All week I have been posting articles about the Market weakness, this Friday the selling pressure increased and now the S&P is testing a support that will be key to determine if the Correction resumes or the Correction is tracing a bottom. There many scenarios that could play in this Market, the only certainties that I see at this point, are that the Bulls aren't strong enough yet and the Bears still haven't given up the Market control.

Market Overview

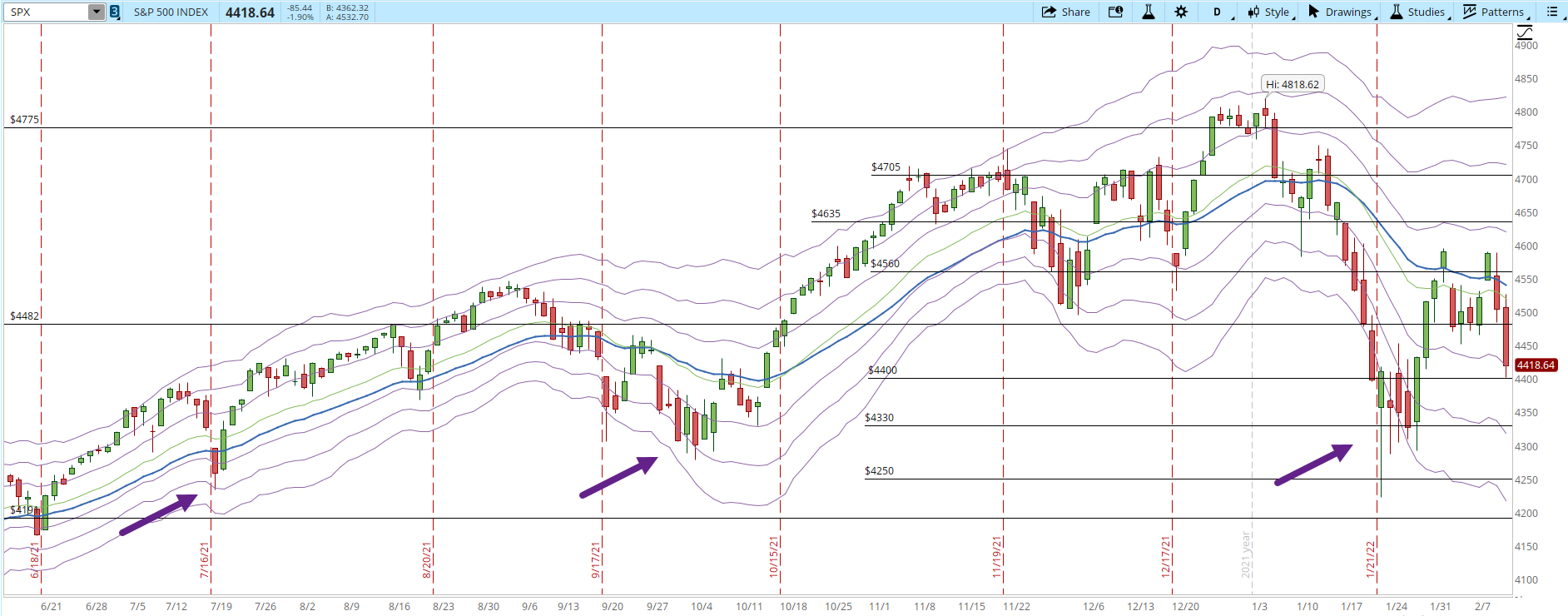

Starting with the daily chart of the S&P 500 (screenshot below) in order to have an idea where we are right now, the situation looks much better for the Bears than for the Bulls. The 30-day EMA (blue line) is pointing down again. The long black lines at 4,191 / 4,482 / 4,775 are weekly support/resistance lines. In order to analyze timeframes such as the daily one I add some additional shorter-term support/resistance lines.

If the 4,400 level is not strong enough to stop the S&P decline, my point of view is that the next strong support will be 4,330 where the S&P has found demand previously (purple arrows in the screenshot below).

The last important rally was in October/2021, there isn't a single rally after that which has lasted more than four days. There are a lot of interesting things that could be said about the chart below but the message is still that the Market is displaying a lot of weakness, the current selling pressure is stronger than the demand that is being created.

Reviewing the weekly chart of the S&P 500 and removing the indicators, except for the 30-week EMA (blue line). Notice how the powerful rally that started back on March/2020 always stayed above the blue line, it tested it a couple of times (green arrows) but the rally kept going, the slope of the 30-week EMA was in a clear uptrend. Things are changing, the slope is now flat, the S&P closed below the blue line for a second time and the news that hit the media aren't very encouraging (i.e. hawkish Fed, Ukraine, Covid, China, etc.)

