Today the important indexes rallied, the Market is behaving in a different way than I thought, where a controlled pullback would take the S&P 500 close to the -1 Keltner Channel (KC) in the daily chart.

If we review the S&P 500 daily chart, the S&P is trying to keep above the +1 KC right around the 4,560 resistance. There is nothing strange in that behavior, the S&P can be moving up and down around that level until there is some catalyst that makes it take a defined direction.

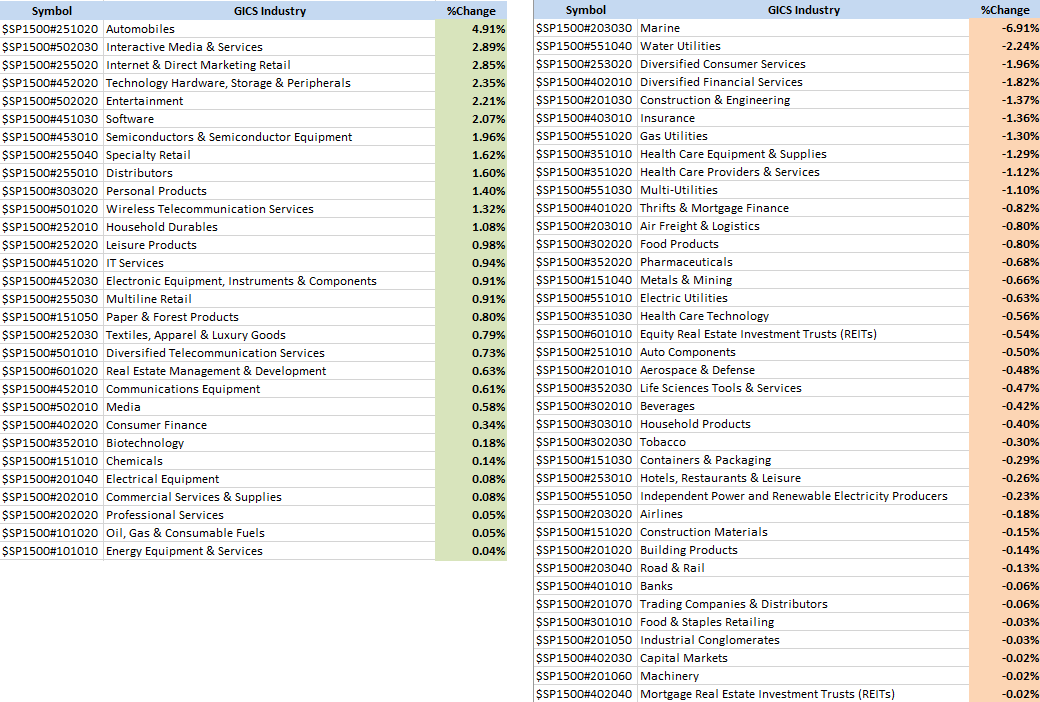

I don't like that the rally is being fueled by a very small portion of the Industries. Only 16 out of 68 GICS Industry indexes were able to at least match the movement of the S&P, that's 23%. Only 7 out of 68 of those Industries, that's 10%, were able to at least match the performance of the Nasdaq Composite. Today's rally was heavily dependent on the Information Technology Sector.

