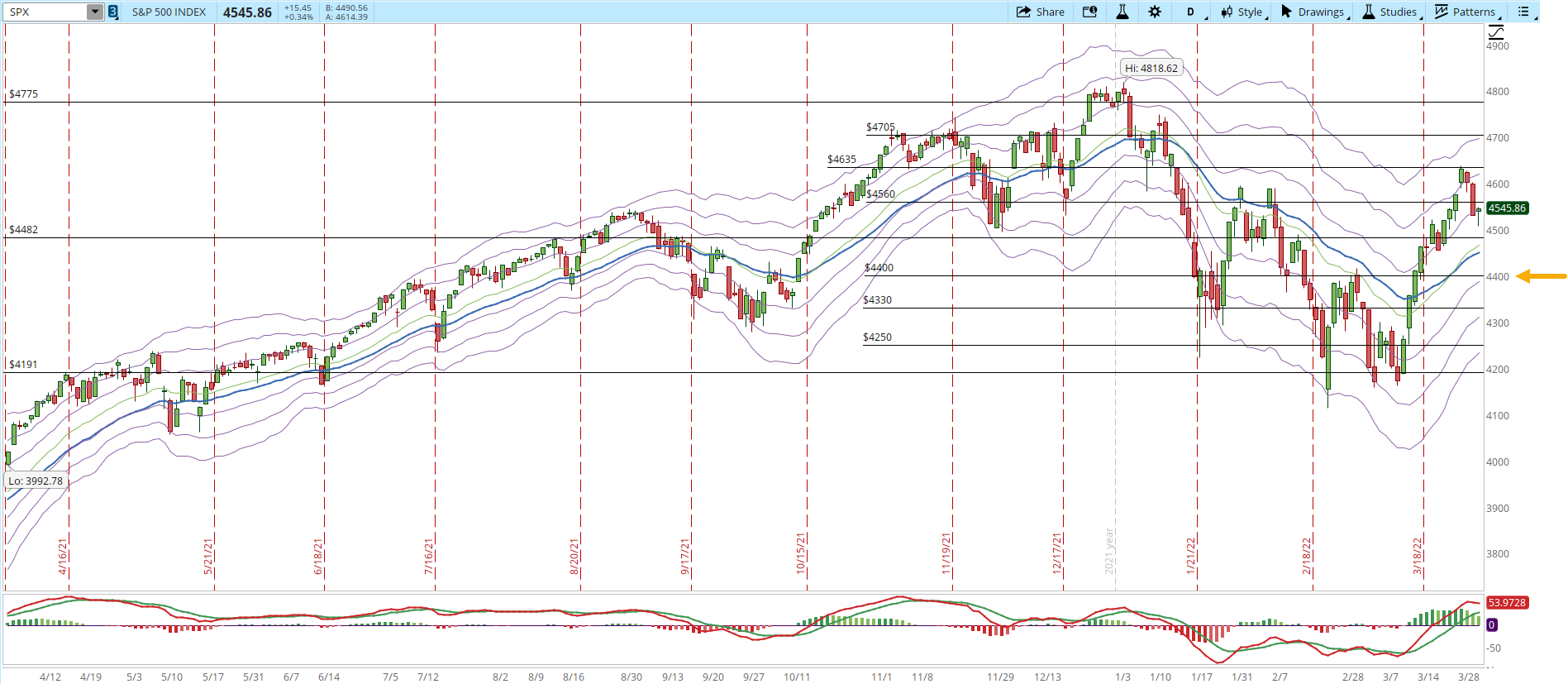

Moving to the daily S&P 500 chart, it still looks good, I even would like to see the index to pullback more, close to the -1 Keltner Channel but not below that level (currently at 4,390, orange arrow). I do like that the S&P 500 was able to get past 4,600, however it was able to hold at that level just a couple of days before the pullback started.

As a summary I liked that there was this kind of unexpected rally, that it got past 4,600 even if it was just a couple of days and that the pullback is still a very controlled decline. There are a few factors that make me suspicious of the rally and the current Market status. One of them is that the S&P 400 (mid-cap) and S&P 600 (small-cap) stocks aren't joining the rally. Starting with the S&P 400, it's the same story that has been repeating for a year now. In the chart you can view how many times the S&P 400 tested the 2,742 weekly resistance and failed (orange arrows, you can click on the image in order to magnify it).

The S&P 600 is more or less the same story, but a lot weaker on the past couple of months, it wasn't even able to reach the resistance level like the S&400 did. If you are trying to pick stocks to trade, you also need to factor the probability of success if you are going long with something that isn't a large-cap company. It's not impossible to pick a winner, finding one just got harder.

