The abbreviated week in the markets was all but boring. The markets eventually had to have a pullback and the new Covid variant Omicron was the perfect excuse. This correction could open great opportunities once the market finishes discounting the potential negative effect that this mutation will have in the world economy.

Overview

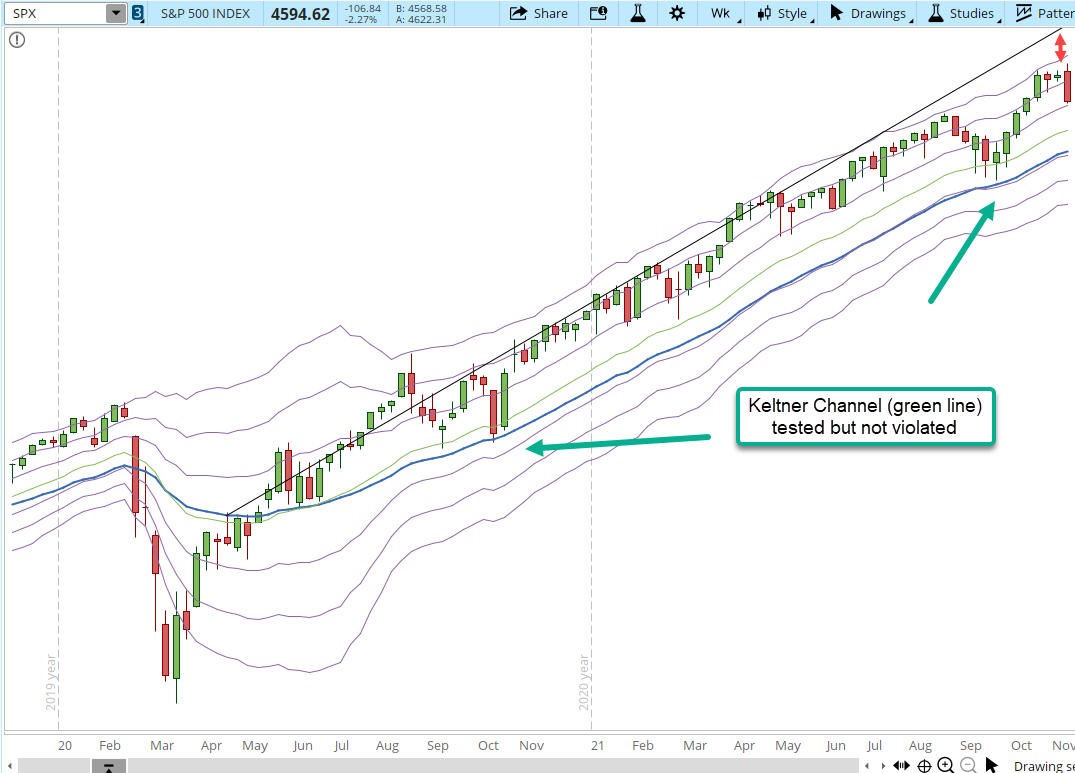

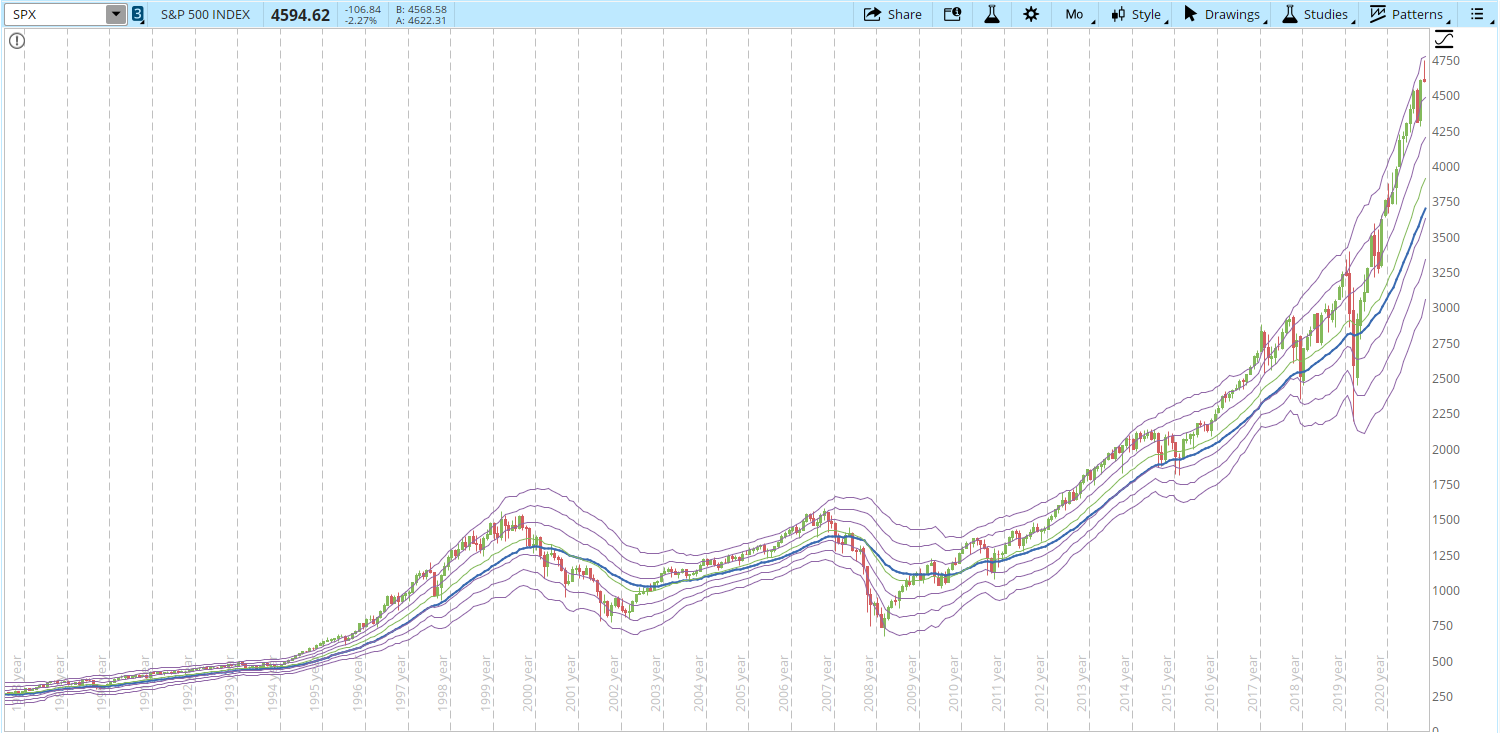

Looking at the S&P 500 weekly chart, the weekly trend still looks intact. The 30-week EMA is up (blue bold line) and the centerline of the Keltner Channels (green line) is acting as a trend line. Since the 30-week EMA started to advance in the second half of 2020, that green line has been tested but not violated.

Reviewing the chart below, the trend has behaved consistently so far, I see however that it's starting to slow down, on the top right corner of the chart the space between the price and the trend line is widening (red arrow). Between August/2020 - May/2021 the price was continually hitting or exceeding the upper trend line, now it's struggling to reach the upper line of the +3 Keltner Channel (KC). Not really a signal of concern yet as all trends eventually slow down and sooner or later they end, more like a warning signal.

I have set the resistance for this week to be at 4,709 and the support 4,418 (the FAQ section describes how I set all my indicators).

