What looked like a powerful rally on Monday and Tuesday doesn't look that strong towards the end of the week. The Market is a chaotic place, at some point favorable conditions for certain strategies will be present and then it's time to pull the trigger before the opportunity is gone.

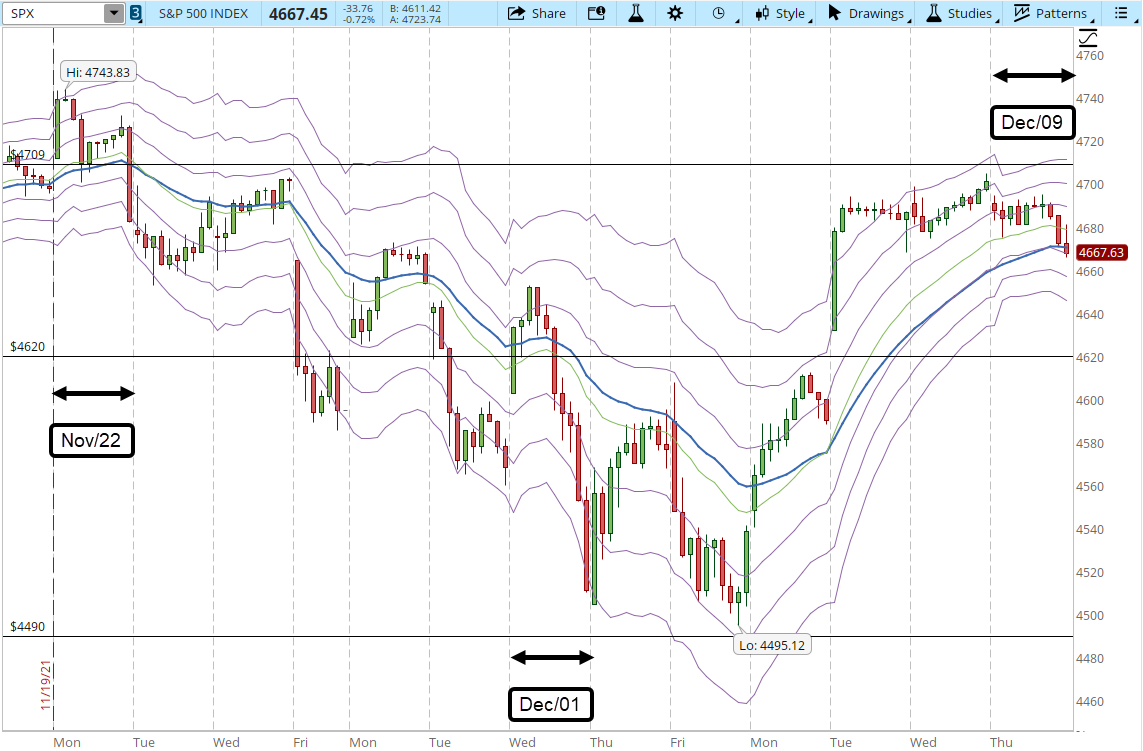

I hadn't traded anything since Sept/01 and on Wednesday I decided to open a position in ACC (American Campus Communities). I thought that the bullish sentiment would last longer, however the rally seems to be fading. The force of the Bulls and Bears is more or less in balance near a resistance level mentioned in several of my previous posts 4,709 (check the link below) and the 39-min chart

