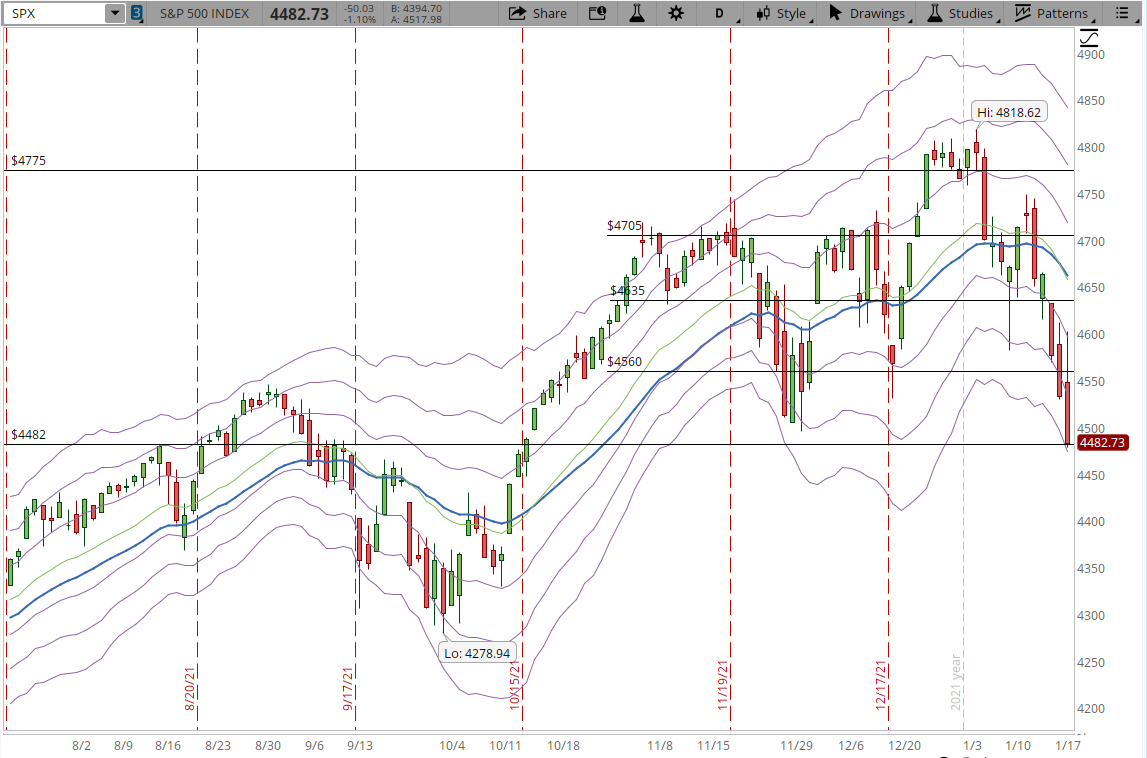

Today we saw a continuation of the Market sell-off, at the beginning of the session the S&P tried to rally, but after a couple of hours the Bears regained the control and took the S&P down again.

