Usually the most popular indexes are the S&P 500, Nasdaq Composite and the Dow Jones Industrial Average. In this post, as usual, I'll review the S&P 500 but as we get close to the 4,600 level it's important to take a look at other less popular indexes that track mid and small cap companies.

Market Overview

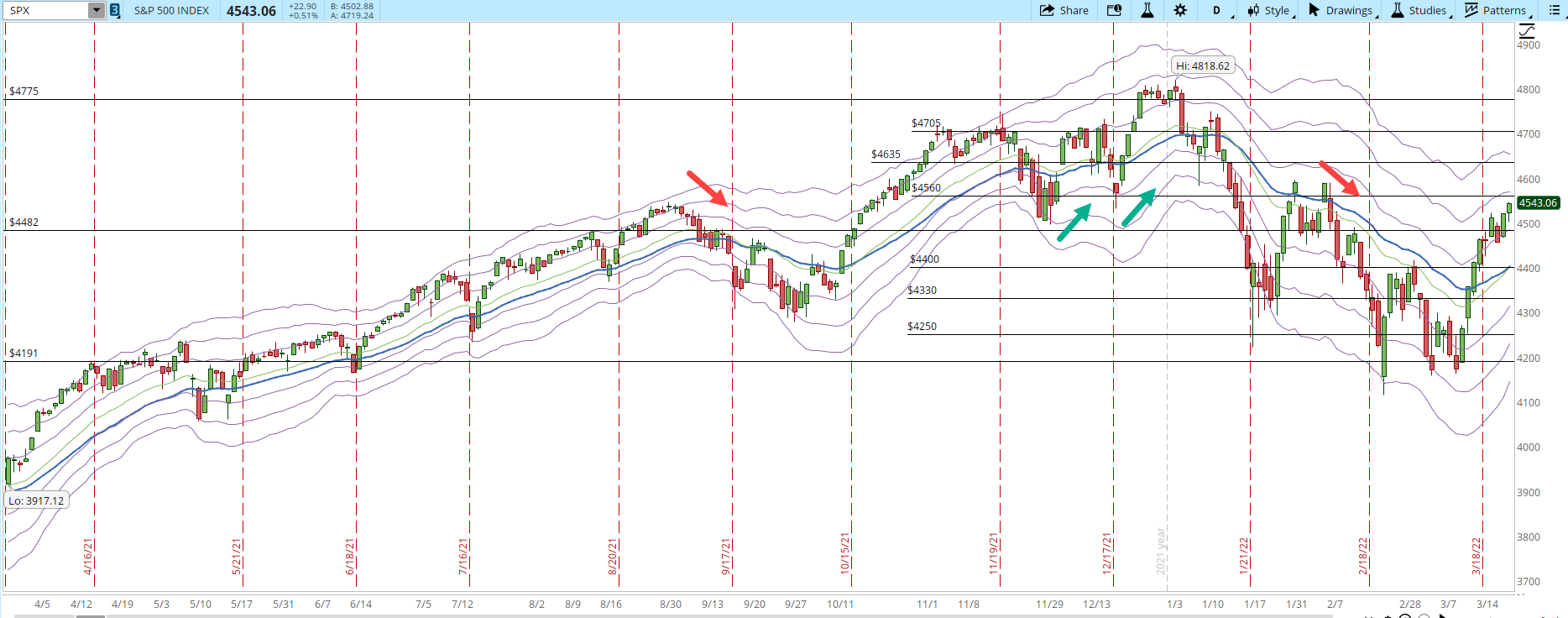

Reviewing the daily S&P 500 chart, we are getting close to a level that has served in the past few months as resistance (red arrows) and support (green arrows). Next week we will be able to see if the S&P is able to break that resistance, or if it stalls or declines. At this point, the Bulls are trying to keep the rally alive but eventually there will be a pullback. No chart moves in straight line.

The S&P 500 is a market-capitalization weighted index of the 500 leading publicly traded companies in the USA. Not all the companies have the same impact in the index. At the moment of writing this article, AAPL weights 7% while FOX weighs only 0.014531%. It's usually accepted that the behavior of those 500 companies is representative of the entire Market. Reading the S&P 500 can be tricky at times, sometimes the companies that weight more can move the index without help of the less weighted companies. It's a good idea to check from time to time the $SPXEW which are the same companies of the S&P 500 but given the exact same weight.

