Eventually every trend slows down and sooner or later it's over. After the S&P reached an all time high of 4,818.62 on Jan/04, the Bears took control of the Market and have broken one support after another.

Market Overview

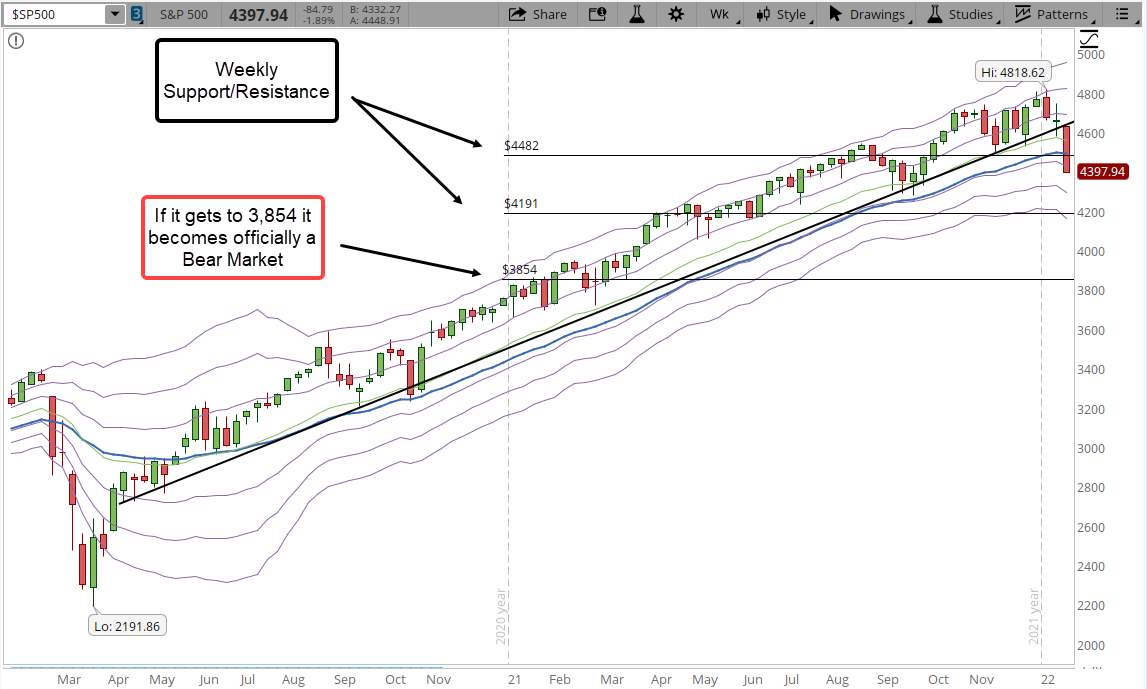

Usually I review the 39-min or daily chart first. This time the weekly chart is the one that has the most important message. The good thing about this chart is that there is no the slightest doubt that the trend was broken, the S&P just sliced through the 4,482 support (now it becomes a resistance) and there is no certainty about if the S&P will have at least a relief rally or it will just keep accelerating the fall. The S&P has lost so far 8.7% from the top, if it gets to 10% it will be considered to be a full Correction, if it gets to lose 20% or more then it becomes a Bear Market.

The percentages about corrections and Bear Markets can be tricky, the S&P 500 is a market capitalization weighted index of the 500 leading publicly traded companies in the USA. That means that based on the market capitalization (the value of the company outstanding shares) and the weight assigned to that company (i.e. AAPL weight is 6.754915% of the index vs FOX 0.013755% only, this is at the time of the writing of this post as these weights keep being updated) we see an index of the 500 most important companies traded in the USA, but not all of those companies have the same impact in the index.

