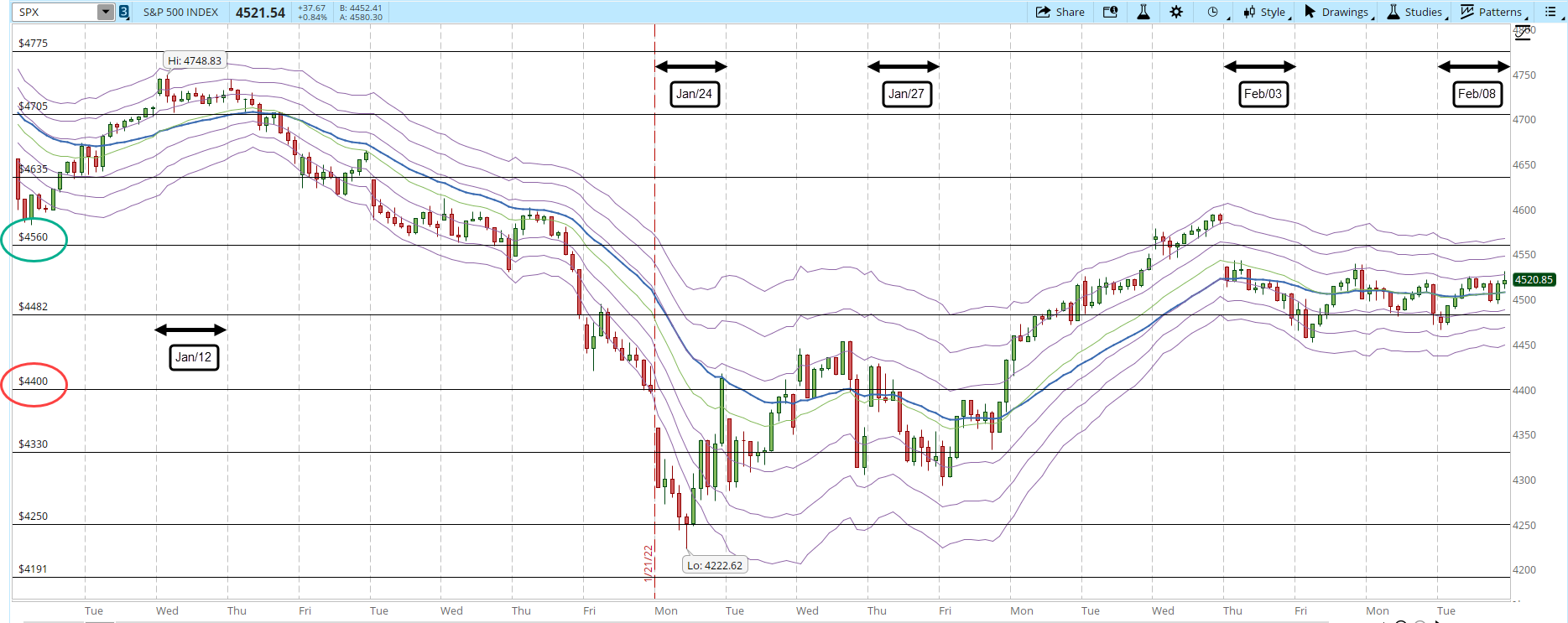

The S&P rallied today but got stuck at the same level I have been monitoring in the last three days. The rally went from 4,465 to close at 4,520, however it has visited several times that level since February started and it hasn't rallied yet past that level.

Reviewing the 39-min chart, is encouraging to see an attempt to rally, the Correction seems to be tracing a bottom, however the levels where the S&P was moving in the first half of Jan/2022 are still far away.

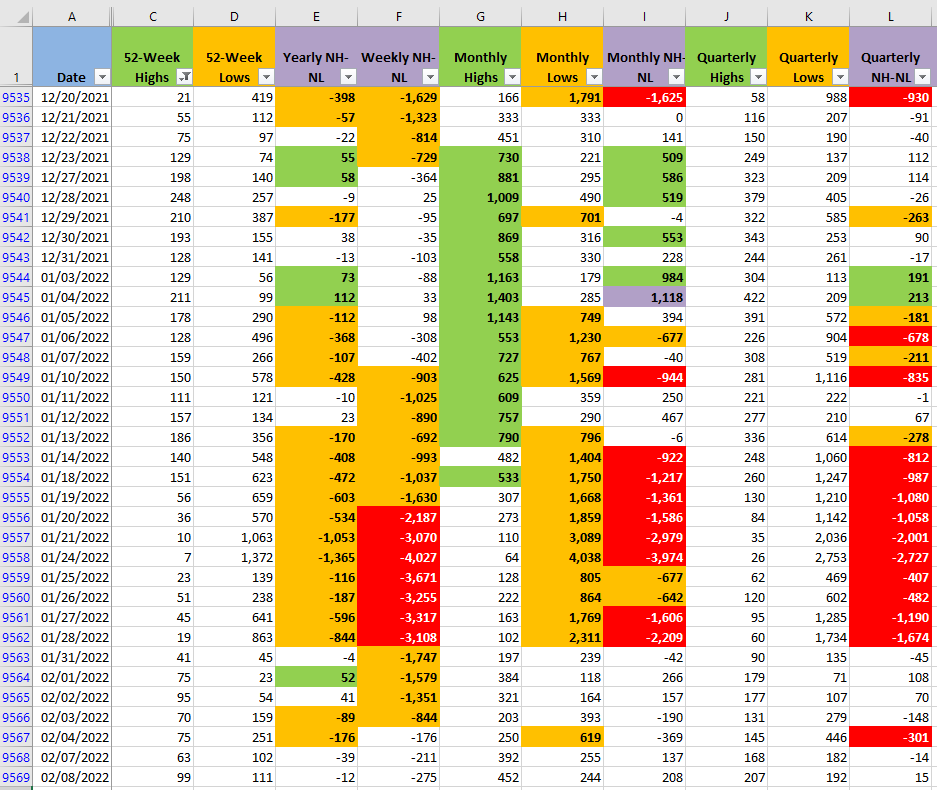

The New High and New Lows (NH-NL) numbers also improved a little bit, check especially the columns G and H which belong to the Monthly timeframe, the one that moves faster from all the ones displayed.

I'm still not opening new long positions despite several of the tickers I monitor already triggered an alert. Oil seems to be the only strong play at the moment, and until there is further evidence that this rally is for real I'll stay on the sidelines. All the gains that the Market had today, can be easily wiped out in a single session.