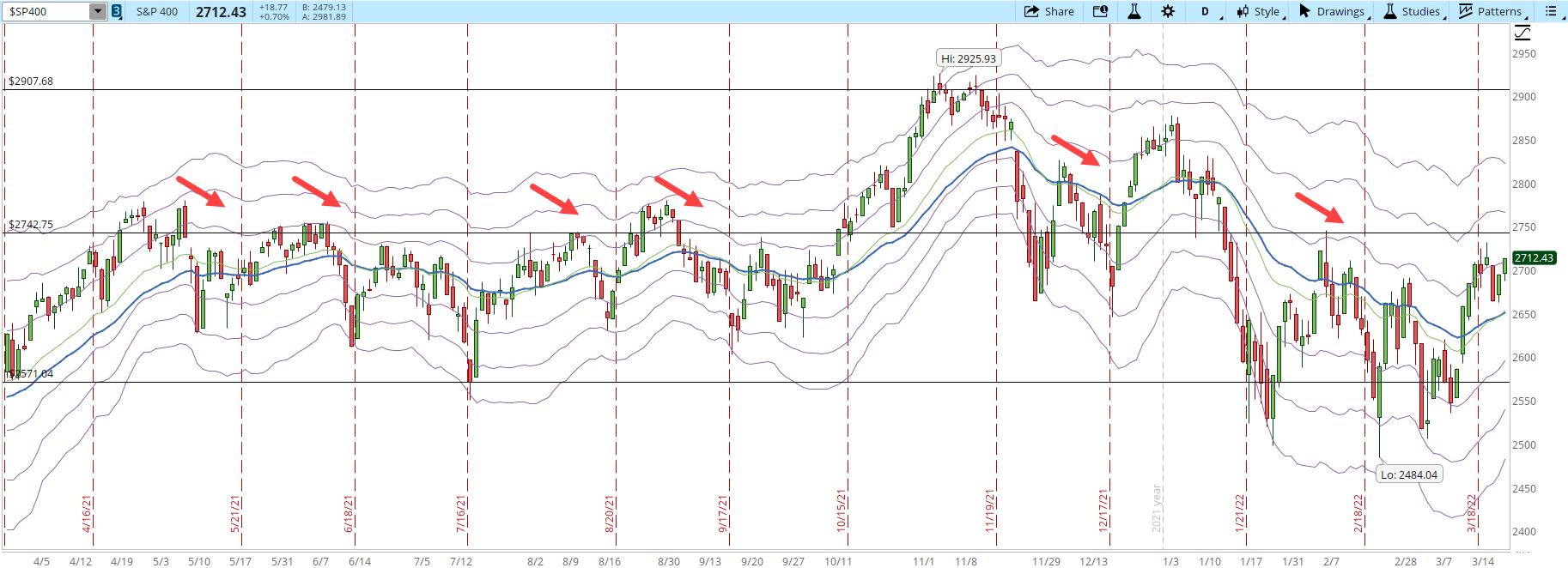

It's also a good idea to look at how the rest of the companies, mid and small cap, are performing. Starting with the daily chart of the S&P 400, which tracks 400 mid-cap equities (at the moment of writing S&P considers mid-cap as a market capitalization of US $3.7 billion to US$14.6 billion). The period is the same than the chart above of the S&P 500, one year, but the behavior is significantly different, the S&P 400 is mostly in a trading range and almost every time it tests the 2,742 resistance, it declines (red arrows).

Reviewing the S&P 600 which tracks 600 small-cap equities you can see that there is something familiar with the S&P 400 chart (at the moment of writing S&P considers small-cap as a market capitalization of US $850 million to US$3.7 billion).

The interesting part is whether the large-cap companies leading this rally will be able to move the Market without the help of the mid and small-cap companies. It also becomes important to pay attention to the stock picking process, picking a big winner will be harder in the mid and small-cap universe unless those companies start a powerful rally too.