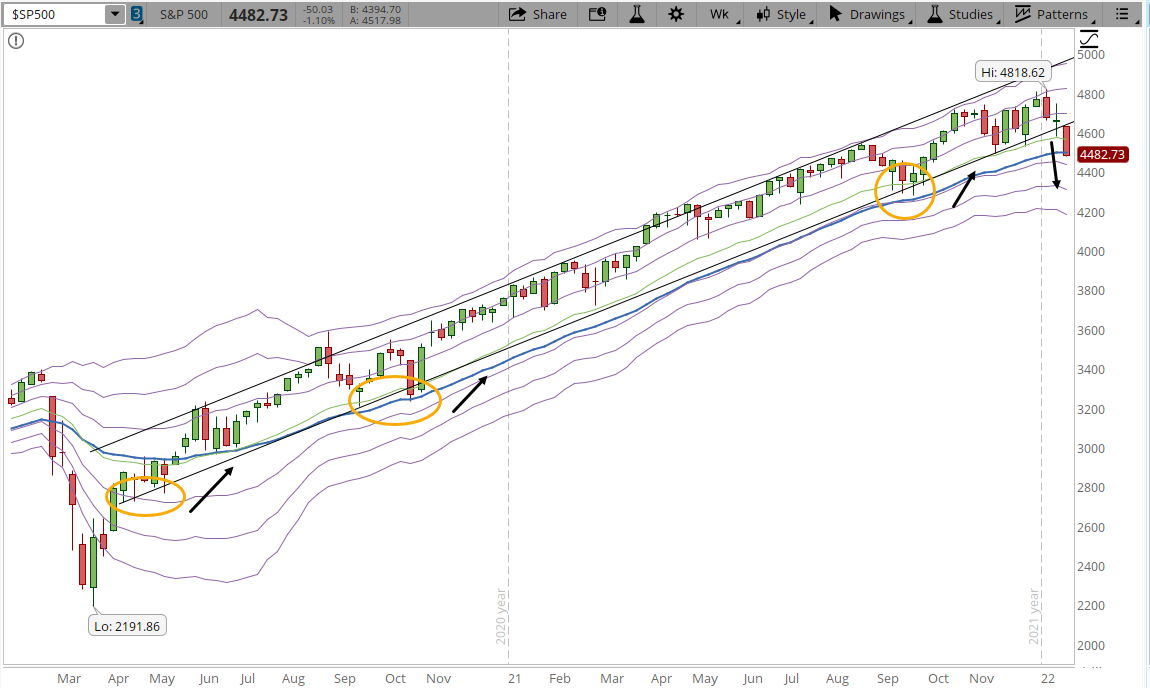

The situation isn't looking good if the expectation was that at some point the weekly uptrend would continue. The S&P broke way below the lower trend line and unless there is a powerful rally on Friday, the weekly uptrend structure will be broken. To make things worse the S&P 30-week EMA (blue line) is now looking flat and the S&P could potentially close the week below the 30-week EMA line.

Analyzing the daily chart on the screenshot below, the sell-off keeps accelerating. It has reached the weekly support at 4,482 and the last bar has reached the lower part of the -3 Keltner Channel (KC). When the price of an instrument gets to the -3 KC it is in a situation of being oversold. There could potentially be a relief rally during the Friday session or early next week. This doesn't mean that the Bulls will gain control, it will just mean that some people perceive the prices to be at an attractive level and will try to buy at that level sending the prices up temporarily. Unfortunately, the last three bars on the daily chart seem really bearish, tall bars the size of a Keltner Channel or more with every attempt to rally killed in a few hours at most.

If the Bears have enough force to break the 4,482 support the sell-off will continue its way down until it finds a support strong enough to stop the fall.

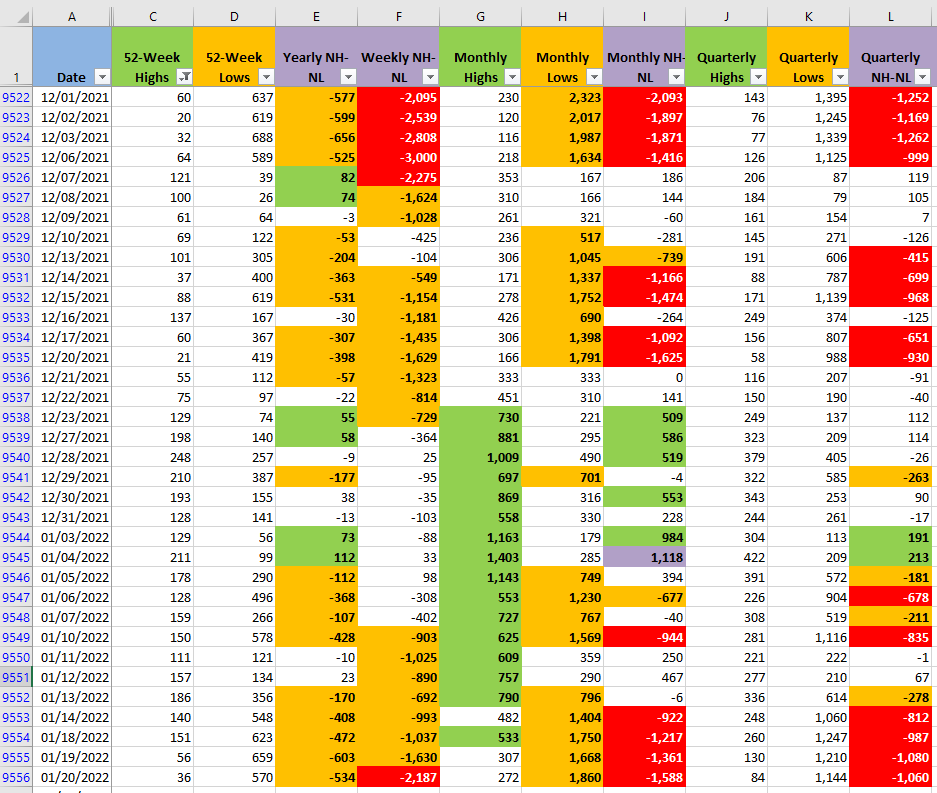

Finally, the New Highs and New Lows just confirming the power of the Bears, the numbers just keep getting worse for the Bulls. The selling pressure is evident even without all these charts and indicators. Until there is a catalyst that stops the fall, we can expect the prices to keep its way down. The first place other than the price where a recovery will be seen is in the reduction in the number of Monthly Lows (column H).

Trying to catch bottoms is a bad idea. Unless you have a plan on how to deal with the huge risk if the sell-off continues, or you are trading on the short side, then waiting on the sidelines is a far better option at this point in time for a strategy like mine that is designed for the weekly charts.