Usually for my personal analysis, I also review the behavior of other indexes, not an uncommon task since the S&P 500 only tracks the most important large-caps and not all of them weight the same when it comes to moving the index.

If you review the screenshot below, other important indexes stopped the uptrend long time ago. Even the S&P 500 Equally Weighted Index (SPXEW) stopped the uptrend in May/2021, which indicates that only a handful of big companies were moving the S&P 500 in the last part of the uptrend.

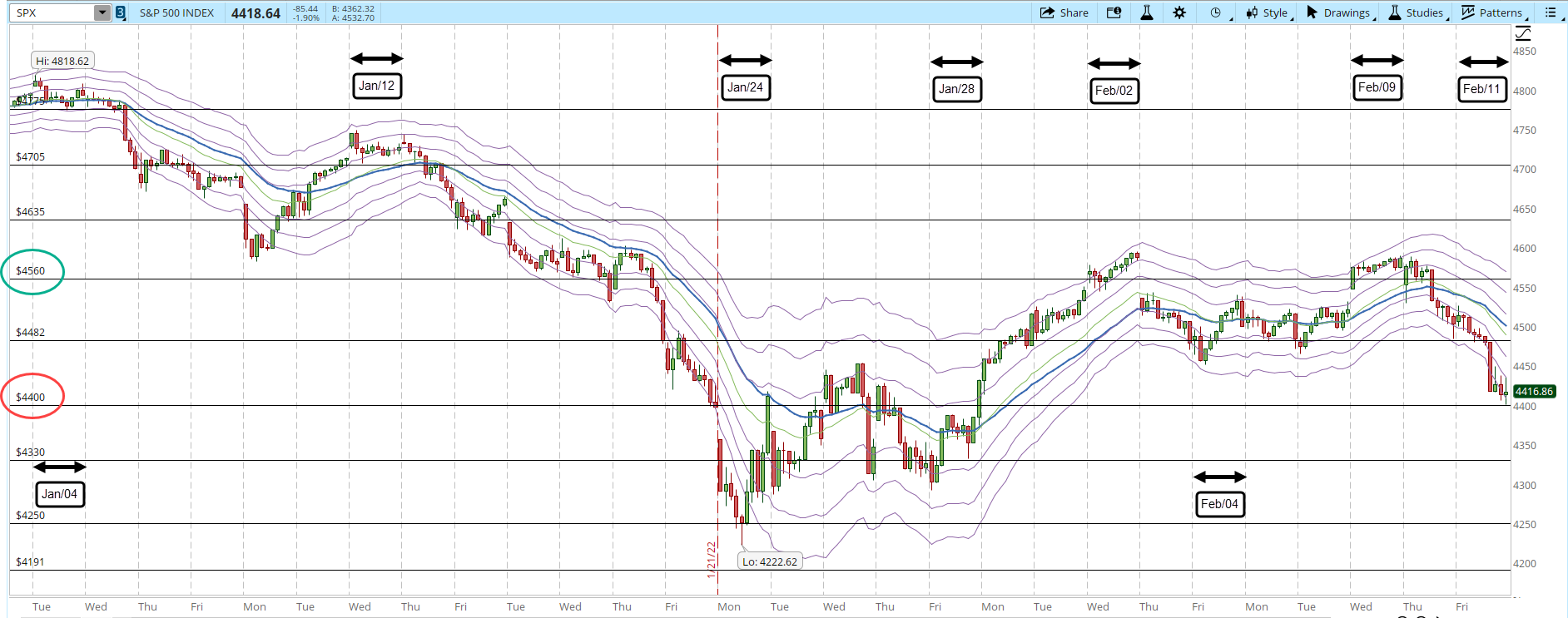

The 39-min chart, though it doesn't govern my trading decisions, is useful in order to understand the daily price action. Since Jan/31 the S&P keeps moving between 4,400 and 4,560 (red and green circles). When the S&P moves above or below those limits, it will be important to see in which direction the Market is heading and if it can hold the levels above or below those limits.

