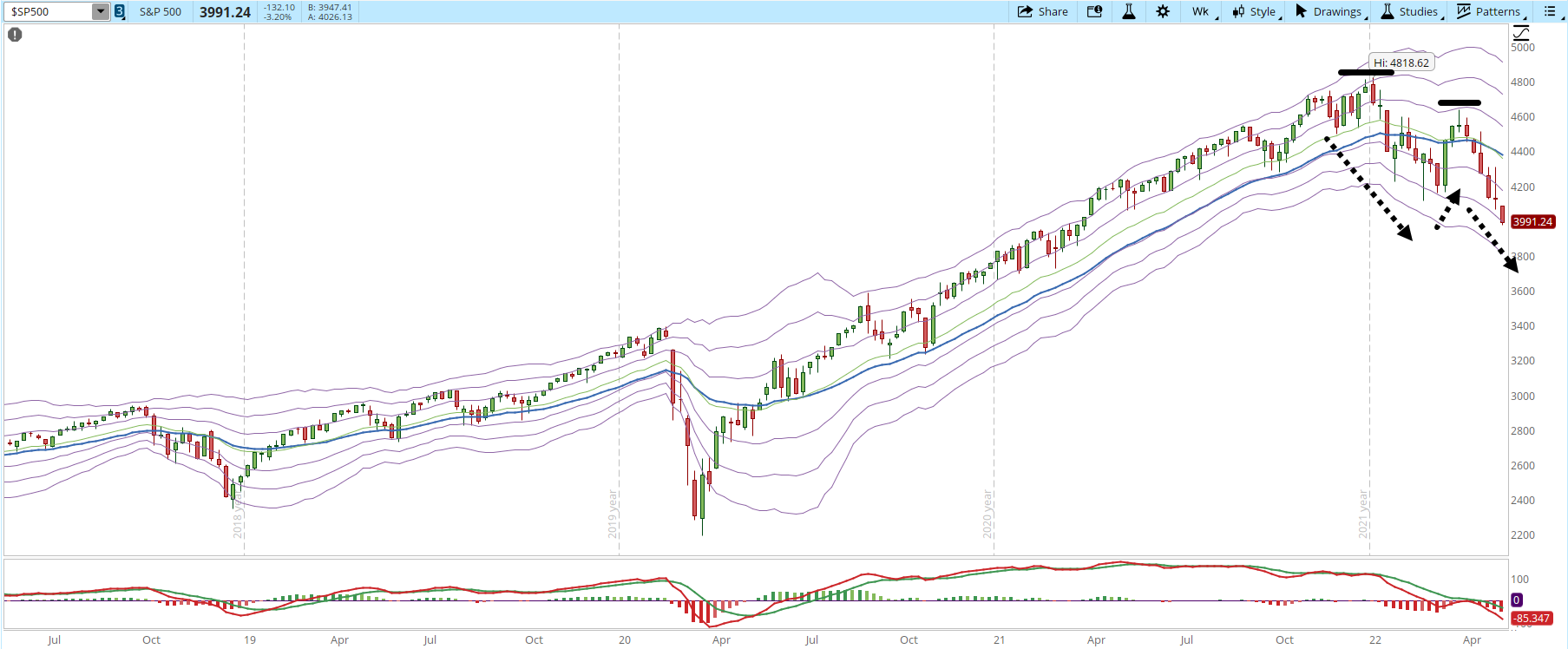

After the Markets closed today I saw good news and bad news. The bad news is that the scenario that I published as the most likely for this week was wrong, I thought that the weekly support was going to hold at 4,191. That support is officially broken and now is a resistance.

The good news is that I have been warning for a while now about the Market weakness, I moved all my account to cash, and now it's time to wait for the Market to build a bottom.