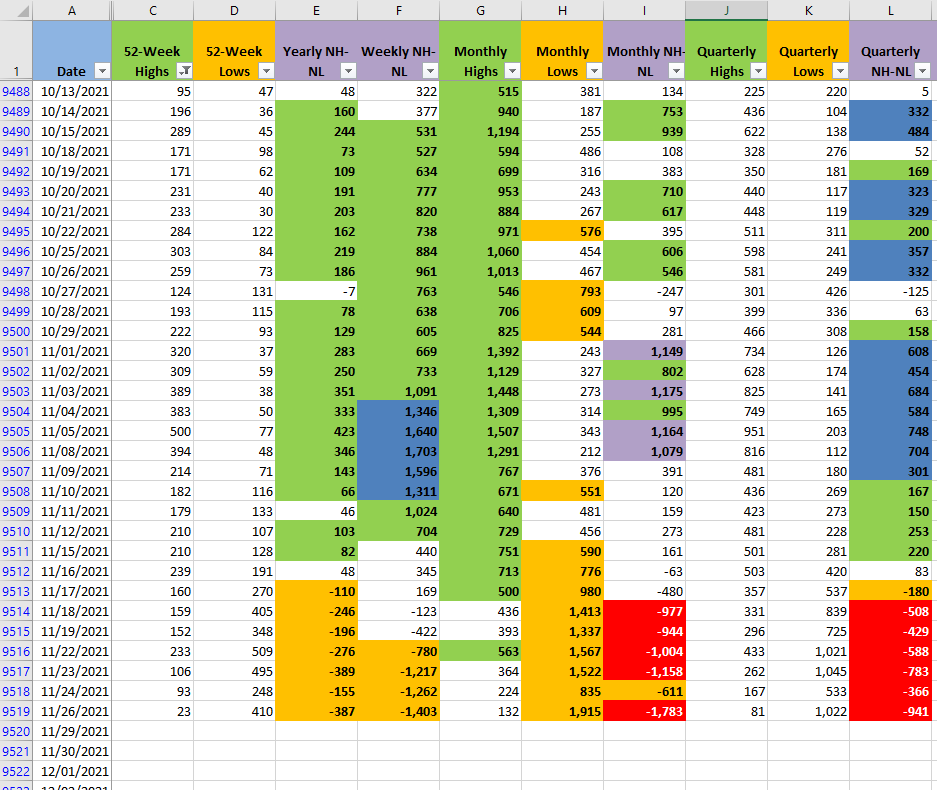

I keep track of very few market numbers, but I consider the New Highs and Lows a key part when I'm trying to determine the market direction (there is a good ebook from spiketrade.com where they get to describe in detail how it works). I use those numbers as a semaphore only; if bulls are in control or at least things are not as volatile as they are now then I'll consider opening long positions.

Check cell H 9,519 of the screenshot below, 1,915 stocks reached a new low for the month, while next to it on column G only 132 stocks made a new high. All time frames have been deteriorating since mid-November.

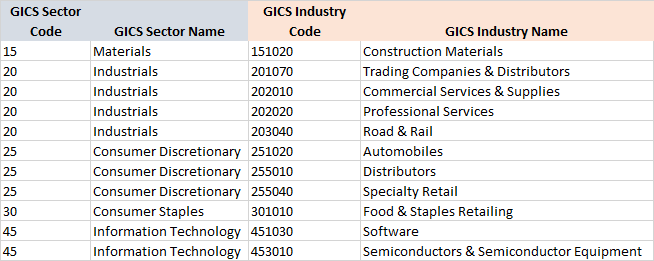

Industries

I'm still bullish until the charts provide further evidence that the trend is over. When I open a trade, I'll look first at the Industry to which the stock belongs. For this week I'm tracking the following Industries but it's very unlikely that I'll open any position, especially since the Sector charts for those Industries don't look great.

Scenarios

I don't trade news or fundamentals and I learned a few years ago that I can't forecast the market so I think in terms of the different scenarios that can happen during the week and how my plan for my open trades will act in each of those situations:

· Scenario #1: If New Lows keep at elevated levels with a lot of volatility, some of my stops might trigger and if they do, they are there for a reason. In this scenario I'll just stay on the sidelines waiting for the storm to pass. If this happens it can open good trade opportunities.

If things get really bad and the pullback starts to test the support or the KC centerline (green line on the first chart posted) I'll consider tightening the stops if they haven't triggered already.

· Scenario #2: What if the market starts a V-shaped recovery? bears are still strong so this scenario is unlikely, even if it happens I'll still wait a few days to see if the rally is for real.

· Scenario #3: If the pullback finds support and a consolidation starts, depending on the number of New Highs and Lows, I will check if any of the individual stocks I'm tracking looks interesting. I'm currently tracking 198 stocks, the alerts I set on them might take months to trigger. I haven't opened a new position since Sept/01/2021 so I'm not in a rush until things look more favorable on the long side.

