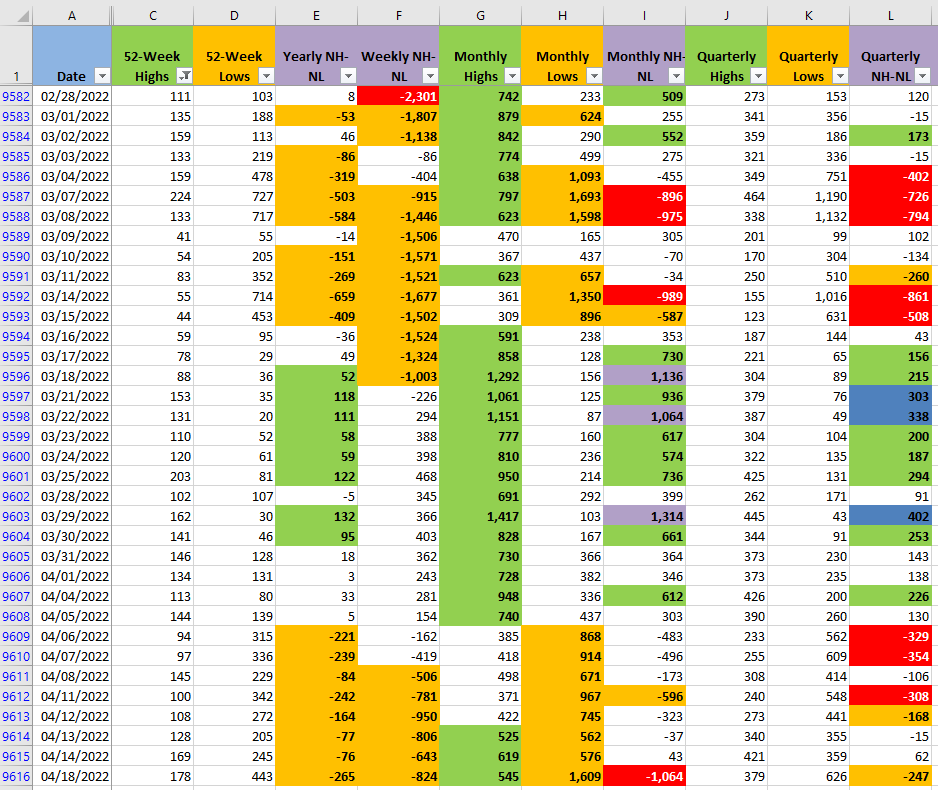

Most of the main indexes suffered marginal losses today. Usually I start reviewing the charts of the S&P but this time it's more important to see first what's going underneath those indexes. The New Highs and New Lows (NH-NL) numbers are deteriorating fast. The most important columns are G, H and I, that display the Monthly numbers, the fastest changing timeframe from all the ones displayed.

The amount of selling pressure is considerable, the new Monthly Lows almost tripled from yesterday. If the Monthly Lows don't decrease in the next two days, it's very likely that lower prices will follow.

