Not long ago the Fed hawkish comments used to hit the Market indexes, today we are back at that kind of Market fragility. From the large-cap perspective the decline is moving around the +1 Keltner Channel (KC), however the mid-cap and small-cap indexes suffered a lot more and are already around the -1 KC level.

The pullback of the S&P 500 is moving around the +1 KC, it closed at 4,525 and the level of the -1 KC is around 4,405 (red arrow). There is still margin for the pullback to continue.

The S&P 400 (mid-cap index) is almost at the -1 KC (red arrow).

The S&P 600, the weakest of the three (small-cap index) is already there (red arrow).

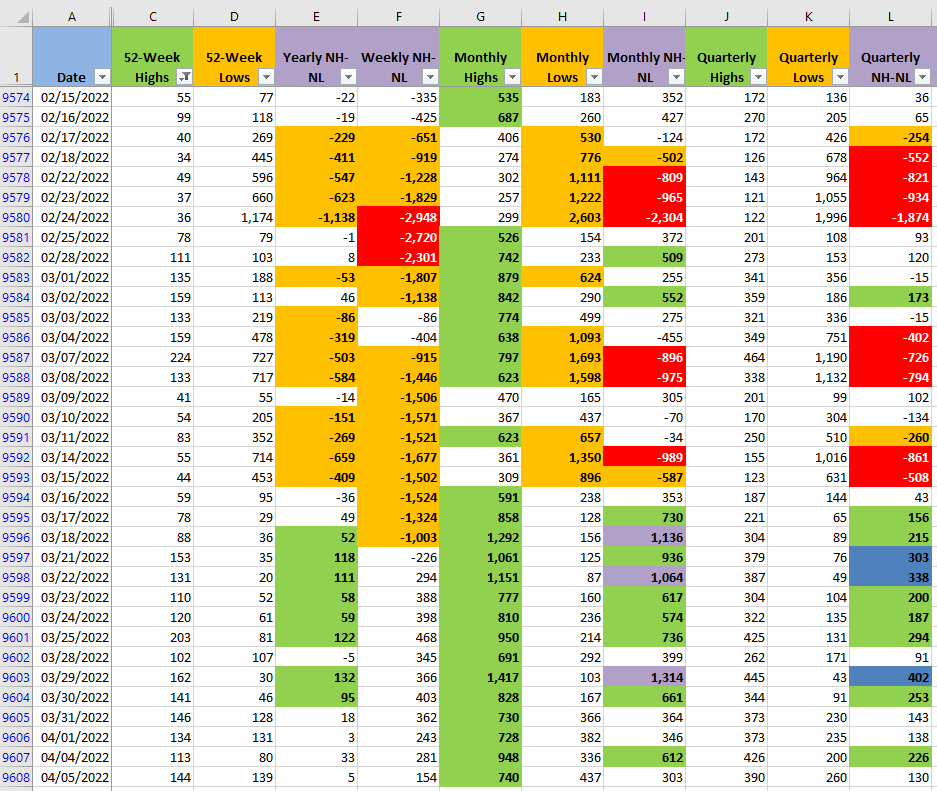

The bullish force that was present previously in the New Highs and New Lows numbers is gone. The most important columns are G, H, I which move faster than the rest of the timeframes. The balance of power, still in favor of the Bulls, is minimal, anything can turn things bearish at any moment.

If the pullback of the S&P 500 holds above 4,400 and then rallies, there's still a chance that the Bulls can recover their leadership. I still don't like that only a portion of the large-cap companies are leading the indexes. In order for a multi-month Bull Market to develop, I would like to eventually see the mid-cap and small-cap companies moving up too.

I stopped opening new long positions (the last one was on March/29) and I was stopped out of two long positions I had already opened. It just doesn't seem yet, to be the moment to take more risk aggressively. Real positions, with real risk using strict risk management is better than any analysis I can think of. It has to be under controlled circumstances in order to be able to time the Market.