In my posts during this week, especially in yesterday's post, I have been warning about the quality of the rally and the signals that made me skeptical about it, holding me from opening new long positions. Today the selling pressure made the S&P plunge as important stock leaders such as Meta (FB) fell sharply during the session.

Reviewing the 39-min chart, the S&P opened on a gap down and never recovered during the session. I had warned about the importance of the psychological barrier at 4,500 in my post of Jan/31 (link below). It's true, the S&P managed to get up to almost 4,600, however it lasted one day at that level before going down below 4,500.

Jan/31 - A Spark of Strength in the Market

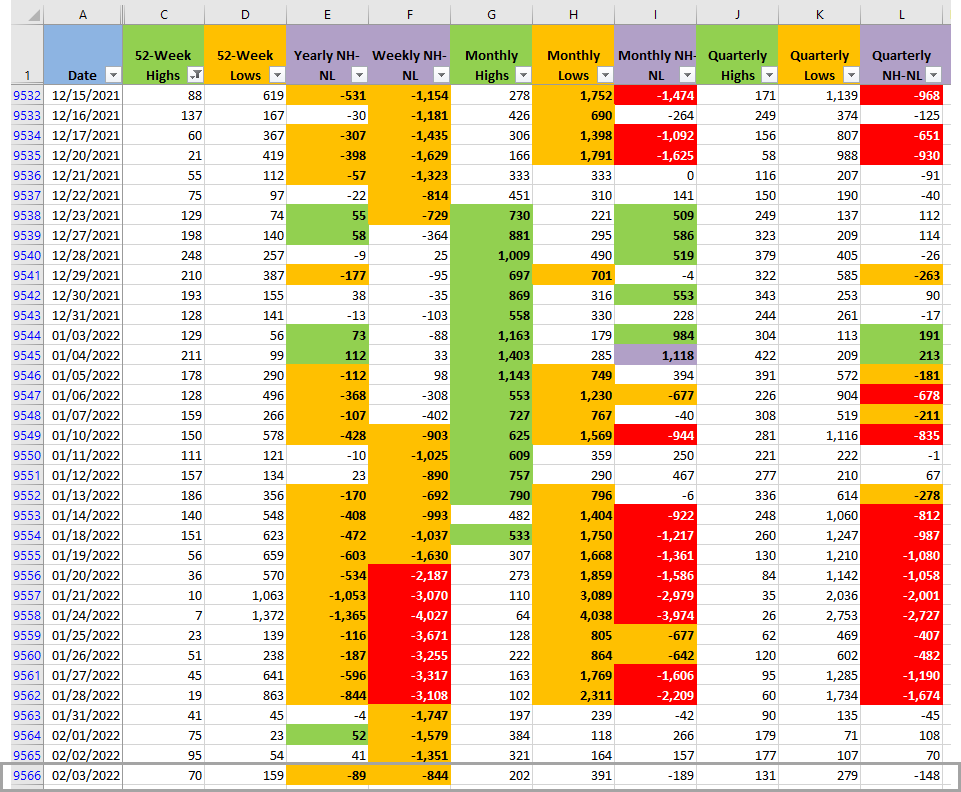

Reviewing the latest numbers of the New Highs and New Lows (NH-NL) the New Highs in all the timeframes I track decreased and the New Lows increased. The numbers are still not completely bearish, however, this rally during its short lifespan hasn't displayed an impressive demand that is able to completely overcome the selling pressure.

It's still early in the earnings season, there can still be a lot of surprises that give further direction to the Market. At this point, the weak rally is most likely over. If the rally is to resume, the price action this Friday has to be a strong upward movement that breaks the 4,560 short-term resistance and holds above it. The numbers for the NH-NL have to start displaying that force, the Monthly timeframe is the one that changes faster, so an increase in NH and a decrease in NL would give more certainty about the Bulls capacity to keep the rally alive.