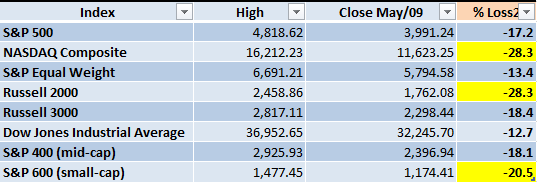

The S&P 500 plunged to the levels of April/2021. The rest of the indexes were also hit by the selloff. The catalyst was again the concerns that the Fed's aggressive actions to control inflation will lead to a recession. There are three indexes that are already in Bear Market territory (highlighted in yellow). Another three are less than 3% away from getting there, including the S&P 500.

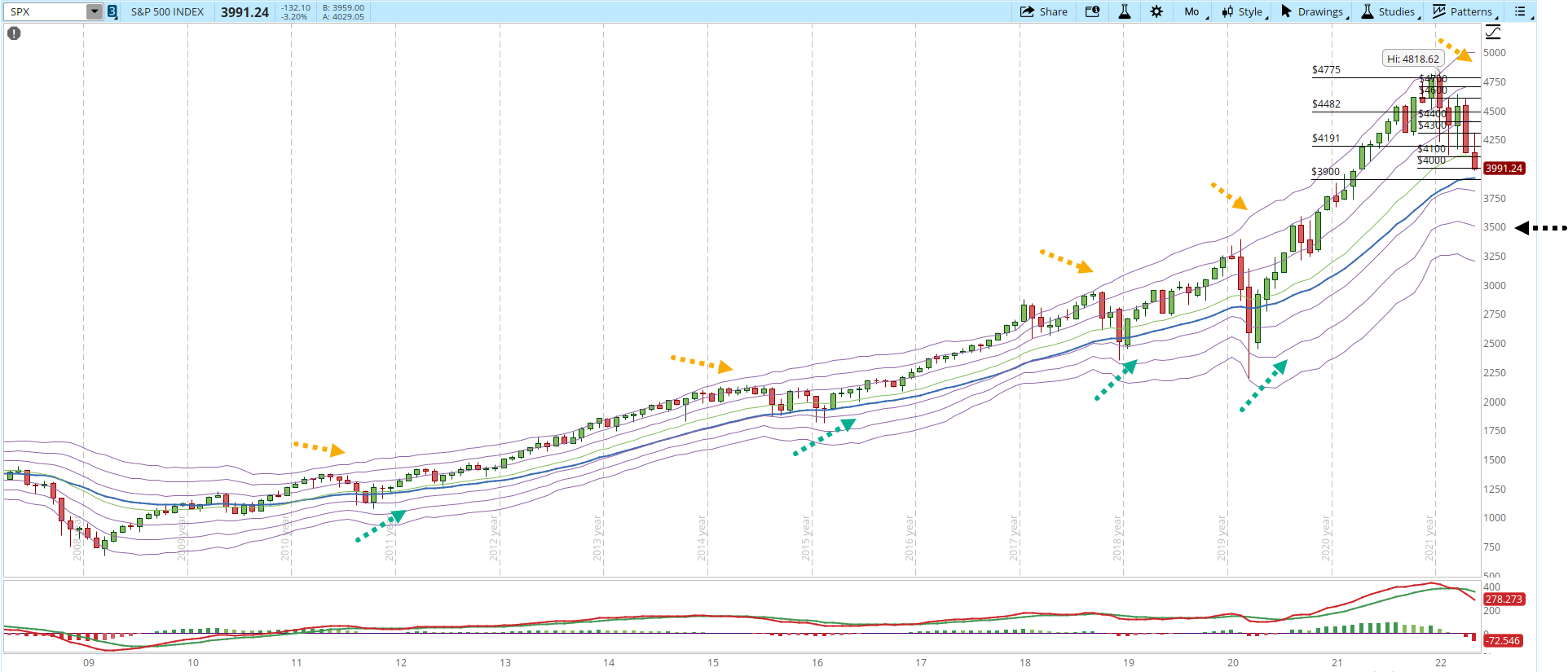

The next levels to monitor are 4,000 and 3,900. It will be important to see how strong the selling pressure is when testing those supports. During my last 'Weekend Market Overview' article I posted the monthly chart of the S&P 500. Every time that the price level got close or to the +3 Keltner Channel (KC, orange dotted arrows) there was a decline around the -2 KC. The only exception was the virus Correction that got to the -3 KC. Once the decline was completed around those levels the S&P 500 rallied (green dotted arrows).