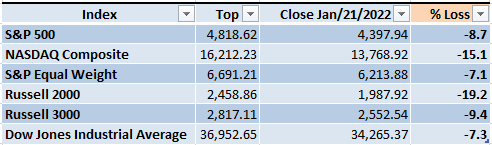

If we do the same exercise for other important indexes that track different symbols then we get something like the illustration below where the Nasdaq and Russell 2000 are past the full correction and heading towards the Bear Market barrier:

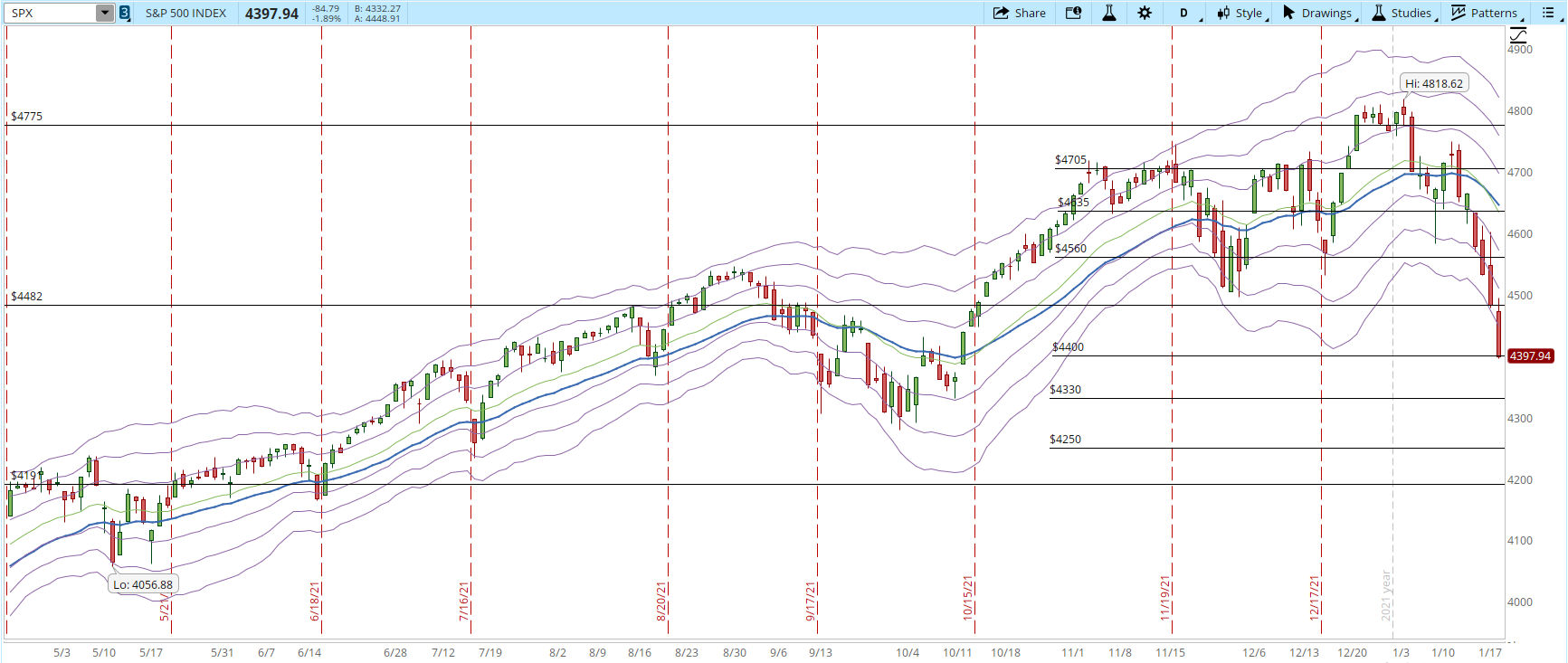

I have updated the support and resistance lines. The S&P broke past the old ones so there is the need to have new references. The weekly levels that I track are at 4,775 / 4,482 / 4,191. Additionally I add short-term support/resistance lines for illustration purposes, the new ones that I added are at 4,400 /4,330 /4,250.

