During the past four days, we have seen the S&P rallying and closing at its highs. However, the rally started to lose steam and there are other warning signals that could severely change the current conditions, such as the earnings season that doesn't seem to be meeting the investors' expectations.

If we review the daily chart of the S&P 500, the last four bars that form the current rally, it would seem as the S&P starts to struggle in order to get to higher levels. It's still a rally, if tomorrow it shows that there is still power left on it I will start opening new long positions. The numbers enclosed in green are the points that the S&P advanced from the close price of the previous day, let's see how far it can get.

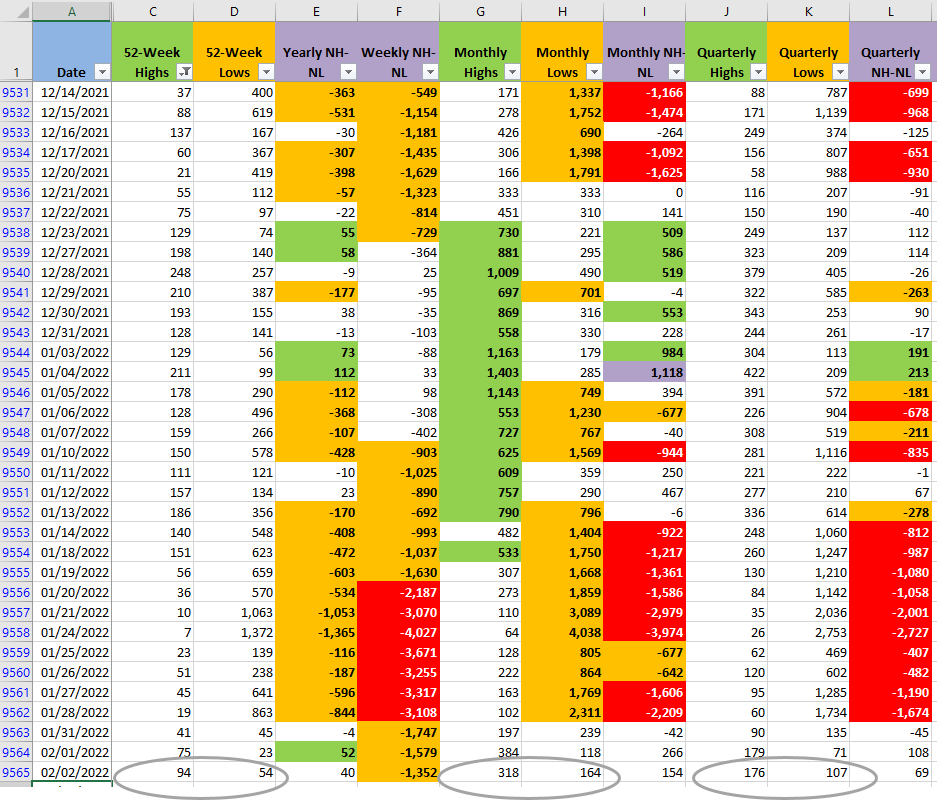

In terms of the New Highs and New Lows (NH-NL), they remain mostly unchanged, the New Lows increased a little bit in all the timeframes but the New Highs aren't increasing significantly even after the rally described above. There is a difference between the Correction being over and a rally that is probably just fueled by traders covering shorts and dip buyers trying to catch the bottom of the Correction. These NH-NL numbers are a warning sign that we could still see some volatility and selling pressure in the near future.

Another warning sign comes from the current earning season. It's not meeting the expectations of the investors, at the moment of writing this post Meta, previously known as Facebook (FB), reported earnings after hours and is plunging 23%. Alphabet (GOOGL) rallied after an impressive earnings report up to $3,058 but after the Market opened it went down to $2,960. Advanced Micro Devices (AMD) and Nvidia (NVDA) had similar behaviors where they couldn't hold the high prices.

I'm ready to start opening new long positions if the rally continues tomorrow. Unfortunately, the warning signs can't be ignored, the price action tomorrow and the numbers for the NH-NL Monthly timeframe will be key for my decision about going long or continue on the sidelines with a few long positions still alive (all of them with stops in place).