At the beginning of today's session the S&P rallied but not that much, it just keeps showing the weakness I have discussed in the last couple of posts. At the end of the session the index just went down to close below the open price (screenshot below, you can click the image in order to zoom in). The S&P has been testing for three days the 4,800 level without enough force to rally again.

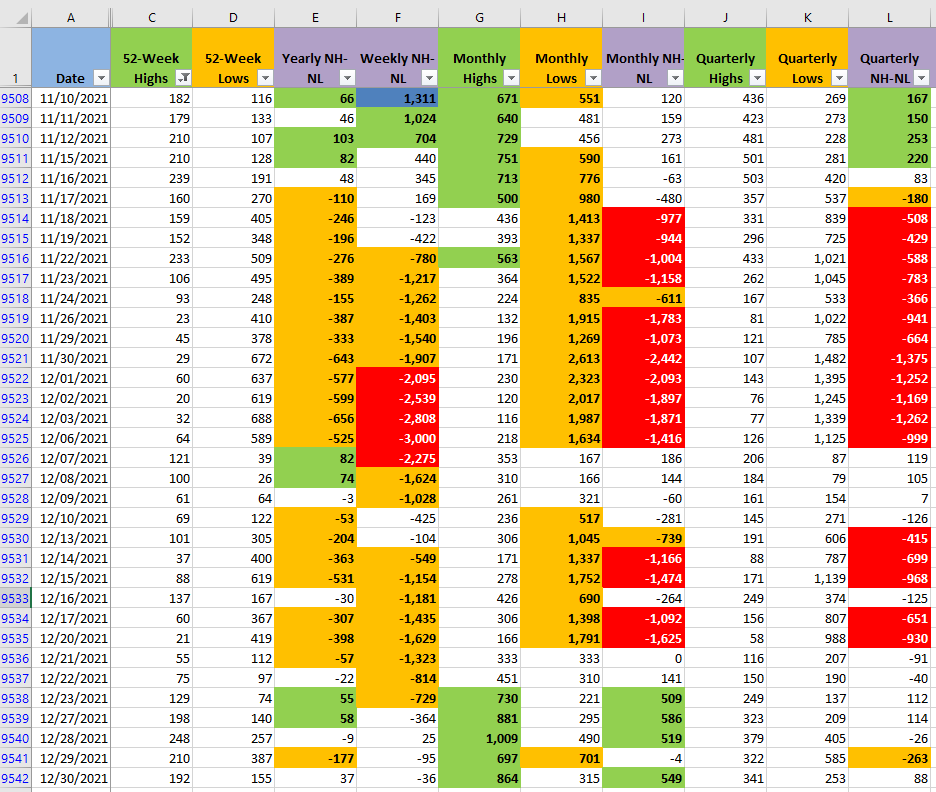

The New Highs and Lows (NH-NL) don't look that bad but I still think the most likely scenarios are that the S&P will be moving sideways if it already found a short term support, or if the selling pressure comes back as intense as for example Dec/16 then it might test the 4,732 weekly support or maybe even break it.

In yesterday's post, I mentioned that in order to start opening positions for my particular way of trading I was expecting that the rally resumed and that I could see strength in the NH-NL. Since none of the conditions was met, I stay on the sidelines waiting for the Market to give me an entry.

Whatever is your style of trading evaluate if you have the proper risk controls in place if the S&P is unable to get past 4,800. If the weakness persists a Market correction could potentially happen in the next few days.