Today the CPI report was the most expected piece of information in the Markets. The prevailing consensus was that there would be at least a slight decline in the inflation numbers. Now that the report is published it seems that the inflation will remain high for a while and there is the fear that the Fed will take even more aggressive measures that will send the economy into a recession.

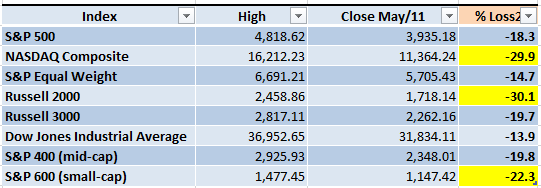

Another three main indexes are about to enter officially into Bear Market territory (20% decline or more from the previous high), including the S&P 500. That could be this week if the Correction continues. The ones in yellow are already there.

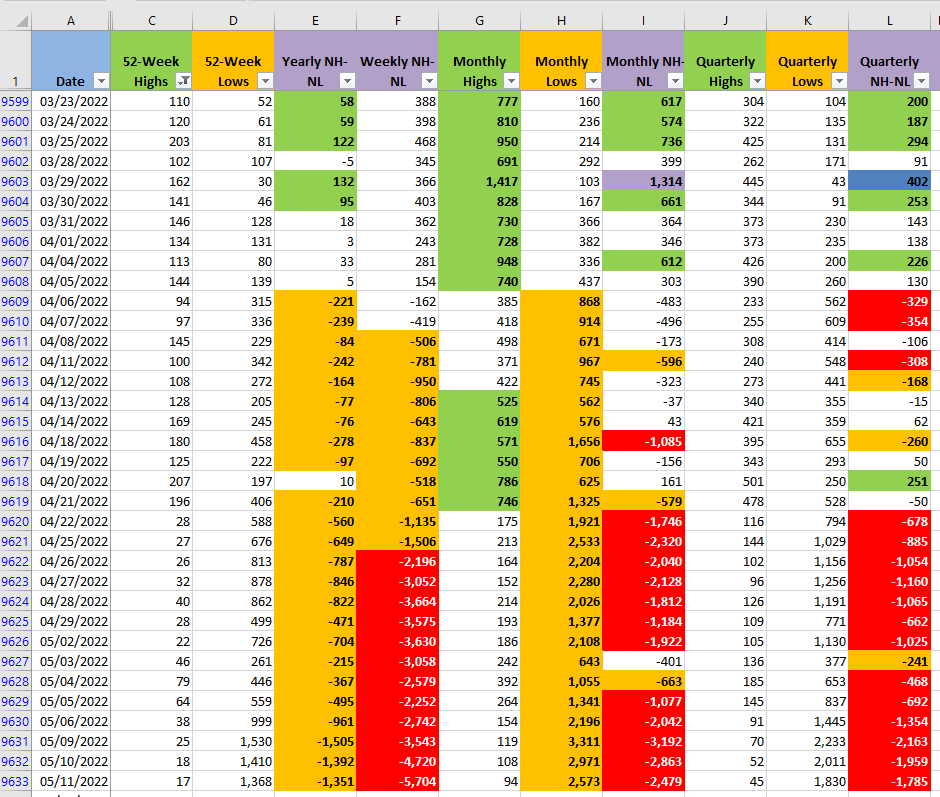

The importance of the charts has decrease a little bit lately, I'll still do a few remarks about them. The most important part, from my point of view, is the New Highs and New Lows indicator (NH-NL). The selling pressure continues out of control, that will make it very difficult that we get a multi-day rally. In fact, yesterday and today the Markets tried to rally, both days the main indexes couldn't hold the gains and ended closing towards their lows.

When the selling pressure finally starts to decrease the New Monthly Lows (column H) should reflect that improvement. Otherwise, I would be very suspicious about the quality of a rally. So far, we have 25 consecutive days where the New Monthly Lows haven't been below 500, that's a lot of time with elevated supply.

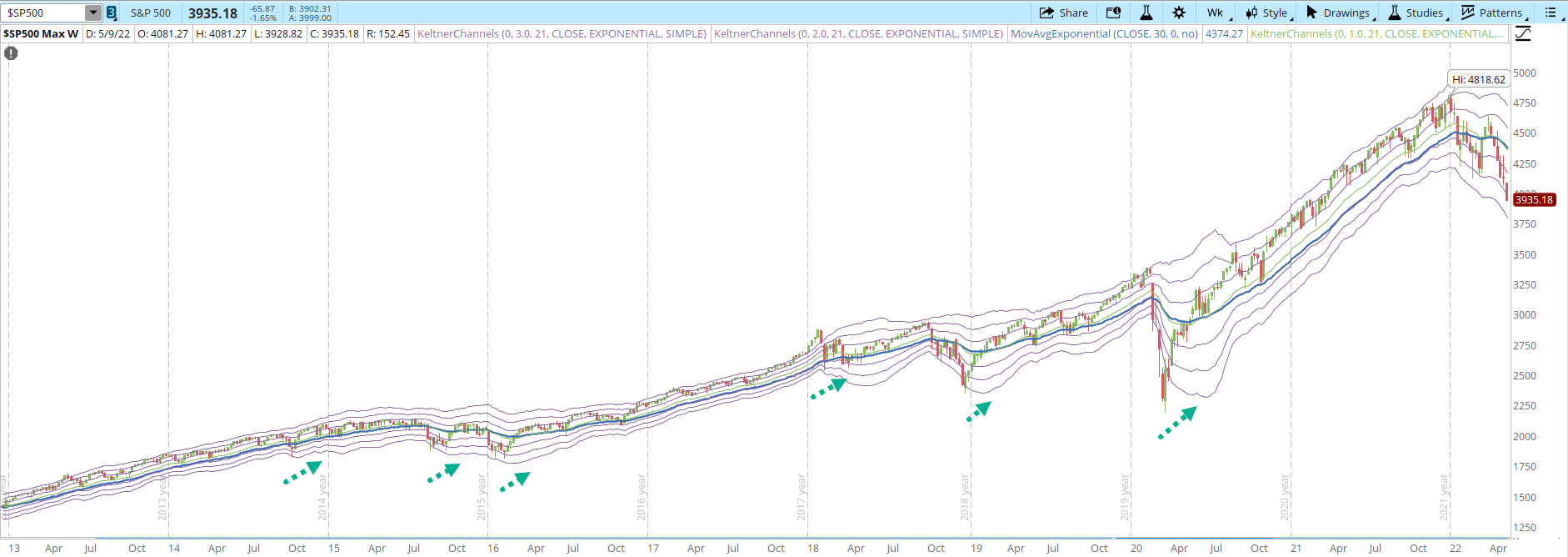

We are at oversold levels in the weekly chart of the S&P 500. Since 2013, every time that the index gets to the -3 Keltner Channel, it eventually ends rallying (green dotted arrows). There isn't a rule that says that whatever happened in the past will repeat this time. It will be a strong warning signal if this time the index just keeps falling without even attempting to rally. Let's see what the last couple of trading days of the week bring for us.