Right now, the monthly chart of the S&P 500 is at the -1 KC. The -2 KC current level is 3,500. Rather than forecasting if the index will get that low or not, the first step is to see if the decline stops at 3,900.

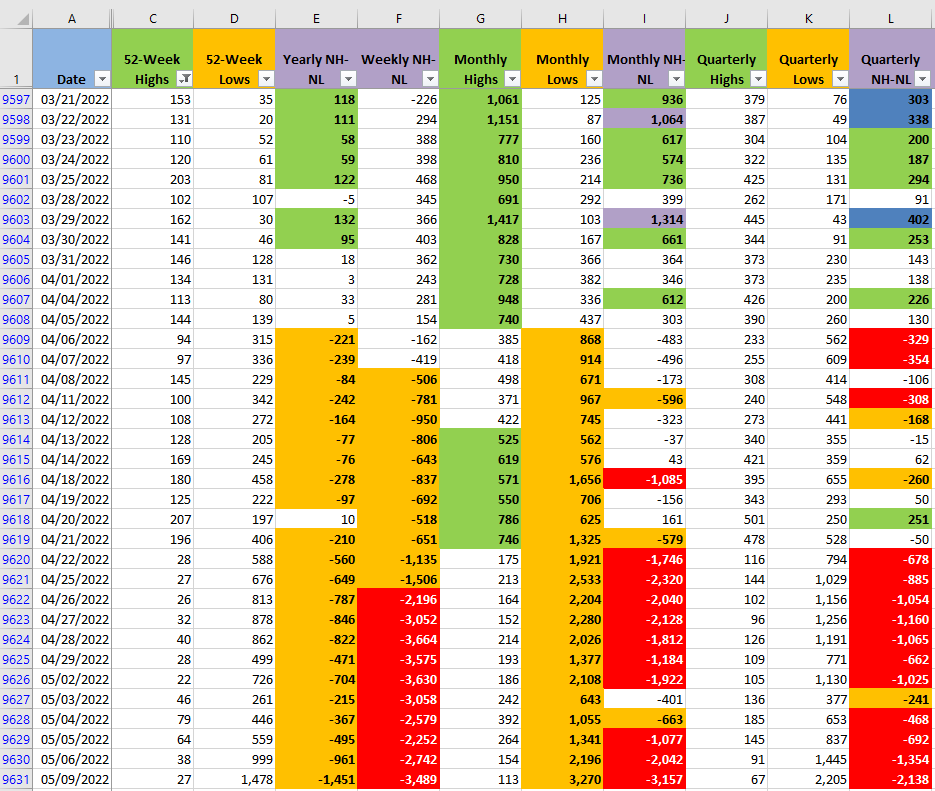

Unfortunately, the New High and New Low (NH-NL) numbers just confirm the current scenario controlled by the Bears. The most important columns are G, H and I. They are the ones that will change faster in this leading indicator.

The Monthly Lows for today are around 3,270 which is the number of stocks that today made a new Low based on a timeframe of a month. It's a very elevated number.

In the daily chart of the S&P 500 we are already at oversold levels. A reaction rally at this point wouldn't be crazy. Those reaction rallies tend to confuse people, some might think that those rallies mean that the situation is changing. It's a possibility, but that's not a rule, it's more likely that it's just people covering shorts or trying to pick a bottom that temporarily stops the decline. In the recent history, the last two times when the index was at the -3 KC in the daily chart there was at least a reaction rally (green dotted arrows).

We are close to being at oversold levels in the weekly chart too, not just in the daily one. I'm more concerned about the weekly chart since it seems to be tracing a downtrend pattern of lower highs and lower lows.

Forecasting is of no use, no one can consistently do it. However, these are important warning signals from the Market which is the ultimate judge. I'm waiting on the sidelines especially after today. Risk management is essential for any position that you still keep open.