Today we saw the same news moving marginally the different Market indexes. The Ukraine tension is still a factor, whether or not Russia is pulling its troops from the border, the Fed hawkish notes, weakness in the Tech stocks. None of them surprising or new, that's why the Market moved little today.

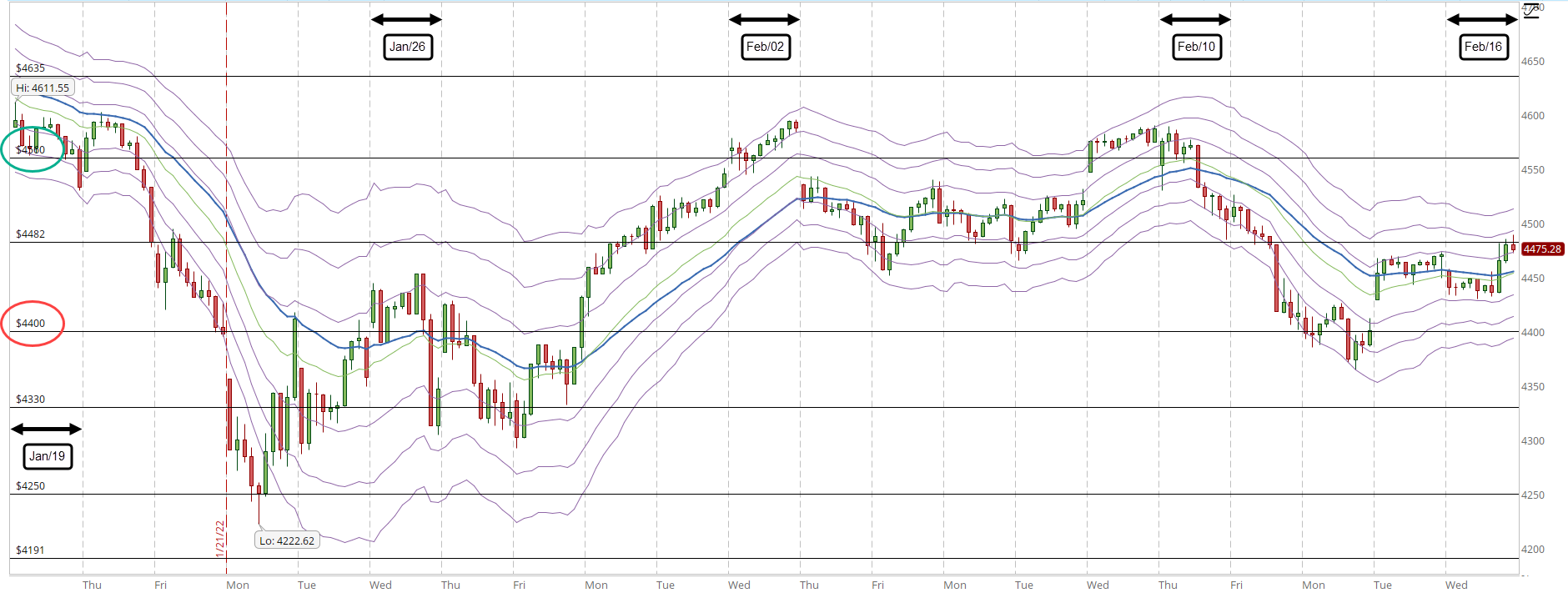

Reviewing the 39-min chart, the important part is that the price keeps moving between 4,400 and 4,560 (red and green circles). In between those limits, there is the 4,482 line which is acting as a resistance during the past two days.

