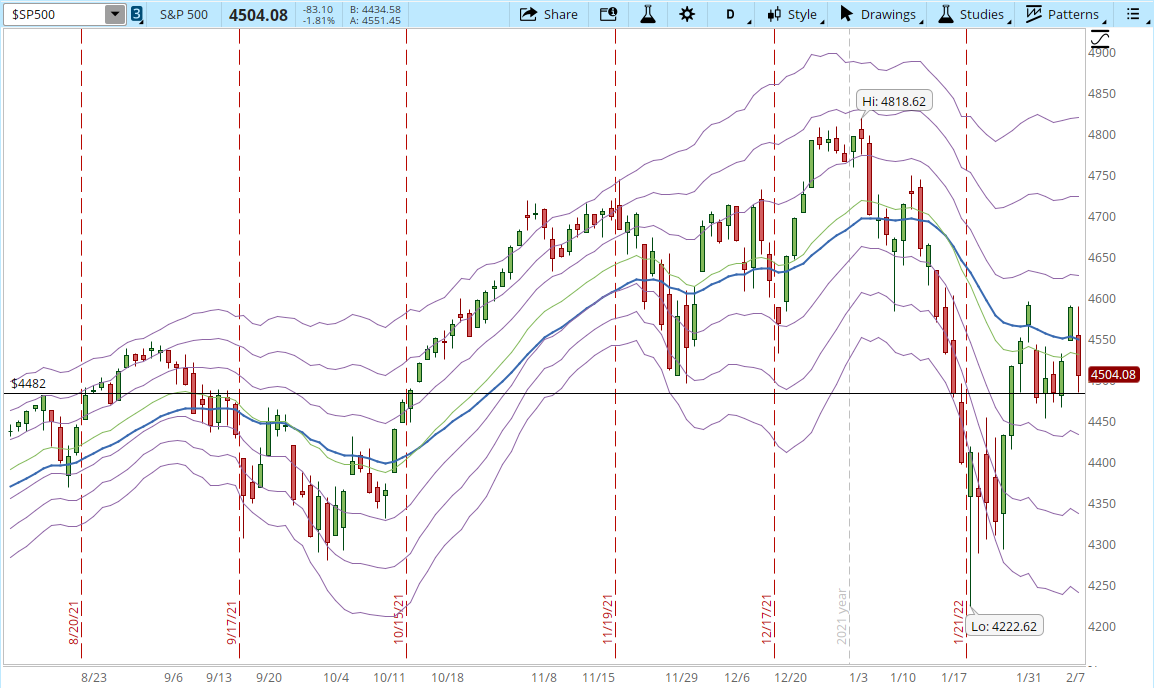

Yesterday I posted about the S&P getting to a strong resistance level and how every rally since October last year has been killed in four days or less (link to yesterday's post below). Today the Market did what was most likely to happen, it declined since there isn't enough force yet to reach or get past the 4,600 level. There was a small chance that the S&P rallied and displayed some force, but the inflation numbers and the Fed comments were enough to bring the S&P down. The other important indexes ended going down too.

Feb/09 - Weak Support, Strong ResistanceReviewing the 39-min chart of the S&P it is obvious to see that the four-day rally that started in Jan/28 and the two day rally that started on Feb/08 are over, and they both ended at the exact same level. The news about inflation and the Fed, the virus, Ukraine, China, they are all going to continue during several weeks and most likely months. The Market keeps displaying a lot of fragility any time those news come back again to hit the journals.

Looking at the daily chart of the S&P gives a little bit more perspective of where we are at right now. Still looks like a potential Correction bottom with not much force from the Bulls to take the index higher yet.

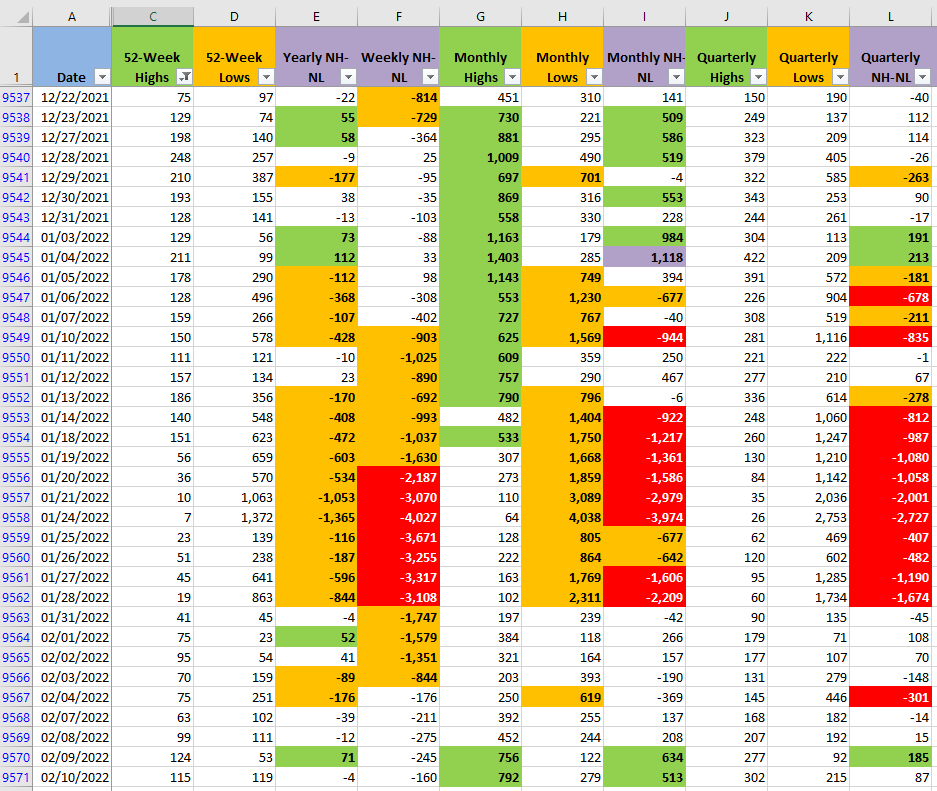

Finally, the New Highs and New Lows (NH-NL) numbers are just a reflection of what's happening. The balance between NH-NL deteriorated a little bit in all the timeframes that I track. I'm still waiting for the right chance to start opening new positions, since there is not a clear direction in the Markets, the sidelines are a good and safe place to be at the moment.