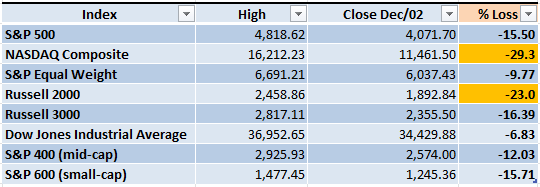

The trading week concluded with a marginal movement of 45 points for the S&P 500. The Market still hasn't picked a clear direction, on one side we still have a couple of important indexes in Bear Market territory (a loss of 20% or more from the previous high).

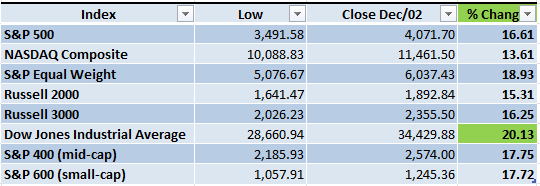

On the other side, the Dow Jones is already officially in a Bull Market (a gain of 20% or more from the previous low). What does it mean to have this kind of conflicting signals?

Market Overview

When I face these kinds of situations where there are conflicting messages, a reference point can help to get some clues of what to do next. For me, the reference is the weekly chart of the S&P 500. The weekly downtrend continues to be intact (lower lows and lower highs, highlighted by horizontal solid black lines) and its structure won't be damaged until the index is able to cross above 4,350.

Even before getting to the part of damaging the downtrend structure, during 2022 the S&P 500 has declined sharply once it gets to the +1 Keltner Channel (KC) which is highlighted by the yellow areas. If this pattern continues it might send multiple indexes back to Bear Market Territory.

The daily chart of the S&P 500 doesn't favor the Bulls. Only two times during 2022 the index reached the +3 KC, soon after that the index had very sharp declines. We are about to get to that level (yellow areas). The rest of the attempts to rally didn't make it past the +1 KC (black circled areas). If something is going to change for the Bulls, the rally should keep going past 4,150.

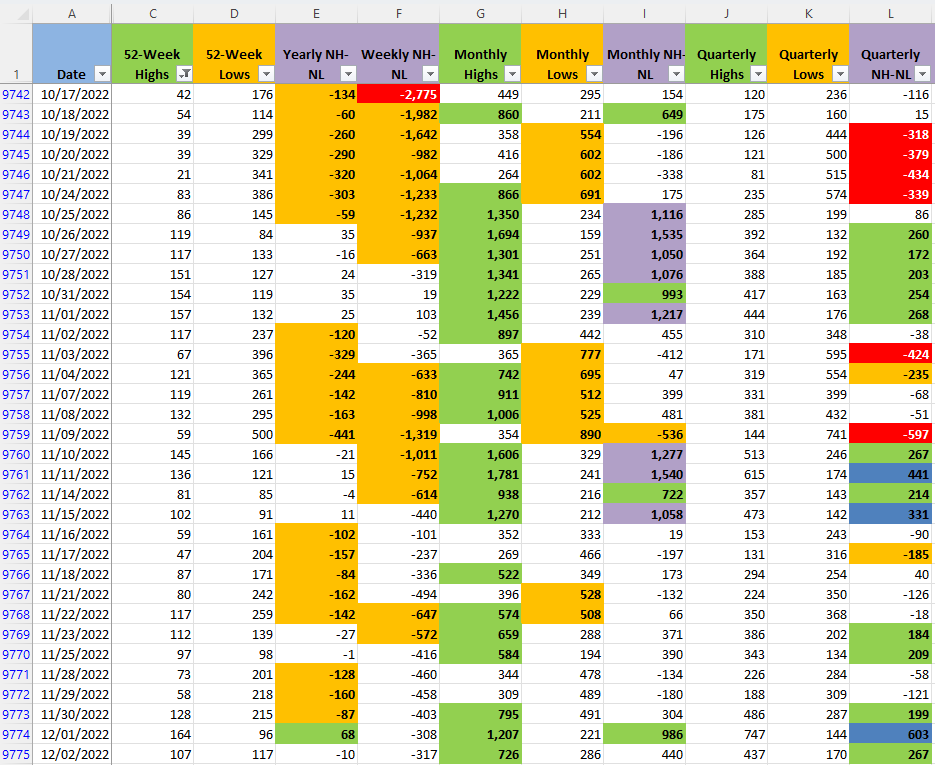

The numbers for the New Highs and New Lows (NH-NL) are a little bit bullish, unfortunately the price action isn't reflecting the force displayed by those numbers. There is a lot of volume around 4,130 that will act as a resistance if the rally tries to continue. If the Bulls can't keep increasing the NH in the monthly timeframe, the rally is destined to finish in the trading week that is about to start.

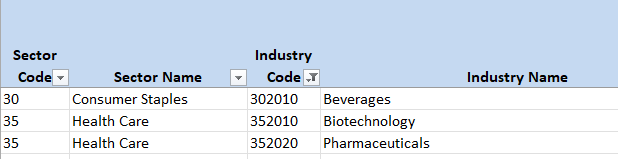

Industries

From the 68 Industries that compose the Global Industry Classification Standard (GICS), only the 'Construction & Engineering' Industry is one that I would qualify with the potential to form a strong uptrend ($SP1500#201030).

There are 3 other Industries that are having interesting breakouts. Remember that the idea of this section is try to identify where the potential big winners of the next Bull Market are likely to be. Industries that, despite the negative Market situation, continue to thrive and are a good place to start looking for candidates.

There are still 31 Industries (46% of the total) that are in a confirmed weekly downtrend and 18 Industries (26%) in which the downtrend structure has been damaged. Bears are still in control, but a few interesting candidates for the Bulls start to emerge.

Scenarios

Scenario #1: The most likely scenario, from my point of view, is that we will see a pullback. A healthy pullback would be one that keeps the index around 3,900. If the Bears gain back the control and manage to increase the selling pressure, the decline could go as low as 3,760.

Scenario #2: A less likely scenario would be that the S&P 500 keeps moving in a range between 4,000 and 4,100. The S&P 500 has been moving around the +2 KC during three weeks so far. Even to keep it there, the Bulls need to keep absorbing the supply that enters the Market. In order for that to happen, some good news or the absence of strong negative catalysts during the next week is required.

Scenario #3: The least likely scenario is that the rally continues. With the current situation a positive strong surprising news is required early in the week. Something that makes the Monthly New Highs increase again and the price action reflects the increased demand by closing at least above 4,150. Even if that happens, the index would be at overbought levels (+3 KC or above) which is an area that could easily trigger a pullback.

Summary

The situation hasn't changed much since last week. At a higher level the Bears are in control (weekly chart of the S&P 500). The Bulls are attempting to break the pattern with limited success. Usually the most attractive options in the Market are buying and selling, they give the sensation of progress and the excitement of potential gains.

I have seven long pilot trades still open, and I was already stopped out of two more (Delek US Holdings / Aehr Test Systems). The idea is to get a much better feeling of the Market sentiment through real trades of limited size. The other option, if you don't find good setups, is to consider staying on the sidelines. Trading more doesn't necessarily translate into more profits.

The balance of power seems to be changing slowly, Bear Markets don't last forever. Eventually the inflation will be under control and even if that means going through a recession that will also eventually pass. It's important to keep monitoring the Market situation and looking for potential candidates that are likely to lead the next multi-month Bull Market.