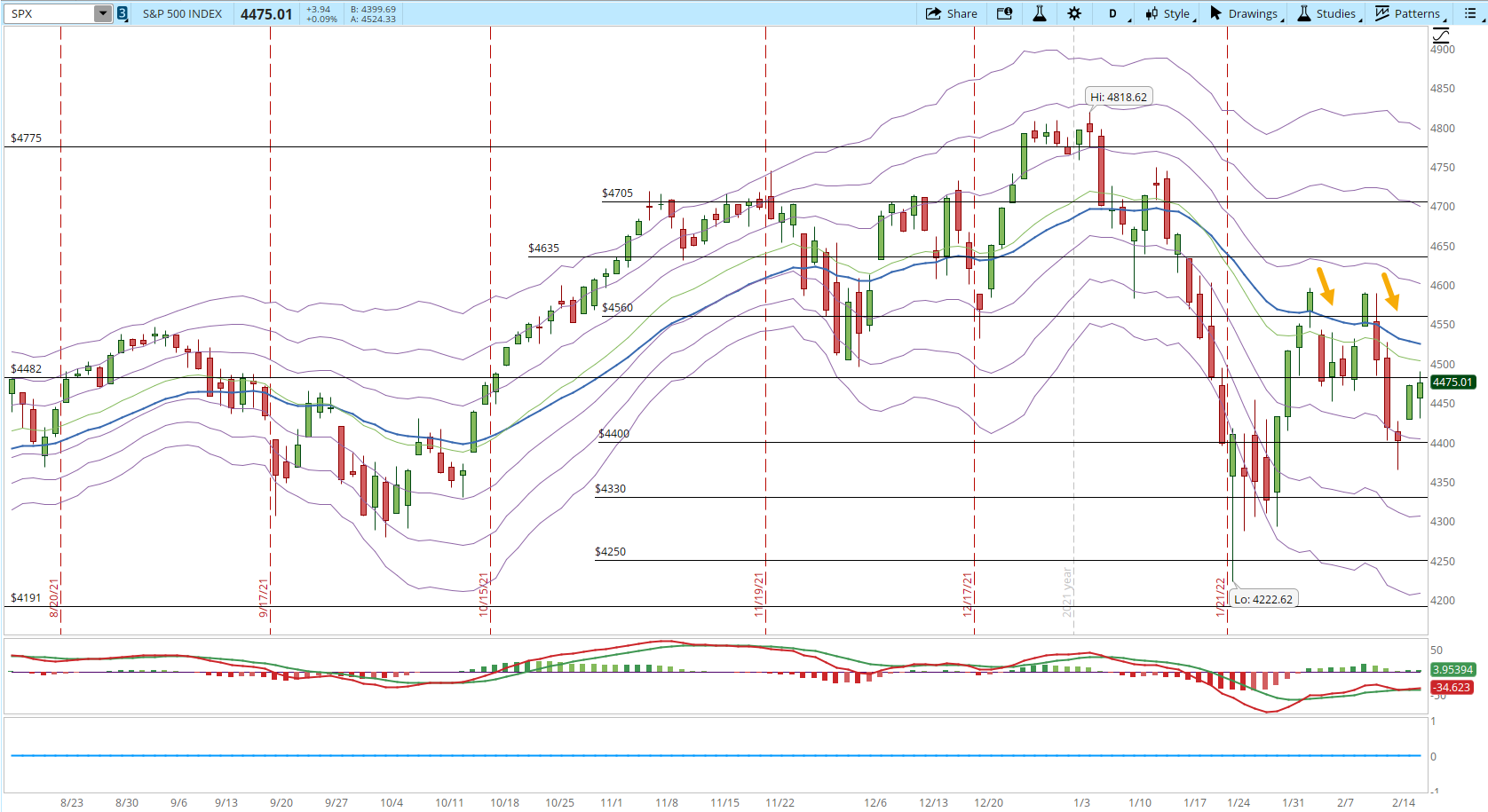

Even if the S&P gets to rally tomorrow or Friday, I would be suspicious about the quality of the movement. It needs to go at least above 4,600 , the level where in previous attempts it has pulled back (orange arrows in the daily chart below).

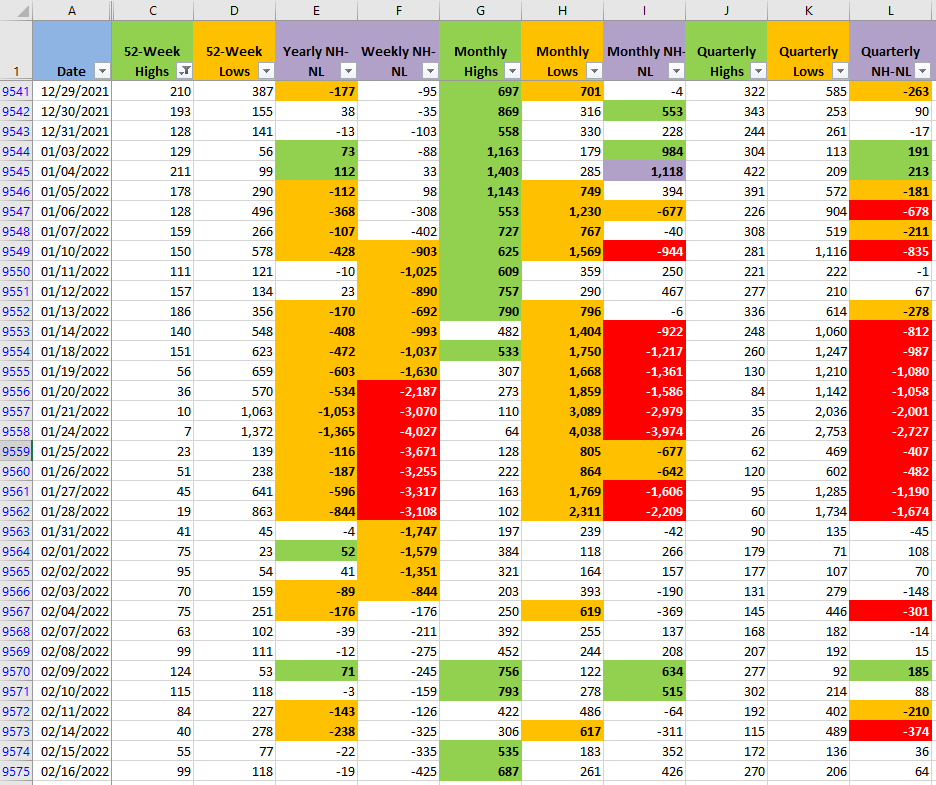

The New Highs and New Lows don't show an important movement in any timeframe. At this point Bulls and Bears have reached a balance in power, the price moves within the trading range, some days the Highs will increase, other days the Lows, until there is a catalyst that makes the Market move in a specific direction.

At this point, I continue waiting for more favorable conditions, since my system is based on stocks trending for weeks or months, right now there aren't plenty of candidates. The only Industry where I still see strength is in oil, and I already have a long position in Marathon Oil (MRO), there aren't plenty of options that are worth the risk yet. Eventually the Market conditions will change, but that could take weeks or months.