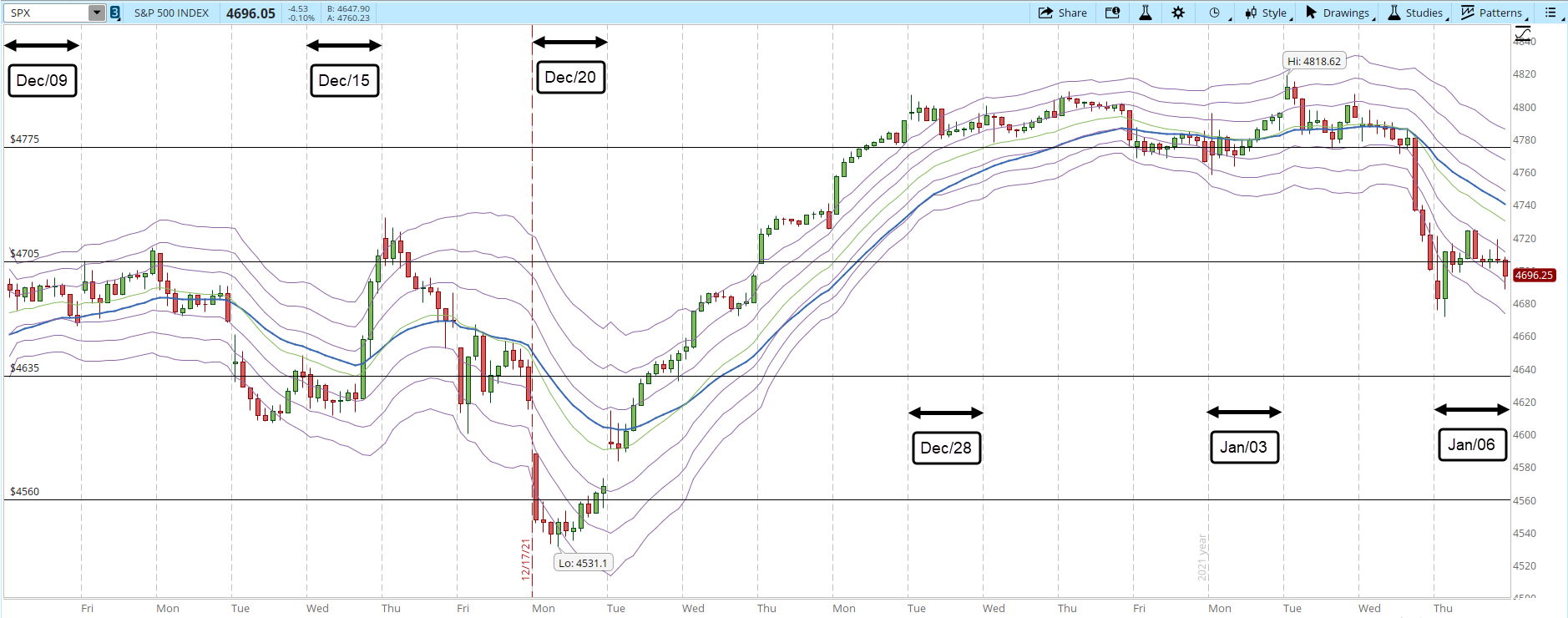

The S&P 500 opened the session with a failed attempt to rally, during the session it kept trying to break the 4,705 level. Towards the end of the session, it just went down in order to close at 4,696. The Bulls keep showing weakness, not just today, but all the previous sessions where the S&P was unable to get past 4,800 since Dec/28. The price action is easy to see in the 39-min chart below.

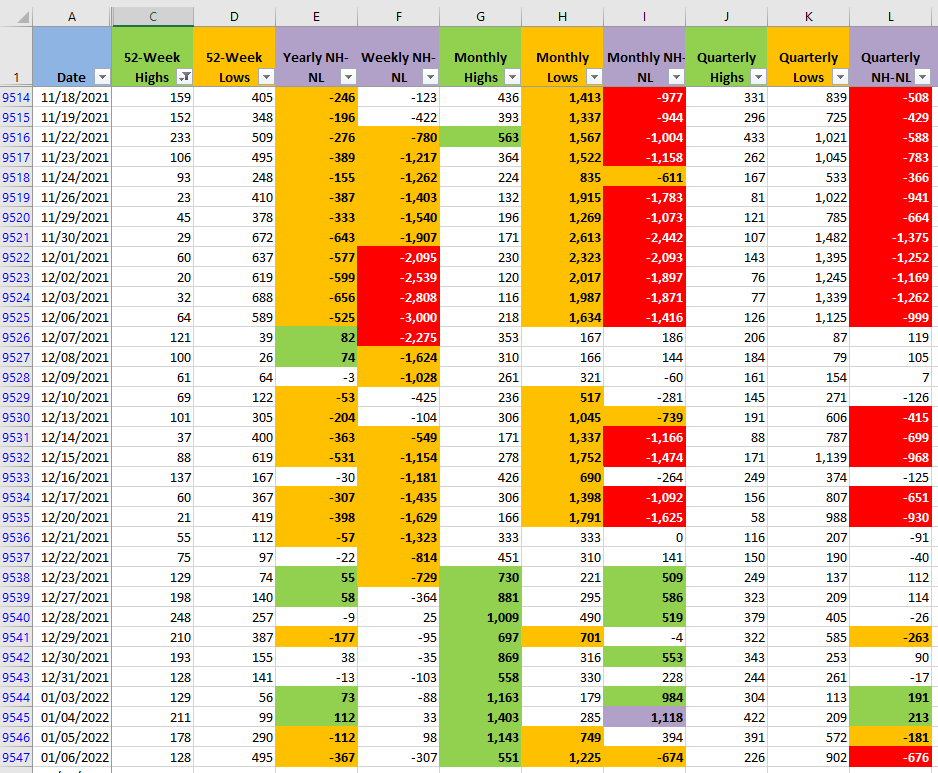

The New High and New Lows reflect how weak the situation is for the Bulls. The New Monthly Lows in a couple of days moved from 285 to 1,225 (column H). All the timeframes show the dominance of the Bears.

As mentioned in my post yesterday, for my particular way of trading, I need to wait in order to open long-term positions that could potentially develop a trend. The S&P is testing the 4,705 support, it needs to hold and rally if there is a chance that the weekly uptrend resumes. In terms of the weekly trend (screenshot below) of the S&P it's still intact, the minor pullbacks and corrections are inevitable.