Today bears showed that are still in control. Trading the news is definitely difficult, it creates opportunities through unexpected events but it's pretty hard to tell for how long the market will move in a certain direction. So whatever information moves the Market in the following days, the new virus strain, the Fed or anything else, for me it's just noise.

Technical trading provides a straightforward way to understand the current situation. Since the sell-off began on the abbreviated session after Thanksgiving the S&P has lost 4.87% compared to the historical high reached on Nov/22 (see the chart below).

Using a 39 min chart, the S&P is behaving in a predictable way for now. Once that it reaches the +1 upper band of the Keltner Channel (KC) it collapses and goes down to the -3 lower band of the KC. The interesting part will be when the market starts to show signals that the correction is over and finally finds support.

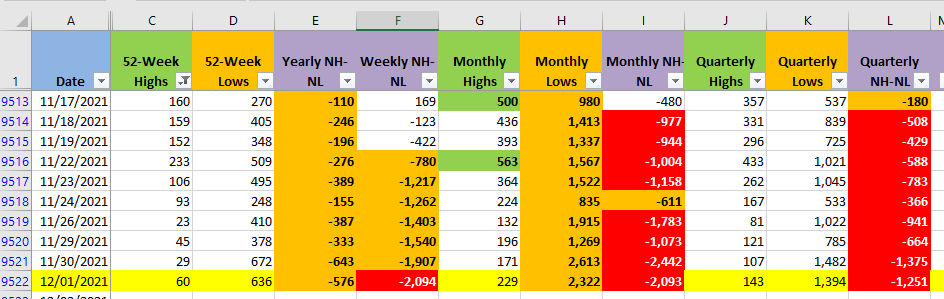

Reviewing the current Monthly New Highs and New Lows (columns G and H) it's obvious that bulls aren't really putting much of a fight yet. The numbers are from barchart.com and they sometimes move slightly through the night, it's not real time data.

The ideas posted on my last Weekend Update are still valid, in case you want to review them the link is:

Nov/28 - Local Optima - Weekend UpdateIn that post I mentioned that the center line of the KC on the weekly chart (green line in the screenshot below) was acting as a trend line that had been tested several times but never violated. Today that line is at 4,482 not that far from being tested again.

It will be interesting to see if during the rest of the week those New Monthly Lows diminish, otherwise the selling pressure will continue.