Running out of Fuel

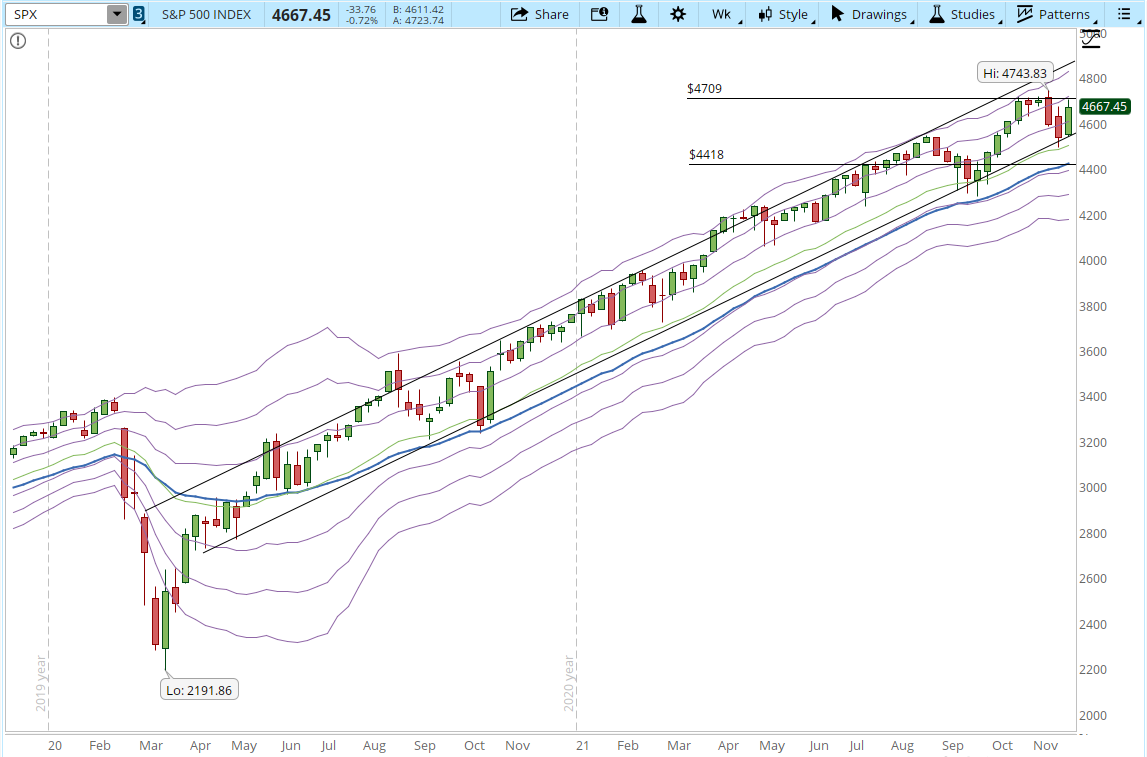

On the positive side, the weekly trend is intact. On the negative side I don't like the way the Market gapped up on Monday and continued to rally on Tuesday, now during the last couple of days it hasn't been able to get past the resistance level at 4,709.

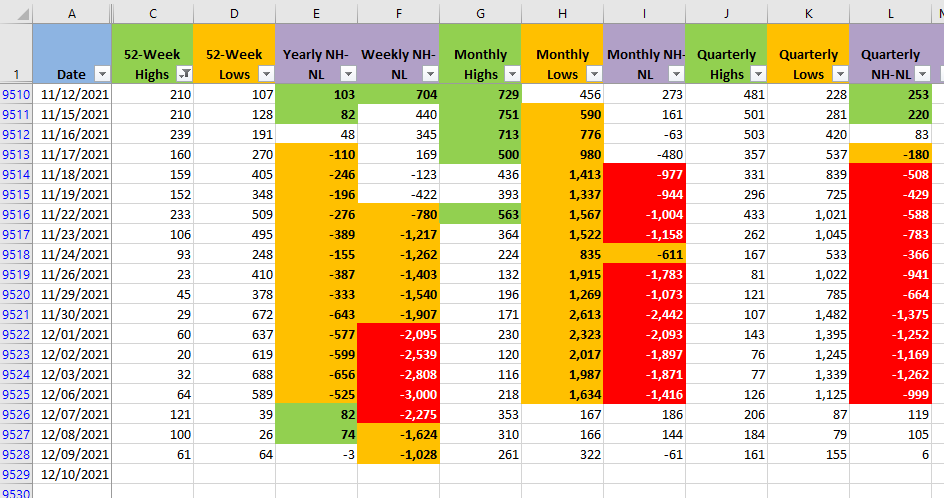

Additionally the force shown during Monday and Tuesday measured by the Monthly New Highs and Lows is no longer there (check columns G and H). On Monday more than 1,400 New Monthly Lows vanished during a single session (1,634 - 167 = 1,467).

It's easy to lose the perspective of the weekly trend when diving into the daily or 39-min chart. So far, the weekly trend is intact, I have marked clearly the support and resistance levels that I'm tracking on that weekly chart. I might not like the action of the last two days but that doesn't change the direction of the trend.

Why did I trade ACC?

The strategy that I have been trading during the last year is based on Stan Weinstein's book, "Secrets for Profiting in Bull and Bear Markets". It's a slow strategy that can challenge a person's patience but it adapts to my current lifestyle. I used to swing trade but I stopped since it requires to be monitoring the Market action a lot more time than I have available for trading.

ACC is challenging a resistance that has been there for the past 10 years, if it can get past $54.61 and rally the upside potential is huge. There is always the possibility that nothing happens and it stays testing the resistance level for a few weeks. Finally it can also just start a downtrend in which I'll be stopped out and take the loss. If I'm wrong it's part of accepting the risk and getting better at taking losses.

I'd love the first scenario where my trade works as planned, it's a stock that I have been tracking for months. It's even more important to embrace the real possibility of failure which hurts a lot, no one likes to lose money and being wrong at the same time.

In the book, "Unknown Market Wizards" there is a trader with an impressing record named Peter Brand that highlights an important point while being interviewed:

"It used to bother me to be wrong on a trade. I would take it personally. Whereas now, I take pride in the fact that I can be wrong 10 times in a row. I understand that my edge comes from the fact that I have become so good at taking losses.

A trader’s job is to take losses. A losing trade doesn’t imply you did anything wrong. The hard part about trading is that you can do the right thing and still lose money. There is not a direct feedback loop that tells you, good job. I only have control over the orders I place. I don’t have control over the outcome of trades."

Peter Brandt