Risks

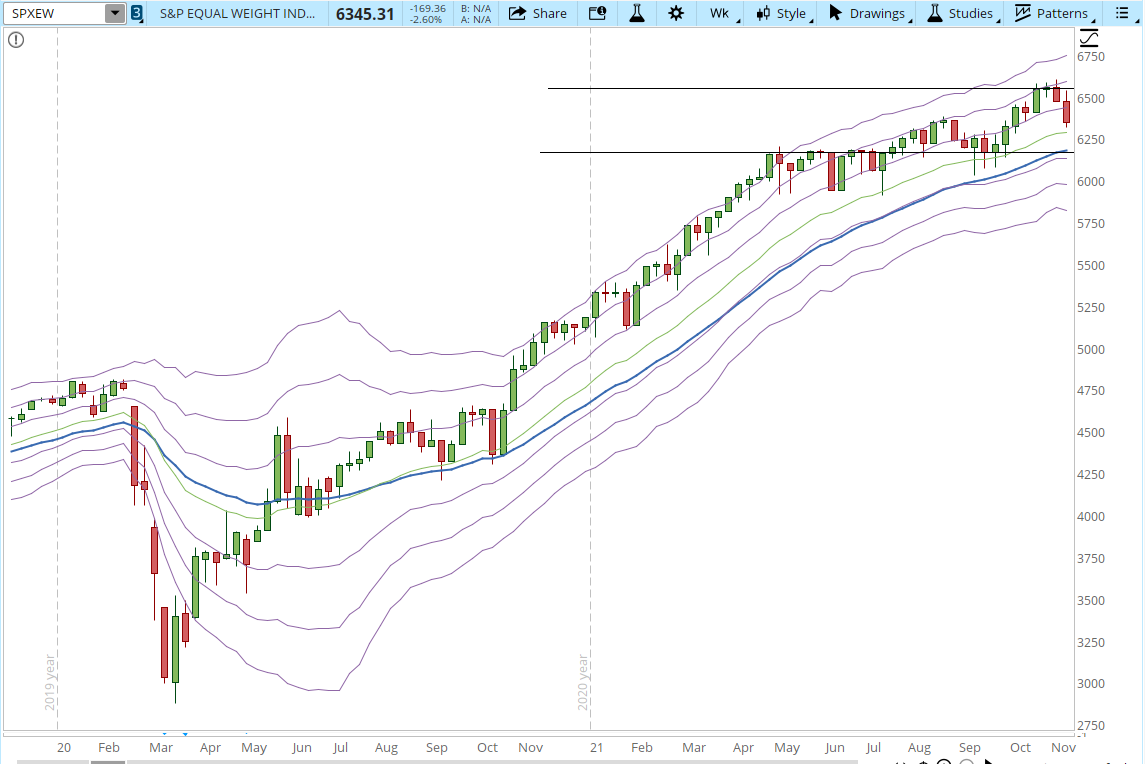

There are a couple of concerns regarding the current market. The first one is that analyzing only the S&P 500 things look good, it's advancing and the current correction isn't yet a big issue. However, the Equal Weighted S&P 500 index shows a different story.

In the widely used S&P 500 each company has a different weight, stocks such as AAPL and MSFT that are the current leaders of the index in terms of weight will have a lot more impact moving the index than UA or FOX. In the Equal Weighted S&P 500 each stock has a fixed weight of 0.2%

The Equal Weighted S&P 500 was stuck for months in a consolidation (chart below) and now it's having a hard time getting past 6,550. I interpret the chart as a limited participation of the stocks composing the index where the big players of the S&P 500 are moving the index up but the other stocks are not really reaching new highs.

The second concern I have is that eventually the party will be over; the S&P 500 is looking more parabolic on the monthly time frame. I haven't found a widely accepted definition of a bubble and I can't guarantee that we are in one, unfortunately no one will be 100% sure until it explodes and by that time the information is useless. I keep my stops in place and the risk of each trade at around 1.5% of the account size, risk management is essential to preserving capital, even if there is a market crash the damage to the account is limited.

Summary

I'm still bullish in terms of the overall market, bears are temporarily in control. Next week we will get further clues of the direction that the market could take. I keep my mind busy with my side projects so that it doesn't trick me into doing something that deviates from my plan if the volatility continues.

As mentioned in the "About" section of the blog, this isn't an advice page, it's my personal journey trading the markets and the way I see them. I sincerely hope that people out there have an action plan, the bull market is not going to last forever and eventually the signs of weakness will turn into a bear market.