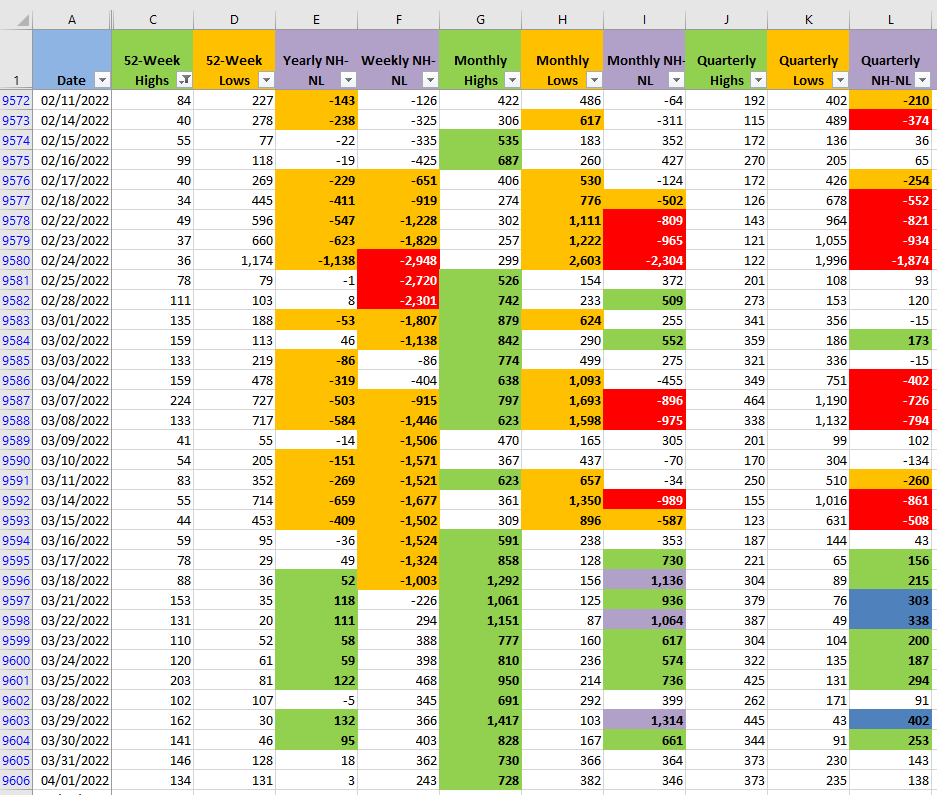

In terms of the New Highs and New Lows numbers they are mostly neutral, which is something expected as the pullback progresses. As long as the New Monthly Lows don't get too elevated (above 500) then there is a good chance that the rally can eventually resume.

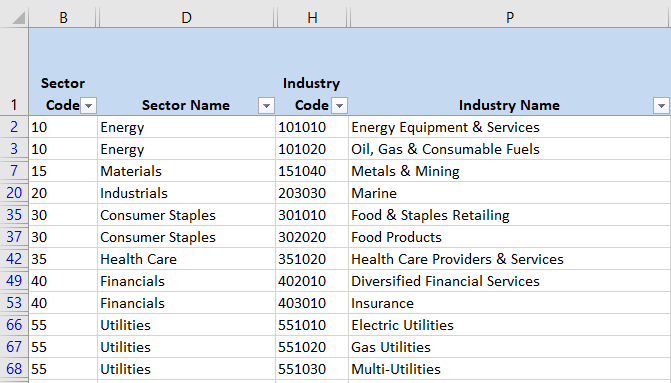

Industries

The Industries where I see strength increased from seven to twelve. That usually would be a good sign, however the number of strong Industries is due to the strengthening of defensive Industries. There are two Industries in 'Consumer Staples' and three in Utilities.

This rotation into defensive Industries, from my point of view, signals that the big Market players are getting risk averse. It could be the fears of a recession, the reaction of the Economy to the Fed measures to combat inflation, the virus, the Ukraine crisis, or a little bit of all of them.

Scenarios

Scenario #1: The most likely scenario, from my point of view, is that the pullback will continue with a moderate decline. There are no signs at this point that we could get into a Correction mode again. The lack of traction in the mid-cap and small-cap, the strengthening of defensive Industries makes me wonder if the rally will still have more fuel to go higher.

When the pullback bottoms (which should hold above the -1 KC in the daily S&P 500 chart) eventually there needs to be at least an attempt to rally. That rally will need to surpass the previous high of 4,637. If there isn't enough force to decisively break past that barrier, then it's time to evaluate the upside potential of the rally.

With the current numbers and charts, I think the S&P 500 will continue to pullback at a moderate pace and eventually have a rally or move sideways until there is a strong catalyst that decides what happens next.

Scenario #2: A second possibility is that the selling pressure breaks the -1 KC level and the S&P 500 continues declining past that level. In this scenario, I'll most likely let the stops trigger, or if the supply entering the Market is too aggressive I might close the long positions that I keep open, even if the stop hasn't triggered yet.

It would be great to only have to think about the most likely scenario, however what really counts is whatever the Market decides. We need to be prepared for the worst-case scenario ahead of time. There is a famous quote by Mike Tyson that applies perfectly to the Markets:

"Everybody has a plan until they get punched in the mouth"

Mike Tyson

Scenario #3: I don't like the possibility of a third scenario, where the pullback is already over and the rally continues. If there isn't a healthy pullback, eventually we could face a quick and sharp sell-off. However is a possibility that we need to keep present, in this scenario the rally keeps on its way up, which will most likely lead to an overbought condition again (getting to the +3 KC).

Summary

The next trading week will hopefully provide some clues about the future Market direction. At this point, I think the rally has a chance to continue but we need to monitor how the pullback develops and the amount of selling pressure entering the Market. It's also important to track the mid-cap and small-cap companies, at this point in time it looks like the rally is mainly large-cap companies. Finally it's important to see where the money is being allocated by the large Market players, the strengthening of defensive Industries makes me wonder if the risk appetite will come back soon.