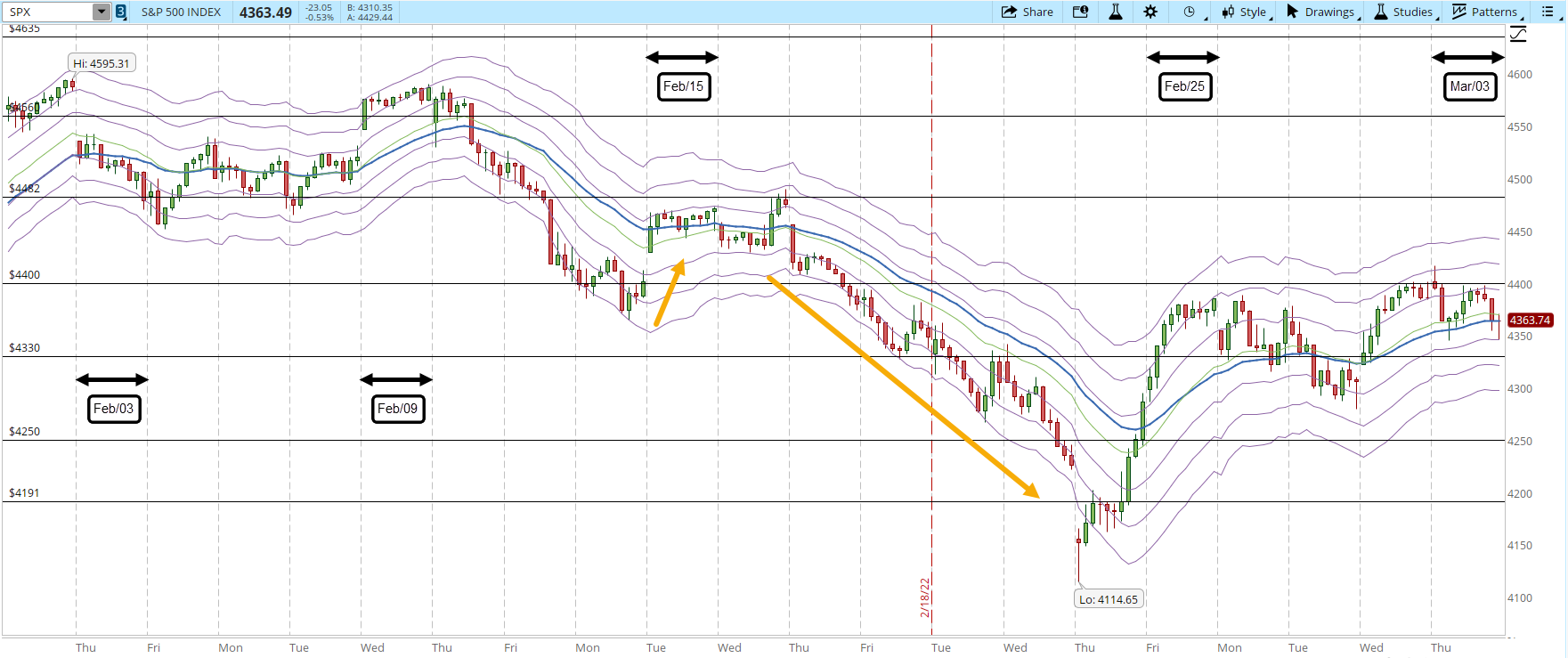

The S&P tried to rally at the beginning of the trading session, but for the last five trading days the 4,400 resistance has been practically intact. The news today were mixed, mostly on the negative side with a hawkish Fed, not so good economic indicators, the war in Ukraine and some important technology stocks with important losses.

From the technical side, the 39-min chart didn't change much from yesterday. Still a weak price action that can't get past 4,400. In the last month the S&P had already tried to get past 4,400 in Feb/15 (orange arrows), it could only hold two days above that level before collapsing to 4,114. It will be an important clue when the S&P is finally able to break through 4,400 and hold above that level, it will indicate real force from the Bulls.

I think there is a small chance that there is a rally that can get at least as high as 4,600. The bullish divergence that I had discussed in my previous posts is there (black dotted arrows). The S&P is unable to get past 4,400 but it's also not declining at this point. If we get to see the 30-day EMA flatten (blue line), a solid breakout that can hold above 4,400 and the number of New Highs increase importantly, there could be a rally.

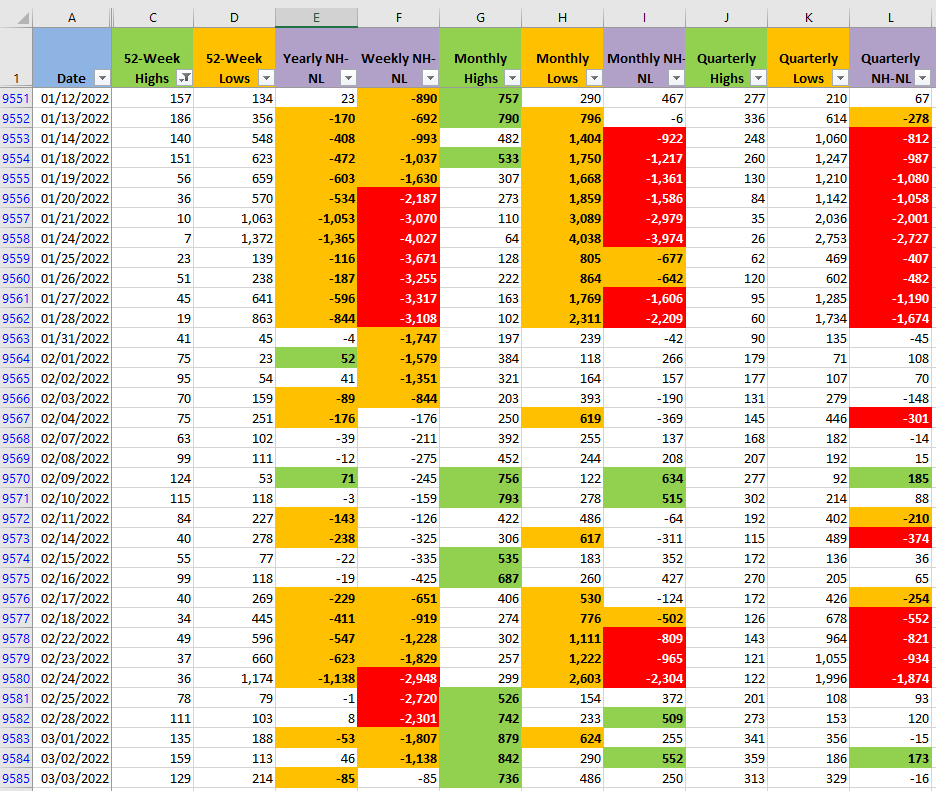

Finally, the numbers for the New Highs and New Lows didn't change much. The New Highs in all the timeframes had a slight decrease while the New Lows increase was more important. The selling pressure is still nowhere close of what we saw in Jan/24 or Feb/24.