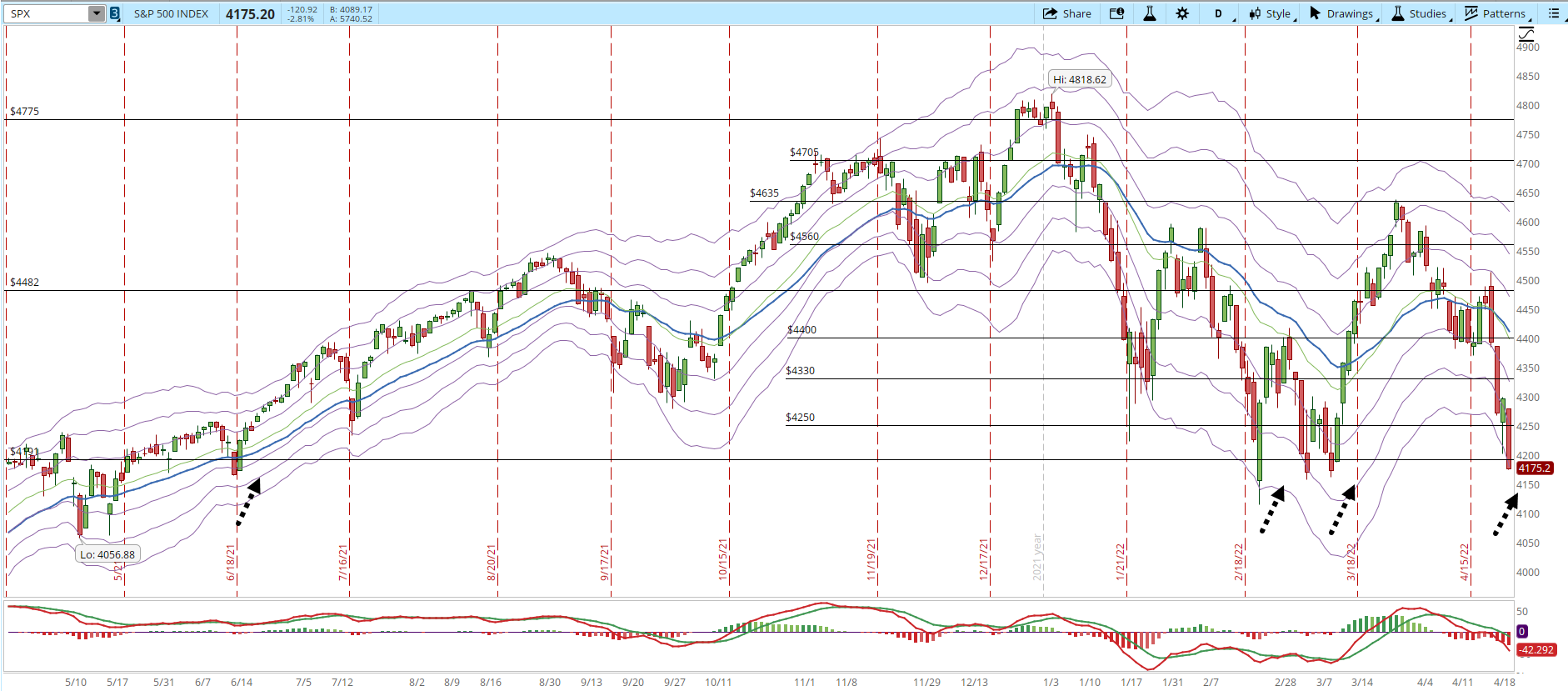

As I mentioned in yesterday's article, I thought that there could be at least a reaction rally, I still think it can happen this week. We are at a level where the 4,191 weekly support has been tested and had at least a reaction that lasted a couple of days, that happened even in 2021 (dotted black arrows in the screenshot below).

The negative catalysts have been the same since months ago, the only most recent one is the negative sentiment, especially on the Tech companies earnings, that made the Nasdaq Composite fall almost 4%.

The 4,191 weekly support will tell us a lot of information, it's not a predictive tool like a crystal ball, but the clues are valuable nonetheless:

- If the support holds, then it becomes stronger, it won't necessarily rally, it could move sideways a few days, but not that much, during earning seasons a lot of news can move the Market in any direction.

- If the support breaks, then we are likely to see lower lows until there is a support that is strong enough to stop the decline. We would be again on the way to confirm a Bear Market in all the important indexes.

- If the Market rallies, which I see very unlikely, it would have to get at least close to 4,500 in order to consider it a rally with some force. Not necessarily in a day, but at least in the next 5-7 days. The problems is what could cause that kind of upward movement, at this point I don't see the positive catalysts.

My perspective is that the support will hold, even if my belief is wrong I will wait until I see real force above 4,500 to see if I can open new long positions. My trading plan is not about guessing and hoping what the Market will do, we are at a time where we need to be extra careful trading. It will be a significant event if the 4,191 support is broken.

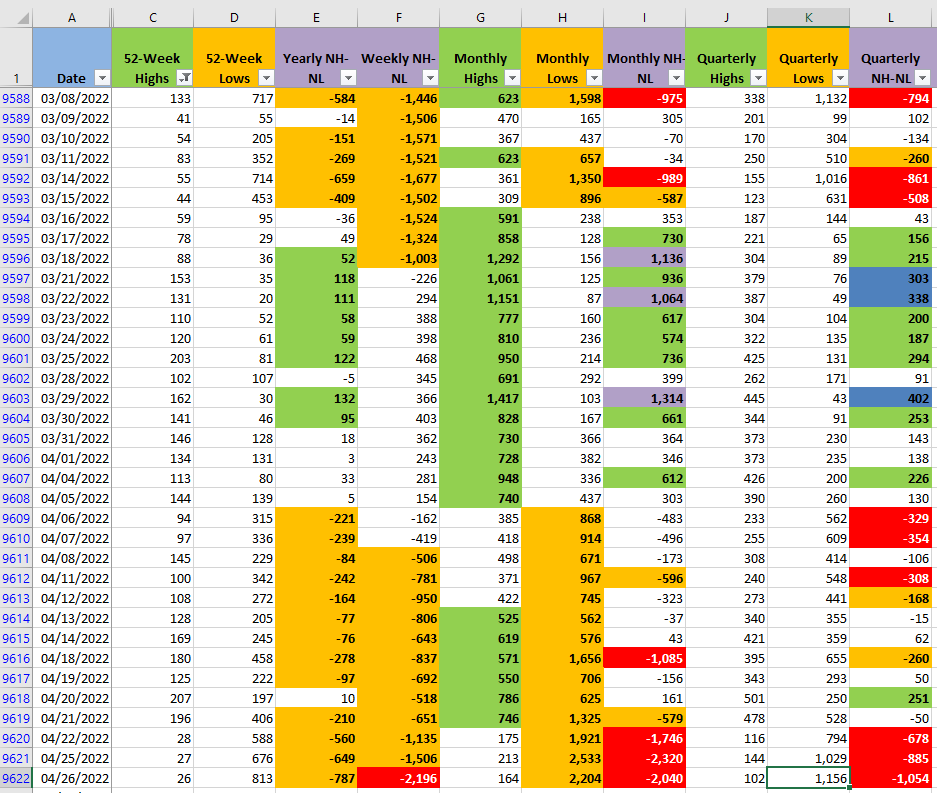

The New High and New Lows (NH-NL) numbers are confirming the way in which the selling pressure is overwhelmingly surpassing the demand. The combination of what happens with the price action and volume in the chart, and how the Monthly NH-NL numbers change will give some insight about the direction for the next few days.