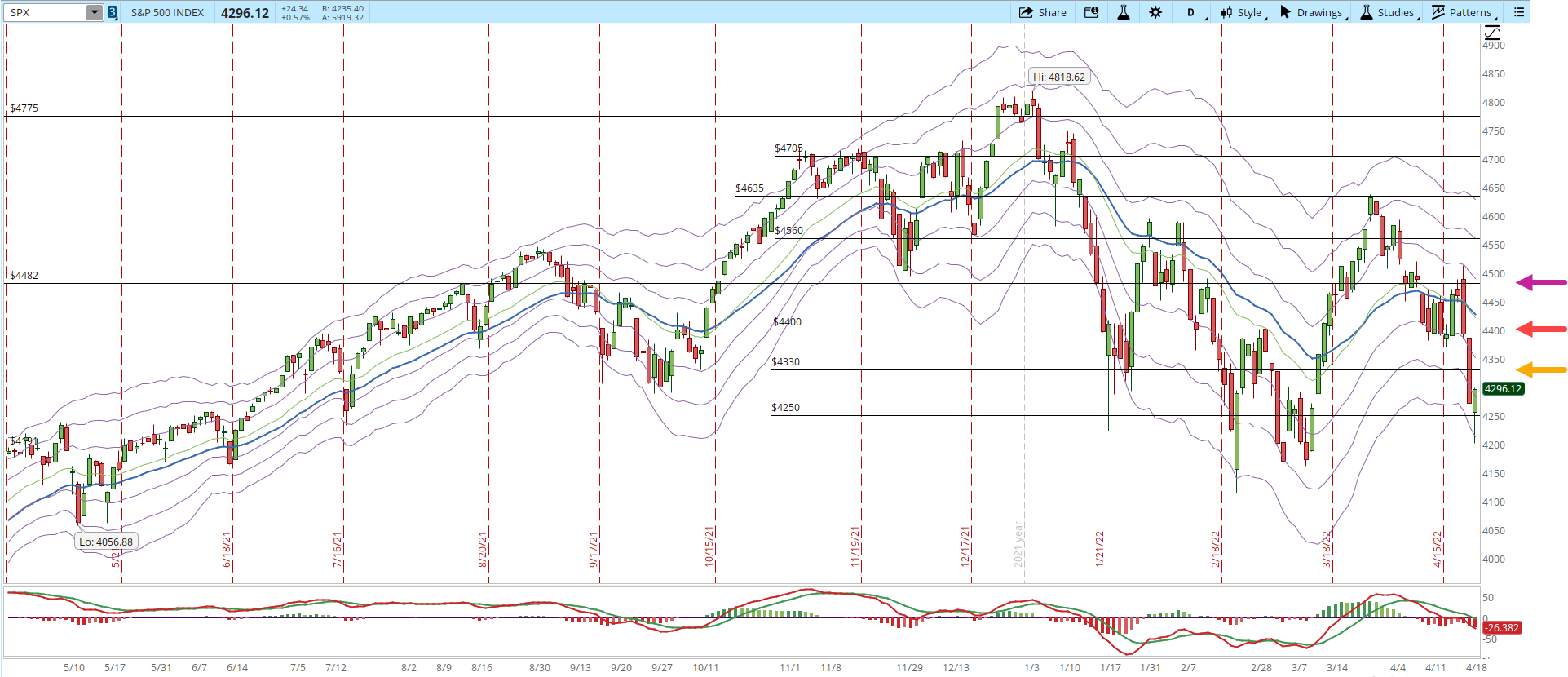

Stocks managed to recover from early losses, if we review the daily chart of the S&P 500 we can see how the index recovered from oversold conditions (-3 Keltner Channel). My personal perspective with the way I see the index has been behaving is that the next three resistances won't be easy to break. I added arrows with a varying degree of intensity and getting back to 4,500 will be a challenge for the Bulls.

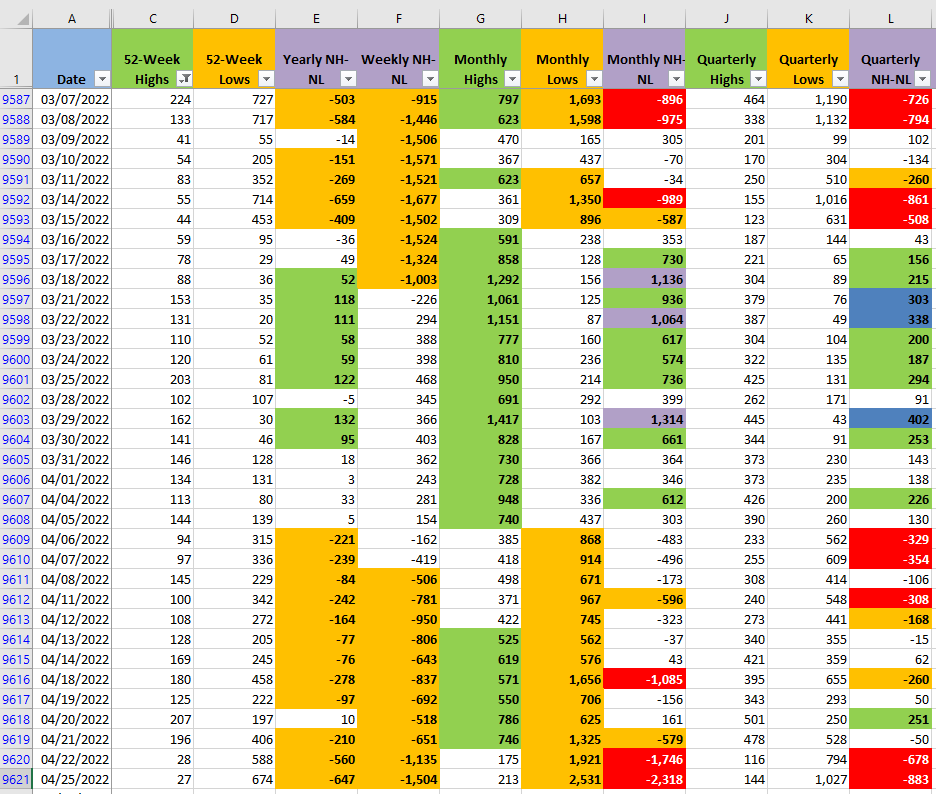

If tomorrow we don't see a significant decrease in the New Monthly Lows the index could still break the weekly support at 4,191. After hitting oversold conditions there can be a reaction rally, this doesn't mean necessarily a change in direction. It could be just a temporary movement caused by people trying to pick a bottom or transactions covering short positions, etc.

The good news is that the lower price was rejected for now. However until we don't see a decrease below 500 in the New Monthly Lows and the price breaking and holding at least above 4,400, the Bears will still be in control.

The Ukraine war, the inflation, the earnings season, the spread of the Covid virus in China, Elon Musk buying Twitter, they have all been recent catalysts in the Market that could add volatility in the next few days.