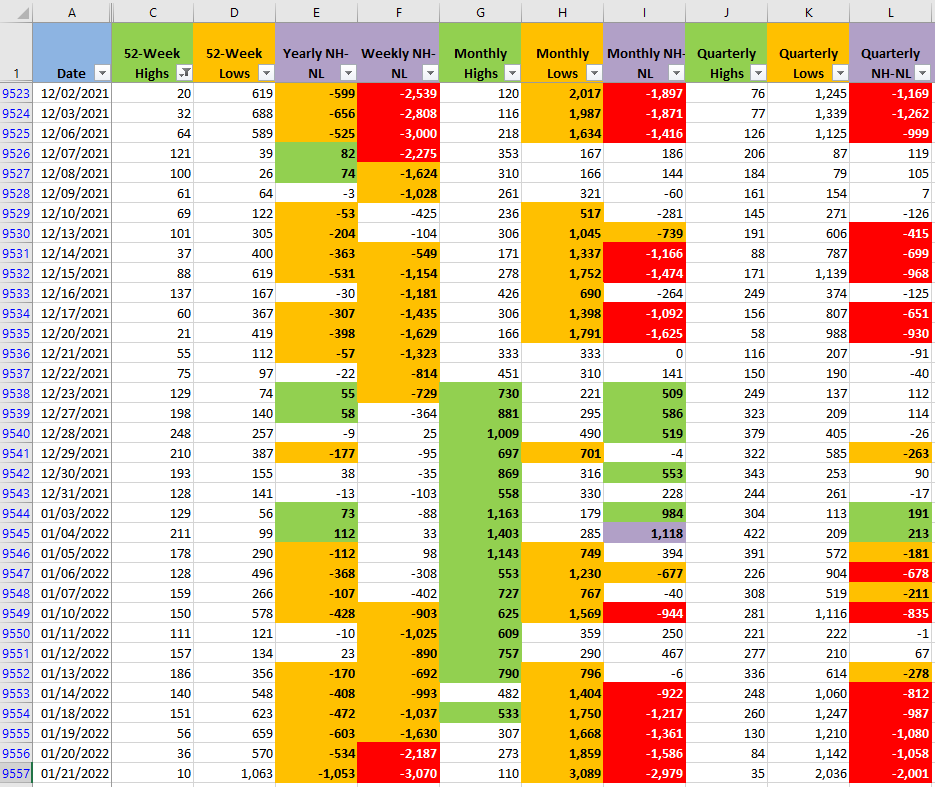

From the previous S&P charts we can see how powerful is the selling pressure in the Market. That is confirmed by the numbers of the New Highs and New Lows (NH-NL). All the timeframes tracked are dominated by the Bears, with those incredibly high numbers of Lows during the trading week that is about to start there could be at least a small bounce, not necessarily a change in direction.

Industries

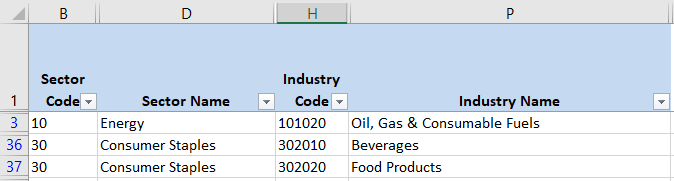

Despite the ongoing correction, there are still a few Industries displaying strength, they are in the Energy and 'Consumer Staples' Sectors, the last one considered a Sector with defensive stocks. Until there is no evidence that the selling pressure is diminishing I'll stay on the sidelines, personally I wouldn't open a long position even in the Sectors that are still strong.

Scenarios

- Scenario #1: If the correction continues, it's important to track if it's accelerating or losing its power. The price chart will tell where the length of the bars on the daily chart and the volume will be the main indicators. The NH-NL in the Monthly timeframe it will be another indicator to track about how powerful the correction still is. In this scenario for my particular way of trading, I won't open any new positions, in fact I have been stopped out already from several long trades.

- Scenario #2: If the correction slows down and the selling pressures diminishes there could be a relief rally, if this happens the correction could slow down or the S&P could start to trace a sideway move. This could help to form a base around or near a support. In this scenario some days the S&P would go up and others it would go down testing the sentiment of the Market and where the volume would lead the next move. In this scenario I'll also stay on the sidelines, it would be too early to tell for my way of trading if the correction would be over or is just a pause before accelerating again.

- Scenario #3: The most unlikely, but not impossible, of the scenarios is a V-shaped recovery. In this scenario there would have to be some catalyst that moves the Market in a very powerful way back to the levels where it was in Jan/04. That movement would require several days of strong demand breaking several short-term resistances on its way up. This is not the same as a relief rally, which can last a day or two before it's over and then the downtrend can continue. In this scenario, the Bulls take over the control of the Market and day after day overcome whatever supply enters the Market with a lot of buying. In this scenario, I would see how far the V-shaped recovery gets towards the end of the week to see if I would open a new position or not, most likely I wouldn't.

Summary

Whether we are in a Correction or heading towards a Bear Market no one knows for sure. Usually I mention that risk management is essential, now is the time where your stops can help you preserve your capital. Things can still get pretty ugly, if they don't that's great, but if they do, risk management is your safety net.