The Market volatility continues as I had mentioned it would in my previous post. Today the S&P opened lower than yesterday, breaking the short-term support at 4,330. Toward the end of the session it rallied but at 4,400 it went back down.

It's too early to tell, but if the Bulls at least manage that the S&P stops falling even more, a trading range around 4,250 and 4,400 could be formed.

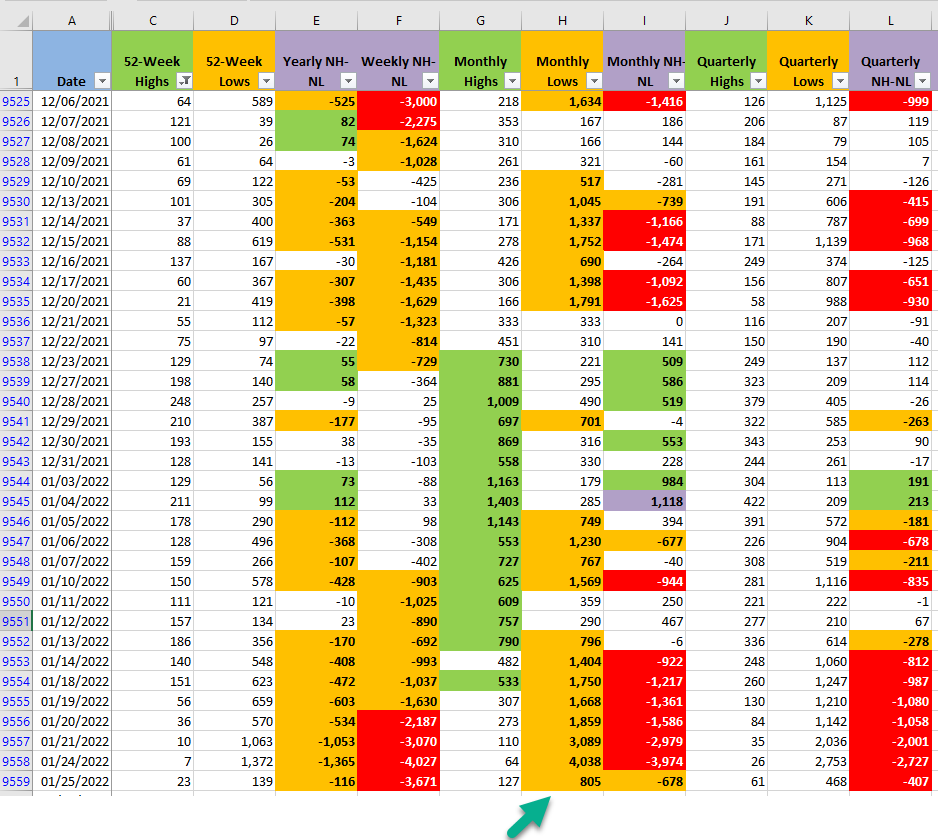

The number of New Highs in the Monthly timeframe (the fastest of all the timeframes I track) didn't move that much. However, the Monthly New Lows had a considerable decrease (column H).

The S&P rejecting the 4,250 level and the considerable decrease in the amount of New Lows are signals that could precede a rally, which doesn't necessarily mean a change in direction, but do signal a decrease in the selling pressure. The S&P after Jan/21 hasn't gained a single point, in fact it's still below the closing price of that date. I'll still wait on the sidelines and look for further confirmation that the Correction is over before opening new long positions.

During a Correction the priority should be to preserve the capital earned during the preceding rally, risk management is the key. The temptation to make money will always be there, however during these times it's definitely a lower priority.

The S&P is struggling for now to get past the 4,400 short-term resistance. It will become a good reference tomorrow to see how the price reacts once it gets closer to that level again.