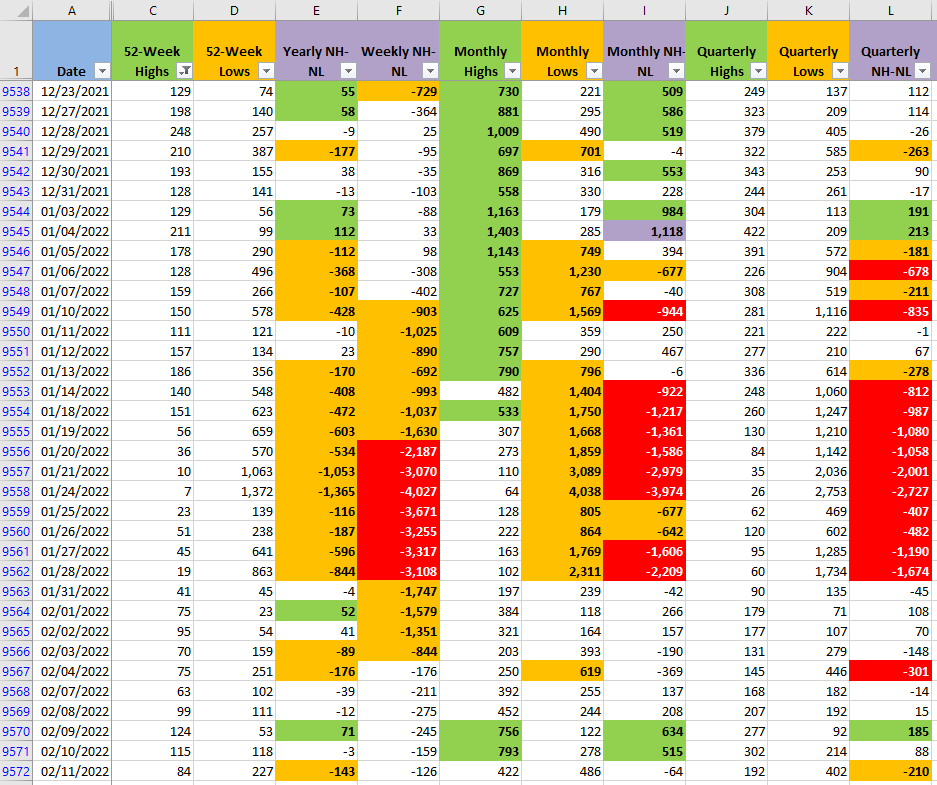

The New Highs and New Lows (NH-NL) numbers started deteriorating again for all the timeframes I track. The Bulls haven't been able to hold an important multi-day rally since Oct/2021 and the NH-NL numbers are a reflection of it.

Industries

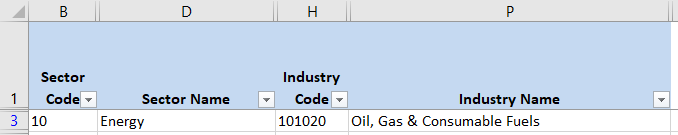

The number of strong Industries is another way to get a perspective of how strong the Market is. I don't use it as a way to decide if I open a position or not, but out of the 68 Industries based on the Global Classification Standard (GICS), this week I could only find one strong Industry, not surprisingly in oil. A single strong Industry won't be able to take the Market higher, but the other 67 Industries that are weak or not that strong could take the Market even lower if more selling pressure keeps entering the Market.

Scenarios

Scenario #1: The most likely scenario that I see for next week is that more selling pressure will keep entering the Market. The catalyst might be the potential Ukraine invasion, additional comments from a hawkish Fed or more Covid news. It doesn't really matter what the news are (at least for me, I don't trade the news), but the Market has been displaying a lot of fragility when the news are negative and not that much force when they are positive. If enough selling pressure enters the Market and it breaks the 4,400 support I see realistic that the S&P could go as low as the 4,250 support. In this scenario, I'm not opening any new positions and any of the five stocks that I still own could trigger their stops, that's if I don't sell them first.

Scenario #2: The second most likely scenario from my point of view, is that the S&P will start to move sideways along the 4,400 support. Maybe the news aren't that great but not as bad as expected. Remember that the Market is a discounting mechanism, that means that the Market prices are based on future events. What are the anticipated news? And when the time comes, did the expectations were fulfilled or there was something surprising/unexpected? If there isn't a catalyst strong enough to move the Market in a clear direction, it might just stay moving around the 4,400 level. In this scenario I'll also won't open any new long positions.

Scenario #3: I don't see the last scenario very likely, but anything can happen in the Markets. If for some reason there is a strong catalyst in the Market that makes it rally during several days (not just a reaction/relief rally), I might consider opening new positions if the S&P is able to close decisively above 4,600. Maybe an agreement is reached for Ukraine, some important statistic displaying recovery from the impact of the virus, etc. Unlikely scenario, at least for the trading week about to start, but we have to be prepared for whatever the Market throws at us.

Summary

The times in the Market are changing. We get to see more declines and days where the Market moves sideways than days where the S&P rallies. This started back in Nov/2021 for the S&P 500 but a lot earlier for other indexes. There is no need to forecast what is about to happen in the Market, having a strict risk management strategy, enter only to high quality trades if they match your strategy will lower the probability of severe damage to your account.

Trying to pick the bottom of the Correction is a very dangerous game, many things can happen that make the Correction resume. Even if you are lucky enough and get to pick the bottom of the Correction, the S&P could be tracing a bottom for weeks or months. Keeping a cash reserve while you monitor the Market from the sidelines is a much better option for me at the moment.