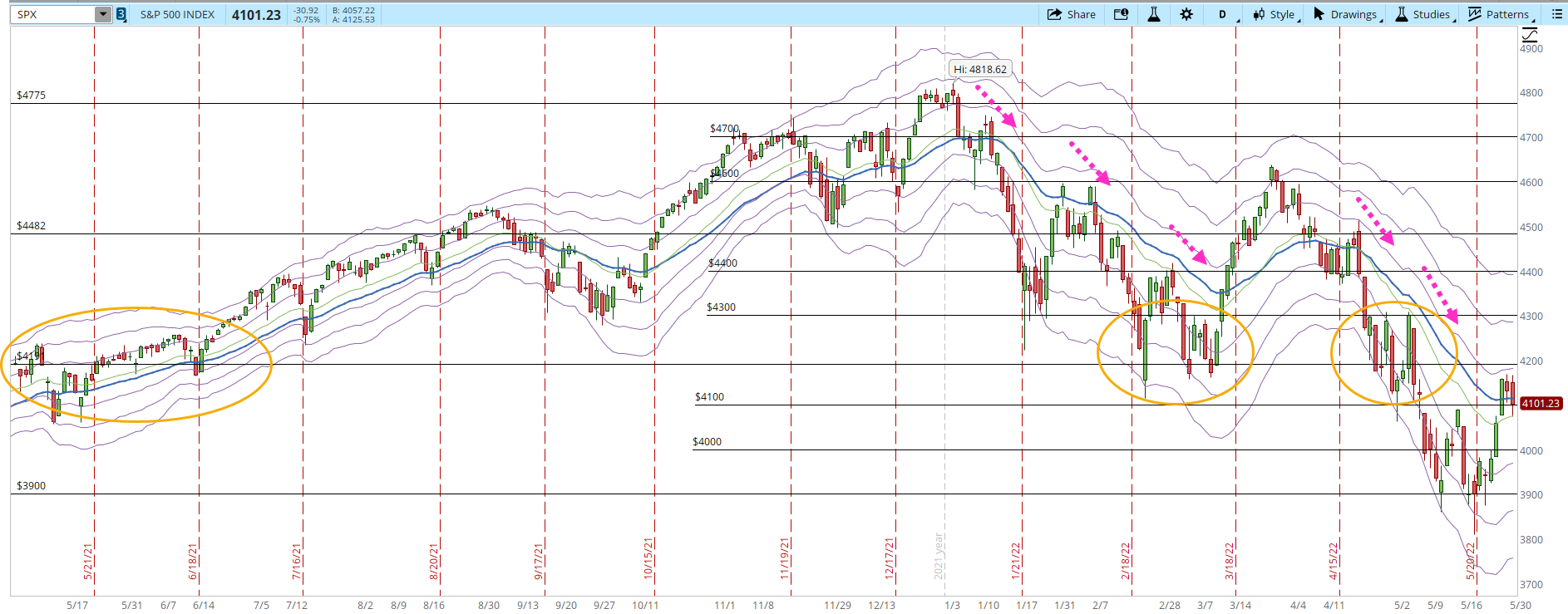

You could see today's Market action in different ways, one way is that the Bulls were able to hold against the Bears' attack. I see it more like Bulls are having a hard time absorbing the selling pressure and the rally starts to show its weakness. I have mentioned several times that the target for this rally was somewhere between 4,100-4,200 which is a level already reached. If the rally is going to become something else, it shouldn't be a problem to aim higher, 4,300-4600 in the next couple of weeks.

During the weekend and yesterday I posted the congestion zones around the 4,191 resistance and that multiple times (pink dotted arrows) the S&P 500 declined when it was close or reached the 30-day EMA (blue line). The analysis is still valid, the rally is stalling, and if there's still force from the Bulls the upward movement should continue soon, preferably during the last two trading days of the week.

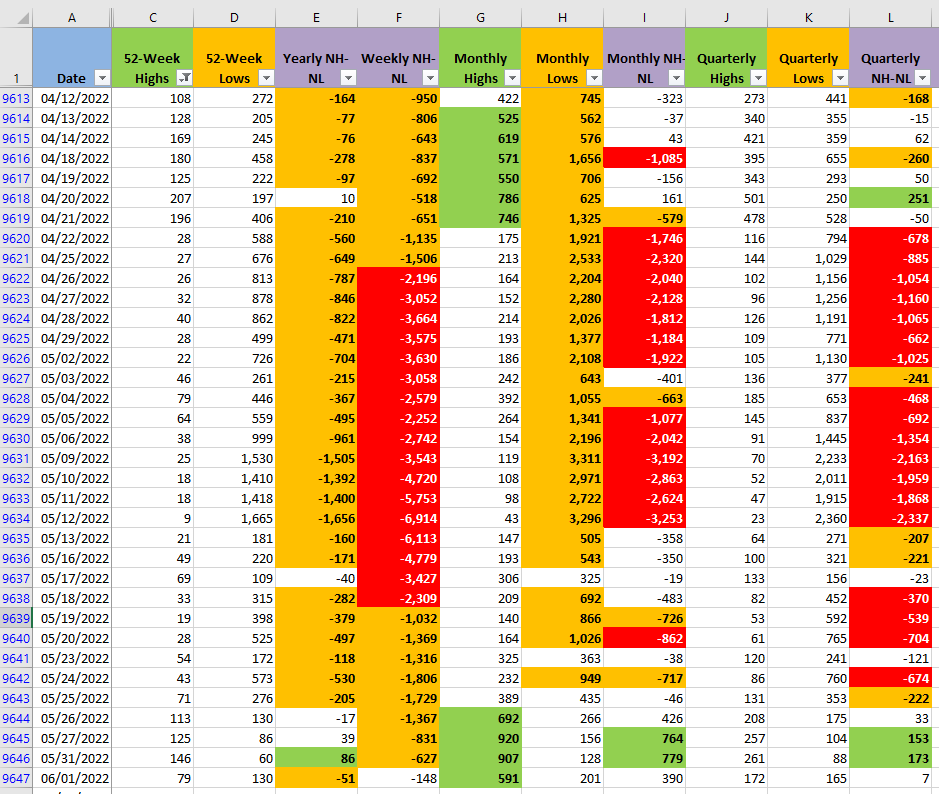

The New Highs and New Lows numbers moved from bullish to neutral in all the timeframes, not a very encouraging signal. The rally that started last week still could continue if it shows some force soon. So far this week, we haven't seen a fraction of the power displayed by the Bulls last week. The negative news about the inflation keep coming and the Market is reacting negatively to them. The Market sentiment might turn bearish if there isn't action from the Bulls during the rest of the week.