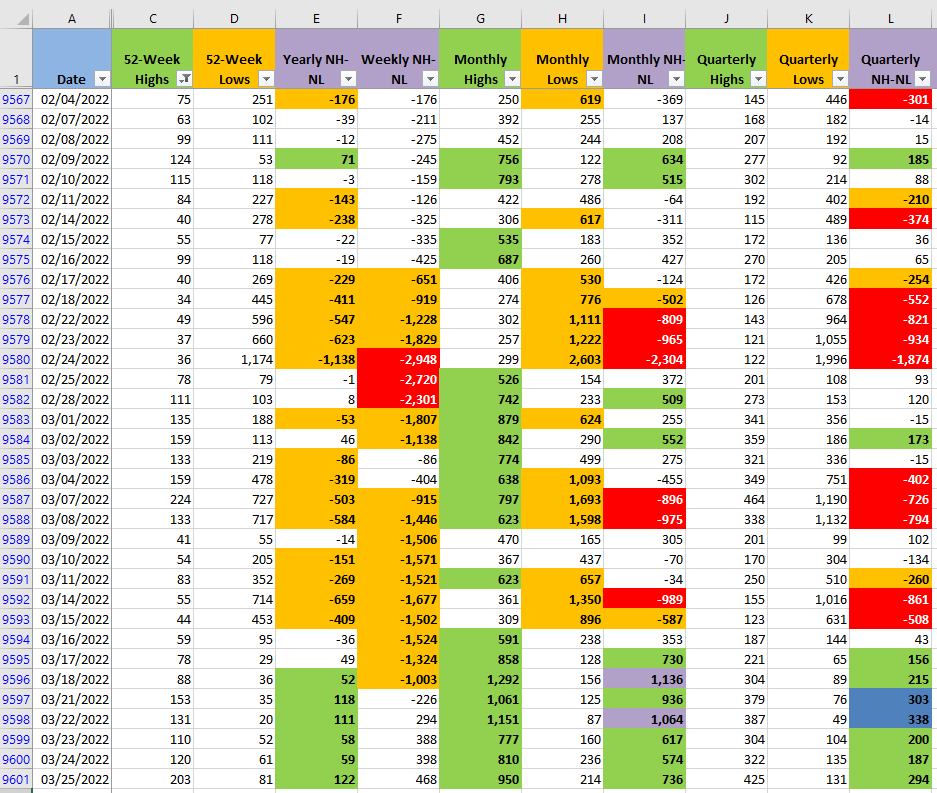

Reviewing the New Highs and New Lows numbers the selling pressure is still under control. Other than price and volume, it will be key to monitor the columns G, H and I which belong to the Monthly timeframe. From all the timeframes displayed, that's the one that changes faster. If the Monthly Lows start to increase significantly it will be a warning signal that important supply is entering the Market.

Industries

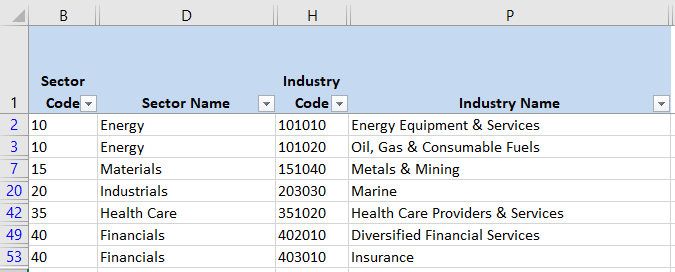

Looking at which Industries are, from my point of view, still displaying force, there isn't much change from last week. A couple of Industries were added to the list, based on the 68 that compose the Global Classification Standard (GICS) there are seven that I still consider to be strong Industries. That's a little bit more than 10% of the Industries.

Scenarios

Scenario #1: The most likely scenario, from my point of view, is that the S&P rally will stall and eventually pullback. However, I think that the S&P will be able to hold above the -1 Keltner Channel (KC, which is currently at 4,310). If this scenario becomes a reality, I won't open new long positions and I'll let the stops trigger if it comes to that. I might even close the long positions that are not really working that well and just keep the ones that are actually rallying. I already moved to Mark Minervini's methodology and I'm trying to follow it as close as possible. In this scenario a pullback doesn't mean that an uptrend can't eventually form after the pullback, it's just part of the natural oscillation that all the charts have.

Scenario #2: A second possibility is that the selling pressure starts to increase significantly. I see this scenario as the second most likely, especially after reviewing the S&P 400 and S&P 600 daily charts. If this happens, the NH-NL Monthly numbers will start to increase for the New Lows. The S&P 500 won't be able to hold above the -1 KC (currently at 4,310). In this scenario, I'll start closing my current open positions if my losses start to increase, even if the stops haven't triggered yet. I'll better break-even or exit them with a small loss than hope for reaction rally.

Scenario #3: The scenario that I consider the less likely (hopefully I'm wrong) is the one where the rally continues. The S&P 500 breaks and holds above 4,600. This is the only scenario where I'll start opening more aggressively long positions. I might still close the positions that are not performing that well and look for better candidates just to cut the risk. Even if the catalyst for this scenario is not obvious at this point, in order for the rally to continue, it will required heavy buying to absorb whatever supply enters the Market.

Summary

The S&P 500 has been able to sustain the rally up to the end of the last trading week. Next Monday we will be able to see if the rally can continue and the behavior of the mid and small-cap companies. At this point, it seems less likely that all the important indexes enter in Bear Market territory, but I always keep the strict risk management.

Eventually there has to be a pullback, it's impossible to forecast if it will be on Monday, in a week or a moth, but there will be a pullback. Those are key moments where unrealized profits can easily disappear without proper risk management.