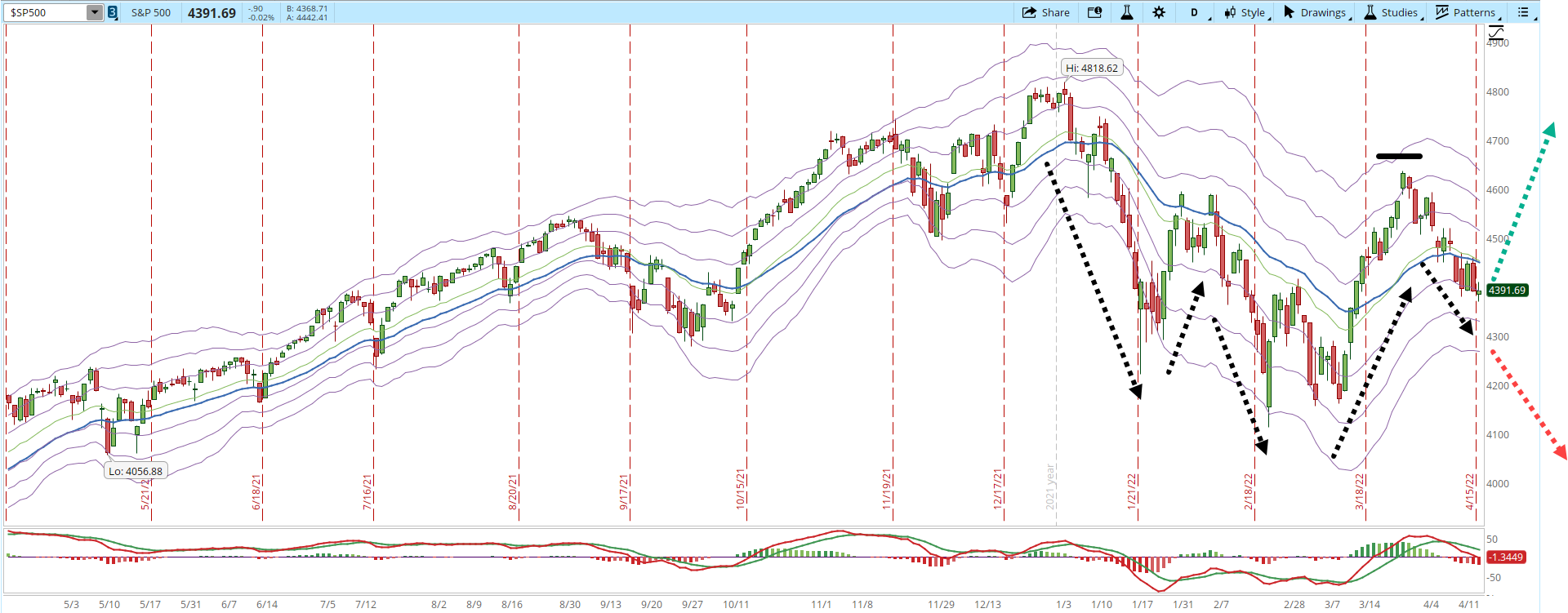

The amount of supply entering the Market is still not reflected in the marginal losses that we saw today in the S&P 500 daily chart. The potential for a rally triggered by the First Higher Low is still there, but the probability of the rally happening, with the current amount of selling pressure, decreases the chances of a big upward movement (green arrow). If the New Monthly Lows don't get below 500 in the next couple of days the pattern is likely to fail and the price could test the February lows.

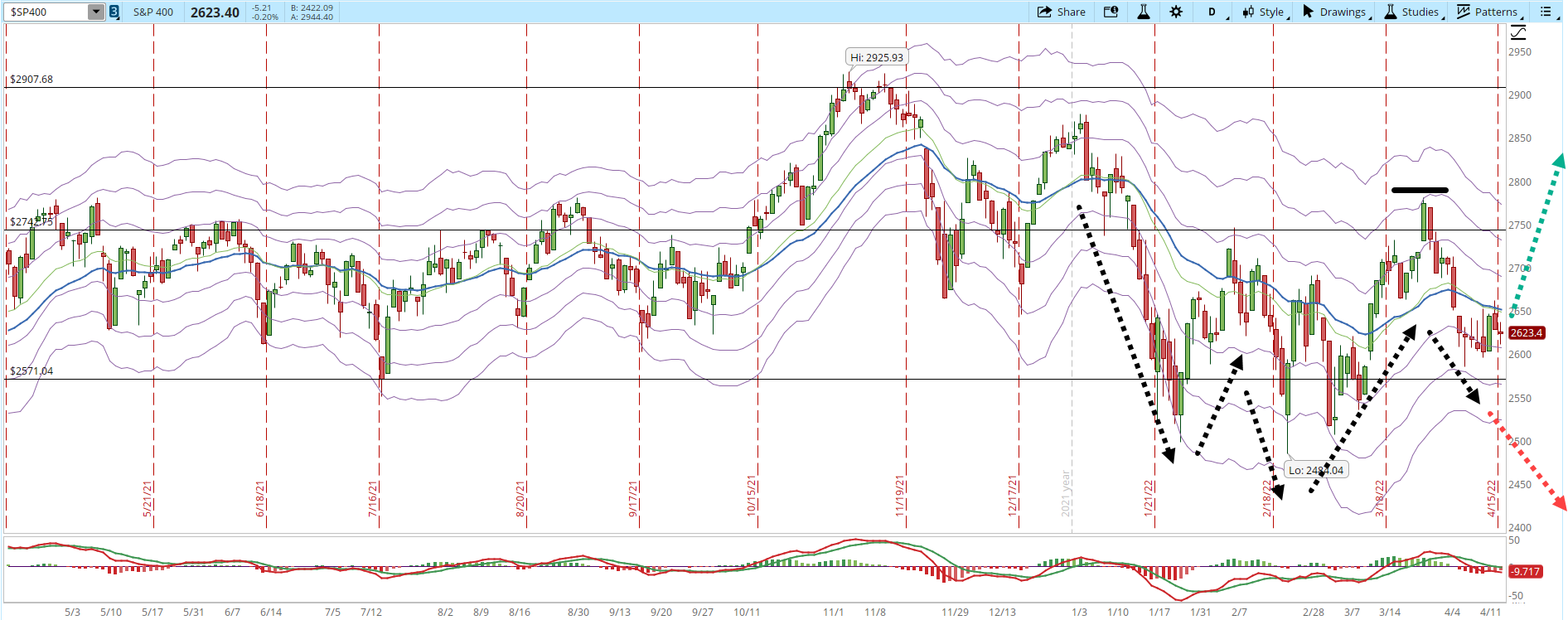

I have marked the same pattern and scenarios in the S&P 400 (mid-cap) daily chart.

The Monthly NH-NL numbers act as a leading Market indicators. Right now, there is a warning where despite the small losses that the indexes posted today, the amount of stocks making new Monthly Lows is increasing significantly. Strict risk management is always important, however at times like this where we aren't in the middle of a powerful uptrend, it's even more important.