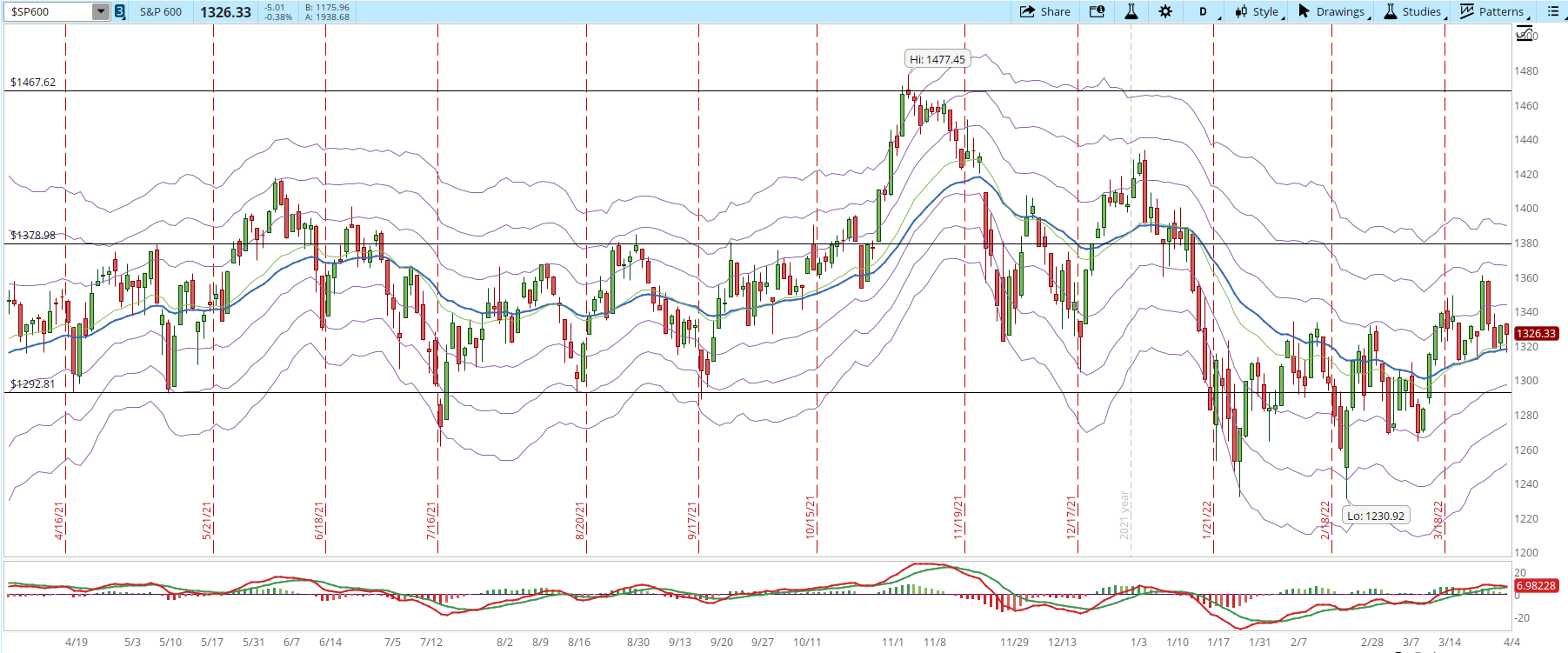

In terms of capitalization, things aren't much better, the S&P 400 (mid-cap) had a small loss of -0.24%.

The S&P 600 (small-cap) had a similar behavior losing -0.38%.

If we make a comparison of the S&P 500 vs the SPXEW (in this index every stock is weighted the same), only moved 0.21%. All these charts, from my personal point of view, indicate that still a very small portion of stocks are the ones moving the Market. The big question now is, will the stocks that keep moving the indexes up, be able to lead the rest of the Market into a new Bull Market that could last a few months at least? Right now, the rest of the stocks aren't following that leadership yet.

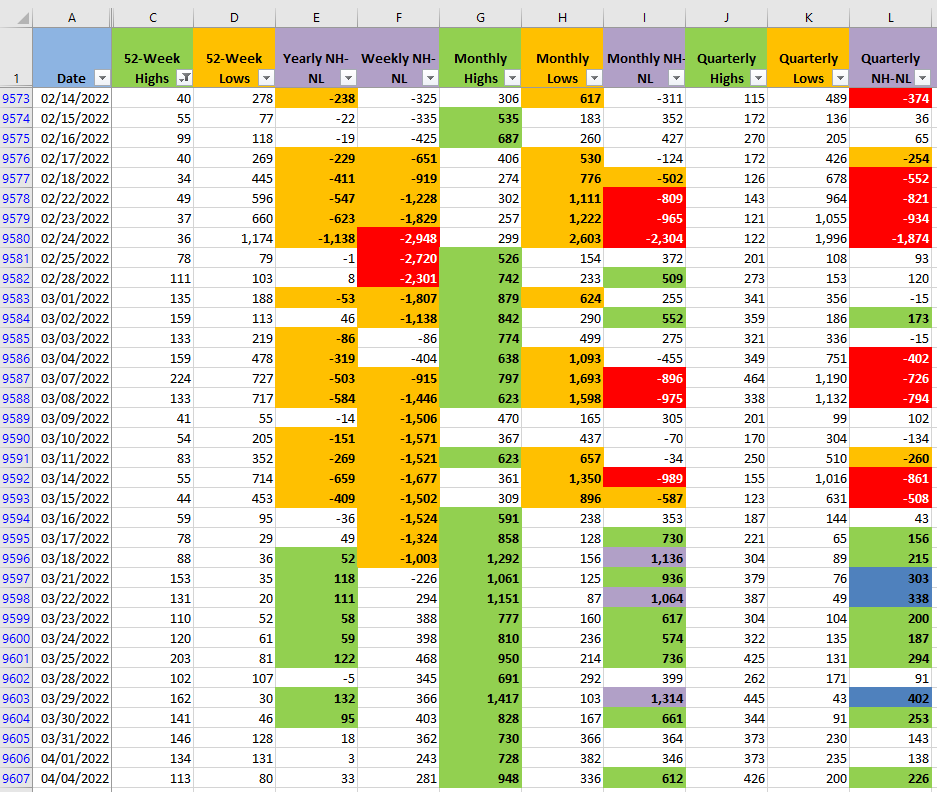

Finally, the numbers for New Highs and New Lows haven't changed much in the last couple of days. The numbers are showing a much more limited force from the Bulls. At this point, the pullback could still resume or the S&P 500 could start moving sideways in a topping action.